I’m usually requested how secure the inventory market is — particularly after intervals like 2022.

It’s a legitimate query and inconceivable to reply definitively besides to remind people who what buyers receives a commission for is taking dangers. When you’re taking a threat, you actively invite (if not precisely welcome) the likelihood that you would truly lose one thing useful.

So finally, there isn’t a actual “safety” within the inventory market.

However, individuals take all kinds of dangers each hour of each day. They do that for a lot of causes, however nearly all the time there’s some payoff that’s imagined or anticipated.

The inventory market is not any totally different. If you’re taking what seems like no threat, for instance by protecting your cash in government-insured financial institution accounts, it might sound that you just gained’t lose.

Except that you’ll lose.

You will find yourself with at the least the identical variety of {dollars} as you began with — and doubtless extra. But your curiosity earnings gained’t be sufficient to maintain up with inflation — and that revenue is perhaps taxed.

In order to at the least sustain with inflation, you’ve obtained to take some threat. The trick is to take clever threat, and for my part the perfect place to do this is within the inventory market — as long as you make investments intelligently.

At a minimal, which means protecting your bills low, diversifying broadly and properly, and specializing in longer time intervals as a substitute of short-term ones.

The remainder of this text is in regards to the distinction between short-term investing and long-term investing.

One yr at a time, market returns are fairly random.

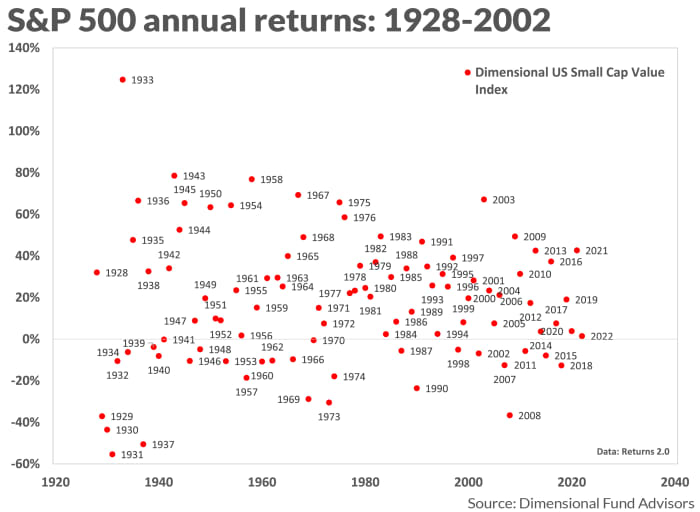

In Figure 1 under, every dot represents a single calendar-year return for the S&P 500 index

SPX,

As you look throughout from left to proper, you’re monitoring the a long time over 95 years.

You’ll see just a few actually terrible years: 1931, 1937, and 2008; plus some actually terrific years, together with 1933 and 1954. But past that, the returns appear fairly random.

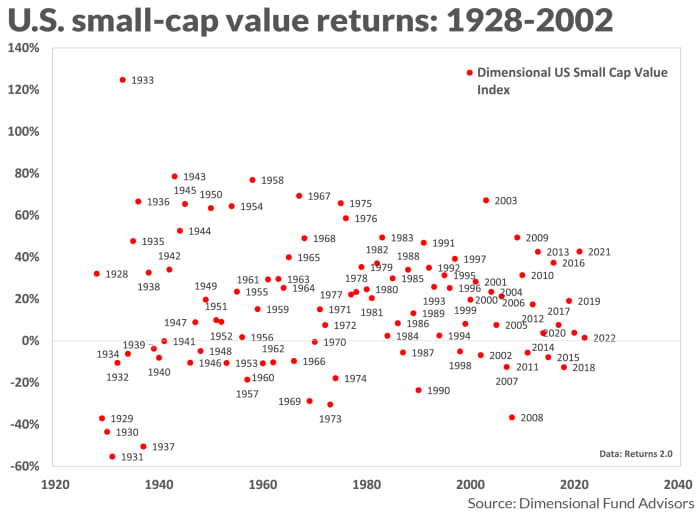

Figure 2 is analogous, displaying returns for U.S. small-cap worth shares. You’ll discover one extremely good yr and a beneficiant handful of returns over 60%. On the draw back, one of many largest losses occurred in 2008, and a lot of the relaxation within the Nineteen Thirties.

When you mix these graphics into one, the randomness is emphasised. If you need to have a look, you are able to do so right here.

All this knowledge could seem dense. But don’t hand over but.

The following three tables will help make some sense of it.

Table A: One-year returns, 1928-2022

| Best single yr | Worst single yr | |

| S&P 500 index | up 54% | down 43.3% |

| U.S. small-cap worth | up 124.7% | down 55.4% |

| 50/50 mixture | up 89.4% | down 49.4% |

| Source: Merriman Financial Education Foundation |

One yr at a time, the outcomes present numerous selection. The distinction between the perfect yr and the worst yr was a lot better for small-cap worth than for the S&P 500.

The third line exhibits the outcomes of mixing equal elements of these two asset lessons.

As you’ll see in Table B, for buyers who held on to 1 or each of those asset lessons for 15 years, the variability of returns was a lot decrease.

Table B: 15-year returns, 1928-2022

| Best 15 years | Worst 15 years | |

| S&P 500 index | up 18.9% | down 8.6% |

| U.S. small-cap worth | up 26.5% | down 1.9% |

| 50/50 mixture | up 23.9% | up 0.3% |

| Source: Merriman Financial Education Foundation |

Table C: 30-year returns, 1928-2022

| Best 30 years | Worst 30 years | |

| S&P 500 index | up 13.7% | up 8.5% |

| U.S. small-cap worth | up 22.7% | up 8.4% |

| 50/50 mixture | up 18.6% | up 8.8% |

| Source: Merriman Financial Education Foundation |

Table C is the true eye-opener amongst these three.

The worst 30-year intervals in every case have been constructive. They have been all moderately productive. And the worst 30-year losses have been remarkably shut to one another.

Sure, there’s a distinction between 8.4% and eight.8%. Over 30 years, an funding of $10,000 would develop to $112,429 on the decrease charge vs. $125,564 on the increased charge. But that’s hardly a life-changing distinction.

However, the variations between the perfect intervals have been significantly extra dramatic.

A 30-year funding compounding at 13.7% (the S&P 500) would develop to $470,775. At 22.7% (small-cap worth) the comparable outcome could be exhausting to imagine: $4.63 million.

Still, not many buyers could be keen to stay with an all-small-cap-value portfolio for 30 years. The 18.6% return of the 50/50 mixture could be simpler to abdomen, and it might flip $10,000 into $1.67 million.

These tables illustrate just a few classes for buyers.

- The variability of returns is way decrease in longer intervals;

- The variations between the perfect returns are normally better than the variations between the worst returns.

- Combining the S&P 500 and small-cap worth supplied a smoother trip in one-year and 15-year intervals and supplied the very best 30-year return.

Here’s one thing else: Regardless of what time interval you measure, small-cap worth has been by far the probably to be the highest performer among the many 4 main U.S. asset lessons, which additionally embrace small-cap mix and large-cap worth along with the S&P 500.

This helps my view that small-cap worth could be a worthwhile addition to any long-term portfolio, even when it performs solely a modest position.

I believe there’s at the least yet another useful lesson for all the coloured dots in Figures 1 and a pair of above.

The subsequent time you hear somebody predicting the inventory market, keep in mind: This yr or subsequent yr, the S&P 500 has demonstrated that it could possibly be up by greater than 50% — or down by greater than 40%.

Here are two items of knowledge, overlaying all of the calendar years from 1928 by 2022, that may assist slender that down a bit.

- Two-thirds of the returns for the S&P 500 fell between minus 10% and plus 30%.

- Two-thirds of the returns for small-cap worth shares fell between minus 30% and plus 40%.

Want to know extra about small-cap worth investing? Check out my video “20 things you should know about small-cap value stocks.”

Richard Buck contributed to this text.

Paul Merriman and Richard Buck are the authors of “We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.” Get your free copy.

Source web site: www.marketwatch.com