For the real-estate sector, 2023 is popping out to be the summer time when all of it got here to a halt.

Mortgage charges have stayed across the 7% vary over the previous few days, making it costlier to purchase a house for a lot of aspiring householders. Even if consumers come to phrases with excessive charges, dwelling listings have been scarce, as householders maintain out on itemizing and promoting their houses.

So how would one describe the housing market this summer time? “Rock bottom,” Glenn Kelman, CEO of Redfin

RDFN,

a real-estate brokerage, informed MarketWatch on an episode of Barron’s Live.

“Sales volume couldn’t be worse. The only people moving right now are the ones who absolutely have to,” Kelman added.

Sales of beforehand owned houses fell by 3.3% to an annual fee of 4.16 million in June, the National Association of Realtors mentioned Thursday. July knowledge will probably be launched subsequent week.

“‘Sales volume couldn’t be worse. The only people moving right now are the ones who absolutely have to.’”

Even although some consumers are discovering good offers, they’re buying houses at excessive pursuits charges, all whereas dwelling costs have remained comparatively regular, Kelman added. “Part of the problem is that there hasn’t really been a break in affordability, and homebuyers really need to catch a break right now,” he added.

As Bill McBride, writer of the economics weblog Calculated Risk, places it, with the 30-year fastened rate of interest at 7.24%, a $500,000 dwelling with 20% down would equate to a tough month-to-month fee of $2,700.

If a house purchaser had purchased that half-million-dollar property in August 2022 at 5.25%, the month-to-month fee can be round $2,208.

But if that they had purchased in August 2021, amid the pandemic, the month-to-month fee on the $500,000 dwelling with a 30-year mortgage fee of two.99% — with 20% down —would have been $1,706.

Glenn Kelman, Redfin CEO, talking on Barron’s Live: “Apartments are expensive and houses are expensive. So I think household formation is going to be low”

MarketWatch/Barron’s Live

Rising price of proudly owning a house inflicting a generational shift

The surge in the price of proudly owning a house — extensively thought to be a key a part of the “American dream” — is inflicting a generational shift, Kelman mentioned.

In the previous, when individuals sought to reside on their very own, transfer out of their mother and father’ place, or transition from dwelling with a roommate to dwelling on their very own, they tended to maneuver in direction of locations that had cheaper choices.

“People could go across the country. So if a home was too expensive in [Los Angeles], they would be able to buy a $300,000 home in Oklahoma City,” Kelman mentioned. “And now that trend is reversed. Apartments are expensive and houses are expensive. So I think household formation is going to be low.”

“It’s sort of an arrested-development problem,” he added.

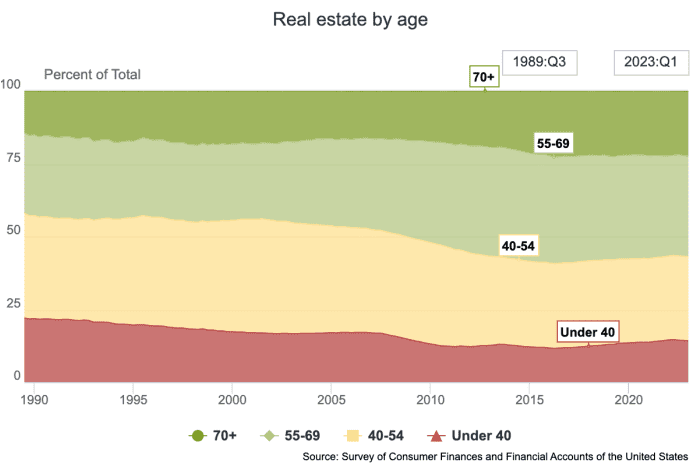

Baby boomers, born between 1946 and 1964, who got here of home-buying age in 1991, owned significantly extra actual property of their 30s than individuals of their 30s in 2023. In the primary quarter of 1993, these underneath 40 owned 20.6% of real-estate, in line with the Federal Reserve. In the primary quarter of this yr, these underneath 40 solely owned 14.2%.

Distribution of Household Wealth within the U.S. since 1989

Board of Governors of the Federal Reserve System

Kelman famous the shift in wealth over generations. Younger generations “just haven’t been able to get the leverage to buy a home and home prices have been out of reach,” he added.

That may additionally push society to defer the American dream of homeownership, as renters keep put for longer earlier than accumulating sufficient wealth to buy a house.

“All the money is owned by old people in America and that transfer of wealth that normally happens when people are able to get a piece of the American dream just hasn’t been happening over the past few years,” Kelman said, “because home prices have been so expensive, and credit has been tight.”

Source web site: www.marketwatch.com