A preferred pandemic spot for banks, money-market funds and monetary establishments to park money in a single day with the Federal Reserve may present a lift to Treasury market liquidity.

A 12 months in the past, use of the Fed’s widespread in a single day reverse repo facility swelled to a peak of just about $2.6 trillion, however it since has dwindled to about $834 billion as of Tuesday, marking roughly the bottom each day demand in additional than two years.

Diminished use of the ability seems to mirror elevated confidence concerning the Fed wrapping up its most aggressive cycle of charge hikes in many years, with the central financial institution subsequent week anticipated to carry its coverage charge regular at a 22-year excessive, and to start slicing charges someday within the 12 months forward.

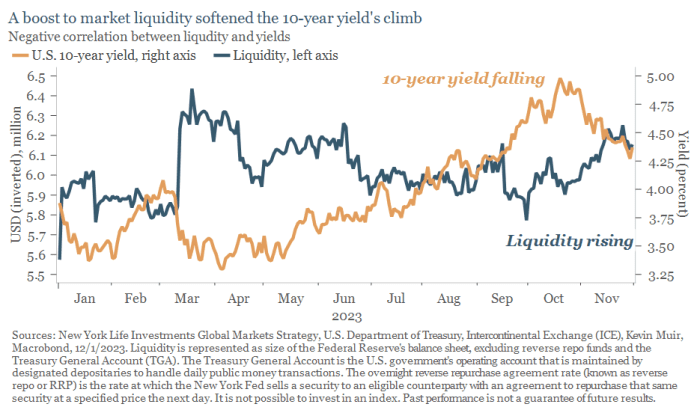

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, mentioned she thinks falling demand for the ability additionally might mirror rising market liquidity. Her staff discovered {that a} liquidity increase this fall helped ease the 10-year Treasury yield

BX:TMUBMUSD10Y

again from a peak of 5% in October.

Banks, money-market funds and different monetary establishments can increase liquidity within the $26 trillion Treasury market by transferring money out of the Fed’s reverse repo facility.

The sharp rise within the benchmark 10-year Treasury yield in October sparked a correction within the S&P 500 index

SPX

and the Nasdaq Composite Index,

COMP

which was shortly exited as yields retreated and each fairness gauges rose no less than 10% from their latest lows.

Goodwin argued in a Tuesday consumer observe that rising rates of interest can also immediate monetary establishments to shift funds from the Fed’s reverse repo facility to the $26 trillion Treasury market, “effectively pumping liquidity into the economy.”

“This increase in liquidity facilitates a redistribution of risk and in this cycle, we’ve observed a pattern where greater liquidity correlates with lower yields and vice versa.”

Related: As T-bill yields climb, Fed’s reverse repo facility shrinks to lowest degree in 1½ years

High demand for the Fed facility has been seen as an aftershock of pandemic-era liquidity sloshing by means of monetary markets. A fear has been that the method of draining liquidity from markets may produce ugly shocks, together with in shares, bonds and different monetary property which will threaten monetary stability — which may then immediate extra financial easing from the Fed.

There have been jitters about potential ripple results in markets when the stability held within the Fed’s reverse repo facility nears zero.

Still, Goodwin mentioned she sees a flooring on the benchmark 10-year Treasury yield of three.5% to three.75%, even in a recession situation.

“A drawdown in Treasury market liquidity related to banks’ financial plumbing, as well as the supply and demand issues working out in the long end of the curve, put some upward pressure on yields in our views,” she mentioned.

Instead, she mentioned she thinks it could doubtless take a “serious” slowdown in financial progress “beyond the mild recession we expect,” to push the 10-year Treasury yield down nearer to three.0%.

Related: Bond market indicators a swift U.S. financial slowdown isn’t off the desk

Source web site: www.marketwatch.com