If you’re eligible to obtain Social Security advantages, you’ll be able to start receiving month-to-month funds on the age of 62. But you’ll be able to wait longer to assert the advantages, to obtain increased funds. There are additionally different components to contemplate.

You can take a look at your personal Social Security fee estimates right here and obtain your assertion. It is a good suggestion to try the up to date estimates every year.

Before considering of how a lot your funds will enhance when you wait to start receiving them, needless to say Social Security’s Full Retirement Age (FRA) is 67 for individuals born in 1960 or later. If you have been born earlier, you’ll be able to lookup your FRA right here. If you’re married and start to obtain funds earlier than your FRA, advantages to your partner could also be decreased. Your month-to-month fee will max out on the age of 70 when you wait that lengthy.

If you’re married, it is very important issue that into your Social Security timing determination. If you’ve a nonworking partner who’s a number of years youthful than you’re, needless to say your partner could dwell for fairly a while after you die, and depend on your Social Security funds for earnings.

Mark Hulbert discusses how your thought course of can drive your determination on when to start accumulating Social Security funds. And dozens of readers have added considerate feedback.

From my very own Social Security estimate, the quantity that month-to-month funds will enhance for annually I wait previous the preliminary eligibility age of 62 varies from 7.3% to 9.1%. But if I calculate a compound annual development charge for the quantity of the month-to-month fee if I wait till the age of 70, the speed is nearly 8%.

For an illustration of the impact of ready, we will create a back-of-the-envelope set of numbers for an individual who’s eligible to obtain Social Security, turns 62 this 12 months and is dealing with the timing query. For simplicity, we are going to pass over the Social Security Administration’s cost-of-living changes (COLA), that are primarily based on inflation.

Here’s how a lot the funds will enhance if the particular person waits, from an arbitrary month-to-month baseline fee of $2,000, with funds growing 8% for annually of ready:

| Retirement age | Monthly fee | Annual earnings |

| 62 | $2,000 | $24,000 |

| 63 | $2,160 | $25,920 |

| 64 | $2,333 | $27,994 |

| 65 | $2,519 | $30,233 |

| 66 | $2,721 | $32,652 |

| 67 | $2,939 | $35,264 |

| 68 | $3,174 | $38,085 |

| 69 | $3,428 | $41,132 |

| 70 | $3,702 | $44,422 |

You can calculate share will increase for numerous situations, however beneath this one, the fee will enhance by 85% if the recipient waits till age 70.

If you’re in dire want of earnings while you flip 62, you’ll, after all, start to take the funds. But what if you’re nonetheless working or produce other sources of earnings to tie you over till you’re 65 or till you attain FRA?

In the feedback beneath Hulbert’s story, a couple of reader mentioned they’d by no means heard of anybody regretting a choice to start receiving funds at an early age. Another matter of debate is how lengthy somebody may be anticipated to dwell. One reader mentioned he knew individuals who had waited till FRA and even till the age of 70, after which obtained advantages for lower than 10 years.

From my very own expertise of figuring out many individuals effectively into their 90s, and when factoring-in {that a} nonworking partner who shouldn’t be eligible for their very own Social Security funds would possibly outlive the preliminary Social Security recipient by a few years, the timing determination can have an effect on a household for many years.

More than one reader wrote of the significance of incorporating anticipated funding returns into Social Security timing selections. There have been additionally philosophical discussions and expressions of insecurity within the federal authorities’s means to keep up Social Security long-term.

With so many issues to contemplate, it’s best to create a My Social Security account, take a look at your assertion and skim concerning the eligibility guidelines for you and your partner, that are all in the identical place.

Read on:

- Here’s how the federal government could shore up Social Security

- It is a win-win’: Federal program helps ‘the most vulnerable’ seniors discover jobs — and helps employers dealing with labor shortages.

Tech earnings (largely): the Ratings Game

Amazon Web Services (AWS) has a a lot increased working margin than its mother or father firm does.

Getty Images

Shares of Amazon.com

AMZN,

soared early Friday after the corporate reported an 11% enhance in quarterly gross sales from a 12 months earlier. Analysts had been wanting to see how effectively the Amazon Web Services unit would carry out, due to its excessive revenue margin, and AWS didn’t disappoint.

For AWS, second-quarter working earnings of $5.37 billion exceeded Amazon’s consolidated working earnings of $3.32 billion.

Analysis: How Amazon’s ‘game-changing’ earnings may unlock a sustained inventory surge

Following Thursday’s market shut, Apple Inc.

AAPL,

reported a 1% decline in quarterly gross sales from a 12 months earlier. This was the iPhone maker’s third straight gross sales decline.

At a time when many giant tech corporations are touting their forays into synthetic intelligence, Apple CEO Tim Cook defined why the corporate wasn’t making a lot AI noise.

Read: Apple is slogging towards a mediocre milestone not seen in 22 years

Therese Poletti appears at Uber Technologies Inc.

UBER,

which has defied naysayers to show its first quarterly working revenue.

Here’s a choice of protection from the Ratings Game column as company earnings season rolls on and inventory analysts react:

Are you a contrarian investor?

Getty Images

Here’s how so many people trip together with the herd: The SPDR S&P 500 ETF Trust

SPY

is 24% concentrated in shares of 5 corporations:

So even if you’re invested in a low-cost exchange-traded fund that tracks the U.S. benchmark

SPX

by holding shares of 500 corporations, the weighting by market capitalization means you’re concentrated within the largest tech-oriented names.

A contrarian investor is one who’s prepared to maneuver cash into areas of the market that different traders have been shying away from.

Michael Brush interviews Nick Schommer, supervisor of the Janus Henderson Contrarian fund JACNX who cautions that you just want a compelling purpose to make a transfer in opposition to the market, “which is right most of the time.” He describes three ways for making contrarian investments.

Robinhood makes two strikes to assist traders construct retirement nest eggs

Robinhood Markets Inc.

HOOD,

is well-known for making it straightforward for inventory merchants to win or lose shortly within the inventory market utilizing its cellphone app. But the brokerage agency is now providing to pay traders 1% to maneuver their retirement accounts onto its platform. Beth Pinsker studies how Robinhood modified its interface to encourage clients to take a position for long-term development inside their IRAs.

Fix My Portfolio: I’m in my 70s and doing Roth conversions, however I’m unsure I’m doing it proper

Carl Icahn’s wild trip

Carl Icahn, chairman of Icahn Enterprises.

Neilson Barnard/Getty Images

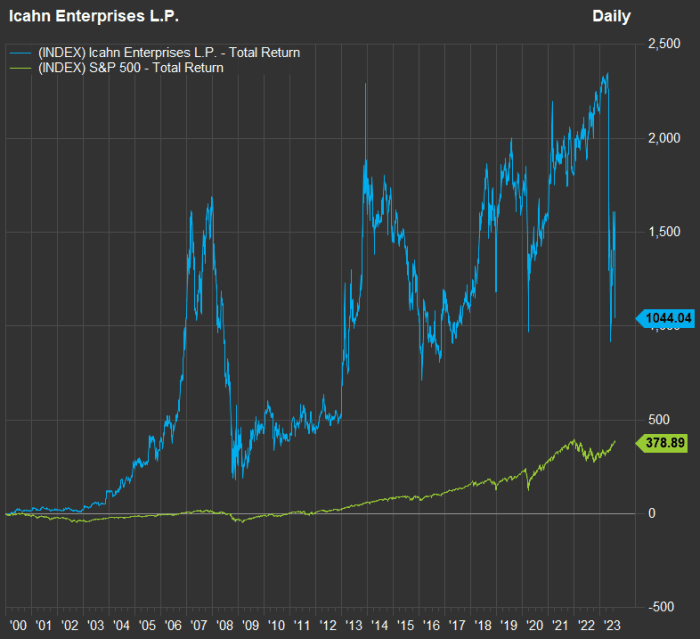

Shares of Icahn Enterprises L.P.

IEP,

have been down 30% in morning buying and selling Friday, after the corporate reduce its quarterly dividend in half to a greenback a share.

The agency’s CEO Carl Icahn blamed the corporate’s second-quarter internet loss and dividend reduce partly on a report printed by the brief vendor Hindenburg Research in May.

In the agency’s earnings press launch, Icahn additionally mentioned: “I believe it is compelling that if you purchased 1,000 IEP depositary units in January 2000, for $7.63 per unit and elected to take all distributions in cash as they were paid, you would have received approximately $76,000 in cash distributions and would have still owned the 1,000 units.”

At a midmorning share value of $23.12 on Friday, these 1,000 IEP items could be value $23,120. If you have been so as to add the Icahn-referenced $76,000 in money dividends, you’d be taking a look at $99,120. Not dangerous for an unique funding of $7,630.

But what when you had reinvested the dividends? Here’s a complete return-comparison between IEP and the S&P 500, with dividends reinvested for each, from Dec. 31, 1999 (when IEP closed at $7.63 per unit) as of about 10:30 ET on Friday:

Despite such excessive volatility, Icahn Enterprises has carried out very effectively for the total interval because the finish of 1999, compared with the S&P 500.

FactSet

Even with the dilution to the inventory, as Icahn himself has taken dividends within the type of new shares over time, the partnership’s complete return since 1999 has been superb compared with the S&P 500, factoring within the giant decline for the inventory early Friday.

The dynamic housing market

Oceanfront properties line the sands of Mantoloking, New Jersey.

Getty Images

Guess which state skilled the biggest enhance in residence costs over one 12 months by means of June 30? Here’s a touch: The state additionally has the very best property taxes within the U.S., on common. Aarthi Swaminathan summarizes the ups and downs of U.S. residence costs from the CoreLogic Home Price Index.

Here’s a pattern that highlights how vital it may be to do a whole lot of analysis earlier than shifting. An growing variety of individuals are shifting to flood-prone areas of the U.S. If your property is in a Special Flood Hazard Area, as decided by FEMA, a mortgage lender would require you to keep up flood insurance coverage. But even if you’re not in a flood zone, your space would possibly nonetheless be liable to flooding and it’s possible you’ll need to carry flood insurance coverage even when it isn’t required.

More housing protection:

Expensive shares, momentum and completely different funding approaches

Joseph Adinolfi explains how costly the U.S. inventory market has grow to be throughout this 12 months’s rally and the way momentum may push costs even increased.

If you assume shares are due for a protracted downturn, right here’s an exchange-traded fund that sailed by means of the 2022 bear market with a constructive return.

And right here’s an outperforming aggressive development fund whose managers persist with their weapons irrespective of what’s going on within the financial system or the inventory market.

James Rogers appears at two shares — Tupperware Brands Corp.

TUP,

and Yellow Corp.

YELL,

— which have shot into the stratosphere over latest days.

A spending pattern

Margot Robbie on the European premiere of “Barbie” in London on July 11.

AFP through Getty Images

Leslie Albrecht appears on the great spending by customers on leisure content material dominated by girls in the course of the summer time of 2023.

Want extra from MarketWatch? Sign up for this and different newsletters to get the newest news and recommendation on private finance and investing.

Source web site: www.marketwatch.com