We’re nonetheless months away from discovering out how the Supreme Court views the Biden administration’s plan to cancel pupil debt. But it’s doable that what they are saying this time round gained’t be the final phrase.

Activists and pupil mortgage borrower advocates have vowed for months to strain the Biden administration to search out one other path for debt aid if the justices knock down the initiative. In addition, a number of exchanges throughout oral arguments indicated that even when the court docket strikes the plan down, it might achieve this narrowly, leaving room for the White House and the Department of Education to attempt once more.

That extra average strategy would concentrate on the scope of this system and the Biden administration’s causes for it, as a substitute of the query of whether or not Congress supplied the chief department with the authorization to cancel pupil debt.

Christopher Walker, a professor on the University of Michigan Law School, stated this narrower route “is more possible than I thought” initially, “just based on how the argument went.”

Ruling on this method would require the justices to create a wonky, however vital distinction — that the debt aid program violates administrative legislation, however doesn’t go in opposition to the HEROES Act, the statute handed by Congress in 2003 that the Biden administration says provides the chief department the ability to enact the plan.

That legislation authorizes the Secretary of Education to waive and modify provisions regarding pupil loans throughout a pure catastrophe or nationwide emergency with a view to guarantee debtors aren’t left worse off. The federal authorities has argued which means the statute authorizes the Secretary of Education to cancel pupil debt throughout the pandemic. The events difficult the plan say the Biden administration is studying the statute too broadly.

Some of the conservative justices had been skeptical that the phrases “waive and modify” could possibly be interpreted to imply debt cancellation.

“If the court either for that reason or some other rules that the HEROES Act in particular does not allow debt cancellation, that would tie the administration’s hands completely to rely on the HEROES Act again to cancel any debt,” stated David Rubenstein, a professor at Washburn University School of Law.

Still, the justices might additionally discover that the HEROES Act authorizes debt cancellation — or punt on that query altogether — and maintain that that the Biden administration violated a principal of administrative legislation that requires an govt company to “sufficiently explain the reasons why it has chosen the policy that it has, taking into account the relevant facts and alternative pathways that it might have chosen instead,” Rubenstein stated.

If the court docket strikes down the plan on that foundation, Rubenstein added, “the agency would then be put to the burden of providing a satisfactory explanation along the lines of what seems to be concerning the conservative justices at oral arguments.”

Conservative justices specific fear about equity

At final week’s listening to, a number of conservative justices expressed fear in regards to the equity of the Biden administration’s plan, questioning out loud if the Secretary of Education thought-about — or ought to have thought-about — its impression on Americans who gained’t have entry to debt aid. To resolve these issues, Elizabeth Prelogar, the solicitor basic of the United States, who was arguing the case on behalf of the Biden administration, tried to steer the justices in the direction of sending the plan again to the Secretary of Education as a result of the company violated administrative legislation rules, as a substitute of placing it down on the idea that it’s not approved by the HEROES Act.

An change between Prelogar and Justice Neil Gorsuch exemplified this technique. Gorsuch requested Prelogar whether or not the HEROES Act permits for aid that may truly make among the individuals who obtain the aid higher off. “Let’s say two people in Missouri, okay, all right, they’re better off, fine. But what if it’s 90 percent of the class just hypothetically that — could — could the Secretary do that under this statute?” he stated.

In response, Prelogar recommended that if the justices had been involved that this system was too broad, they need to look to “arbitrary and capricious review” to take care of that fear. That would imply discovering that the Department of Education violated administrative legislation in enacting the debt aid plan by not offering satisfactory reasoning for it and for its measurement and scope — however not discovering that the HEROES Act doesn’t authorize debt cancellation.

“One of the things you’d want to look at is whether there was a way to tailor it, whether there was a way to segregate the people who actually needed the relief from not,” Prelogar instructed Gorsuch.

If the court docket finds that the events difficult the coverage have standing, or the correct to sue, the possibility that they rule on the deserves on this narrower method is comparatively small, Walker stated — he pins it at about 10% or 20%. But a part of what signifies that it could possibly be a risk is that, “the Chief Justice does like to do these incremental first steps,” Walker stated.

Solicitor General’s efficiency opens up the potential of a narrower ruling

Walker cited two instances the place Chief Justice John Roberts instructed the Trump Administration to supply higher causes for giant govt company coverage, however didn’t say that administration couldn’t pursue them. During oral arguments Roberts stated the coed mortgage problem “reminds me” of a type of instances “where the administration tried acting on its own to cancel the Dreamers program, and we blocked that effort.”

In response to skepticism from Roberts that the HEROES Act approved the chief department to undertake an initiative that can have an effect on greater than 40 million Americans and is estimated to price roughly $400 billion, Prelogar urged him to contemplate pulling down this system attributable to violations of administrative legislation. That would signify an identical path to the court docket’s strategy within the Trump administration instances.

“To the extent that you have concerns about the scope and size of the program,” she stated, “then I think the right place to look to house those concerns is in arbitrary and capricious review. We think here that the Secretary drew reasonable lines in crafting the scope of relief, but if you disagree, or if you think he should have taken different interests into account, that would be a basis to reverse him on arbitrary and capricious grounds, not to distort the plain meaning of the HEROES Act.”

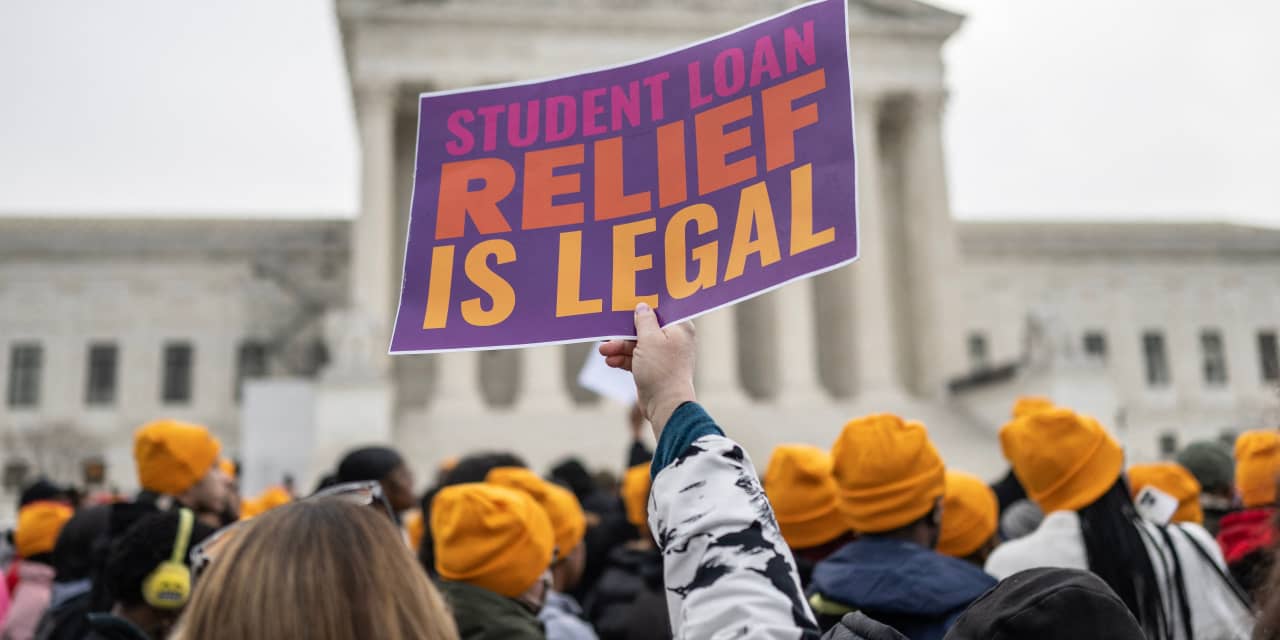

Exchanges contained in the courthouse opened up the potential of a narrower ruling.(Photo by Al Drago/Getty Images)

Getty Images

If the court docket guidelines on this method, then the Biden administration would want to rewrite the justification for the debt aid plan and maybe the coverage itself with a view to handle the court docket’s issues, Walker stated. Though it could seemingly take “pretty minimal” work from the Department of Education to creator a memo with totally different reasoning, the method might nonetheless be difficult, Walker stated.

“They would have to answer some political questions they might not want to answer, such as we’re not giving you any relief because of X,” he stated. And, even after they take that step, the plan is prone to find yourself in entrance of the Supreme Court — which is comparatively hostile to broad govt motion — as soon as once more.

“It could just be a matter of prolonging the inevitable invalidation of the student loan program,” Walker stated. “But maybe not.”

Prelogar’s efficiency on Tuesday opened up the potential of this narrower ruling that may nonetheless preserve the debt aid program alive on remand, Walker stated, as a result of she tied this system very clearly to the pandemic and the HEROES Act.

“On that front, she stayed on theme the entire time and really gave this consistent message,” Walker stated.

That framing “may give the court a little more pause,” in making use of the main questions doctrine when excited about the coverage and as a substitute simply sending the coverage again to the Secretary of Education to supply further reasoning, he stated. The main questions doctrine is a comparatively new authorized principle, which the Roberts-led court docket has interpreted to imply that if an govt company takes an motion that’s of political or financial significance it’s overreaching until Congress clearly approved the coverage.

Another authorized route for debt aid

Still, most of the conservative justices probed Prelogar on the Biden administration’s declare that the court docket shouldn’t apply the main questions doctrine when contemplating the coverage. Even if the court docket strikes down the debt aid plan down on the idea that the HEROES Act doesn’t authorize debt cancellation, some advocates and authorized consultants say the Department of Education can nonetheless pursue different authorized avenues to supply pupil debt aid.

“They could use one of the other authorities in the Higher Education Act,” stated Luke Herrine, an assistant professor on the University of Alabama School of legislation.

That legislation permits the Department of Education to “compromise, waive, or release any right” to gather on pupil loans. Herrine has been writing for years about how the company can use that authority to cancel pupil debt. During the 2020 presidential marketing campaign, Senator Elizabeth Warren stated that if elected president she would use the compromise provision to wipe out $50,000 in pupil debt for a lot of debtors on day one in all her presidency.

At oral arguments, J. Michael Connolly, the lawyer representing two pupil mortgage debtors difficult the debt aid plan, additionally acknowledged that this provision provides the Department of Education the authority to cancel pupil debt.

“The parties are in agreement that they have the power to do this,” Connolly stated of the debt aid plan. “Under — under the HEA.”

Officials might use the compromise and waive authority “to implement the same program — indeed they could implement a much broader program since it wouldn’t necessarily have to be targeted to COVID harms,” Herrine stated.

Still, the administration would face some challenges going that route. The Higher Education Act requires that the Department of Education submit rules for discover and remark — a prolonged course of — which isn’t a requirement of the HEROES Act.

“If they do that, are they doing something like a regulation, or are they going to have to modify their existing regulations?” Herrine stated. “They would not be able to do that immediately and it’s not clear they’d be able to do it before the payment pause stops.”

Payments are scheduled to renew 60 days after the Supreme Court points its ruling, or 60 days after June 30, 2023, whichever comes first. For advocates, turning pupil mortgage payments again on with out debt aid isn’t an possibility.

“Payments cannot resume until broad-based debt cancellation is enacted,” stated Natalia Abrams, the president of the Student Debt Crisis Center. “That’s what we stand by.”

If the Supreme Court knocks down the debt aid plan, the Student Borrower Protection Center and different advocacy teams shall be “working hand in glove with this administration about how to revisit this policy,” stated Mike Pierce, the chief director of SBPC.

“We know that there are other sources of legal authority that the administration could have used,” he stated. “We’re going to keep pushing regardless of the outcome of the court.”

The White House has stated it’s not contemplating different choices. Bharat Ramamurti, the deputy director of the National Economic Council, instructed MarketWatch’s Victor Reklaitis, that there’s “no current backup plan,” for if the court docket knocks down the Biden administration’s plan.

“That’s the plan we’re going with,” Ramamurti stated. “We think it’s legal, we think it’s the right approach.

To rule on the merits, the court would need to find the parties have standing

In order to get to the question of whether the debt relief plan is legal, the court will have to determine that the parties have standing, or the right to bring their lawsuits. One case was filed by two student loan borrowers left out of the debt relief plan and the other was brought by six Republican-led states.

The Court’s three liberal justices seemed skeptical of the standing claims. In addition, one of the conservative justices, Amy Coney Barrett, probed James Campbell, the solicitor general of Nebraska who was representing the states, on one of the states’ main arguments for standing. That claim rests on Missiour’s relationship with the Missouri Higher Education Loan Authority or MOHELA, a state-affiliated organization that services federal student loans. The states have said that the debt relief plan could cost MOHELA revenue, which in turn would cost Missouri, giving the state the right to bring the lawsuit.

Barrett pushed Campbell on why MOHELA wasn’t in the courtroom if the state and the organization were so closely intertwined. Justice Ketanji Brown Jackson questioned why the relationship is enough for the court to find standing given that it’s partly predicated on MOHELA paying into a Missouri fund it hasn’t paid into for years.

The other conservative justices didn’t engage much on the standing issue and “it’s hard to know which way that actually cuts,” Walker stated. Their concentrate on the deserves might sign they consider the events have standing and subsequently they’ll get to the deserves.

“Or the lack of discussion could actually mean that some are really struggling with it, but they don’t want to air their concerns at oral arguments,” Walker added. “It’s hard to read anything into silence.”

Both Walker and Herrine agreed that Campbell didn’t current a really clear rationale for standing.

“We know that these conservative justices have in the past been skeptical of expanded standing,” Herrine stated. Tara Grove, a professor on the University of Texas School of Law, famous Roberts wrote a “really forceful dissent” in 2007 “as to why states should not get a special leg up in going to court.”

Given that the case for standing wasn’t that compelling and among the conservative justices’ historical past on the standing problem, “they might be more skeptical,” Herrine stated.

“All of that leads me to believe that there’s more votes in play on the standing issue,” Herrine stated.

Still combating for cancellation no matter how the court docket guidelines

Regardless of how the court docket guidelines, Madeleine Pope, who makes use of they/them pronouns, says they’ll nonetheless be combating for mass debt aid. The activism outdoors the courthouse Tuesday and the media protection surrounding it, “inspired me,” Pope stated. “I was like okay, I can feel the camaraderie and the kind of union inspiration from this.”

The 36 year-old has about $70,000 in pupil mortgage debt from school and graduate faculty. Pope additionally participates in activism surrounding pupil loans and debt extra broadly with the Debt Collective, a corporation that has been pushing for mass pupil mortgage cancellation for greater than a decade.

Pope had all the time deliberate to have their debt canceled via the Public Service Loan Forgiveness program, an initiative that permits debtors working for the federal authorities or sure nonprofits to have their federal loans discharged after 10 years of funds.

Madeleine Pope will preserve pushing for pupil debt cancellation no matter how the Supreme Court guidelines.

Courtesy of Madeleine Pope.

By the time the pandemic hit, Pope was about eight funds away from having the debt from school discharged, however then acquired laid off. Pope looked for a brand new job for about 9 months and once they lastly discovered one it was for a for-profit firm — which means any months spent in that job don’t rely in the direction of aid beneath PSLF.

“Even though I had worked over 10 years at that point in qualifying work I was still eight payments away because of strange little loopholes in the program that definitely did not make sense to me.” For instance, Pope had submitted month-to-month funds earlier than the invoice was technically due.

Last yr Pope submitted paperwork to see if any extra funds would rely beneath a brief enlargement of the Public Service Loan Forgiveness program that the Biden Administration launched final yr. Pope hustled to get employers they hadn’t labored for for years to fill out the types, however Pope acquired the paperwork in earlier than the deadline. Now, Pope is ready to listen to again.

If the court docket strikes down the Biden administration’s broader debt aid plan, Pope will proceed to protest in addition to name and write to lawmakers to push them to assist pupil debt cancellation — and encourage others to do the identical. Pope may even proceed to share info and sources to assist debtors perceive their debt as a part of a broader system and really feel much less disgrace surrounding it.

“I got involved with organizing because of the government not doing what I think it should be doing,” Pope stated. “I absolutely believe that we can support each other and we can take care of this despite what the government does.”

Source web site: www.marketwatch.com