Thirty-six years in the past, on Oct. 19, 1987, the U.S. inventory market suffered its worst crash ever. That day, the Dow Jones Industrial Average

DJIA

misplaced 22.6%.

The good news is that the percentages are extraordinarily low that U.S. shares within the subsequent a number of months will expertise a comparable single-session decline.

The dangerous news is that these odds aren’t zero. Though the percentages on any given day are low, likelihood is excessive {that a} drop of such magnitude will happen sometime. Investors must take these odds into consideration as they devise portfolio methods, both on their very own or with a monetary adviser’s assist.

We know the percentages of a crash as a result of researchers a number of years in the past derived a components that efficiently predicts the typical frequency of inventory market crashes over lengthy durations of time.

According to that components, there’s a one-in-five likelihood that over the subsequent 30 years the U.S. market will see one other 22.6% one-day drop.

Need to Know: Stanley Druckenmiller says central banks, not earnings, transfer markets. His axiom might be put to the check Thursday.

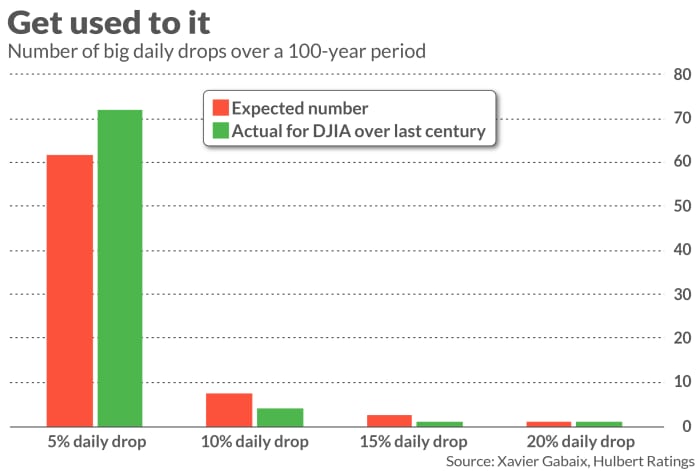

One method of judging the researchers’ components is by evaluating the Dow Jones Industrial Average’s large drops over the previous century with what that components would have predicted. As you’ll be able to see from the chart beneath, the components has accomplished a formidable job.

Insuring towards a crash

To be certain, the researchers’ components doesn’t predict when crashes will happen, solely their frequency over lengthy durations of time. You may suppose meaning you’ll be able to’t plan for them. But that isn’t so, in response to Nassim Taleb, a professor of Risk Engineering at New York University.

In his well-known e book “Black Swan: The Impact of the Highly Improbable,” Taleb in impact argues that we’re unsuitable to suppose that each day inventory market modifications neatly fall right into a bell-shaped or “normal” distribution, with most of these modifications being minor (the hump in the midst of the bell) and some large positive aspects and some large losses in the appropriate and left tails of that distribution. Instead, the left aspect of that distribution is fatter than anticipated; that fats tail comprises what Taleb refers to as “Black Swans.”

Because inventory market positive aspects and losses don’t adhere to a traditional distribution, each buyers and monetary advisers are mistaken in considering they’ll merely decrease purchasers’ portfolio danger and proportionally scale back their returns. Instead, an “average” danger portfolio could have below-average efficiency.

Taleb writes: “[B]ecause of the Black Swan, [your strategy should be] … as hyper-conservative and hyper-aggressive as you can be instead of being mildly aggressive or conservative. Instead of putting your money in “medium risk” investments… , it is advisable to put a portion, say 85 to 90 %, in extraordinarily protected devices, like Treasury payments. … The remaining 10 to fifteen % you set in extraordinarily speculative bets, as leveraged as potential (like choices).”

To illustrate, think about allocating 90% of your portfolio to one-year U.S. Treasury payments

BX:TMUBMUSD01Y

and shopping for one-year name choices on the S&P 500

SPX

with the remaining 10%. Since T-Bills at present yield greater than 5%, you’ll not lose cash over the subsequent 12 months even when the decision choices expire nugatory. If as an alternative the S&P 500 rises sufficient to pay for the choice’s premium, you’ll flip a revenue. And if the inventory market skyrockets, you’ll understand an outsized return.

That’s only one instance. Another chance is to considerably spend money on equities and allocate the rest to S&P 500 put choices. Regardless, you’ll positively sleep higher for it.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He may be reached at mark@hulbertratings.com

Read on: Wall Street warns of ‘Black Monday’ repeat simply in time for thirty sixth anniversary

Also see: Wall Street’s largest bear is standing by his name for shares to hunch 10% by January. Here are 4 charts that help his level.

Source web site: www.marketwatch.com