It might take six extra years for the Federal Reserve to shrink its mortgage bondholdings to lower than $1 trillion, based on a brand new Goldman Sachs estimate.

The Fed’s stability sheet already has fallen to about $8 trillion from a close to $9 trillion peak final 12 months. But progress has been sluggish in shedding its $2.5 trillion in mortgage-bond holdings, a permanent vestige of its pandemic-era insurance policies.

A giant motive for that has been climbing U.S. mortgage charges, now north of seven%, with the Fed’s charge hikes placing refinancing and gross sales exercise largely on ice.

The Fed final week steered its coverage charge might keep above 5% for longer than an earlier forecast, darkening the housing-market outlook and fueling worries that mortgage charges might attain 8%, as an alternative of offering the aid many on Wall Street had been anticipating.

“Although many are locked into fixed rate mortgages, conditions for new buyers are strained,” Emin Hajiyev, senior economist at Insight Investment, wrote in emailed commentary.

As 30-year mortgage charges skyrocketed from a 2.7% pandemic low, house affordability sank to its lowest degree since no less than 1989, based on Hajiyev’s estimates. “For the first time since 2006, the median income does not qualify for the median property for sale.”

See: Interest charges will keep excessive ‘well into next year,’ Fed’s Goolsbee says

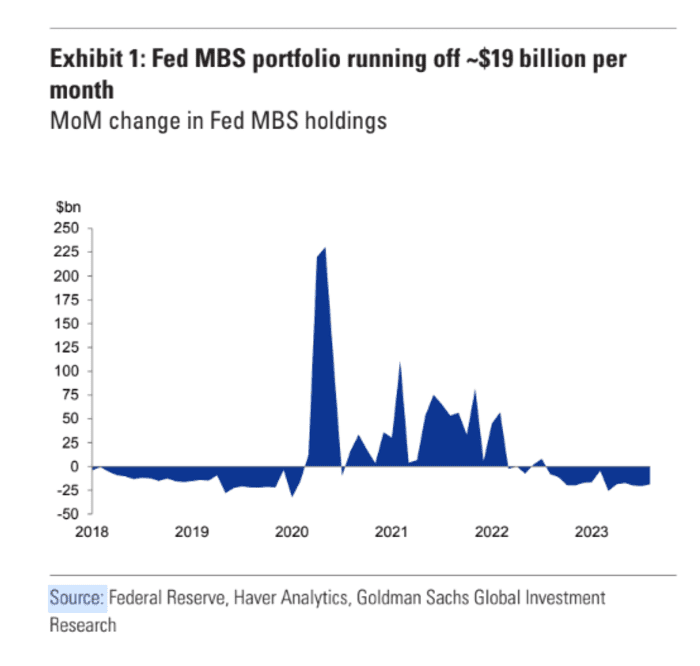

Goldman breaks down how the Fed’s footprint grew within the roughly $12 trillion company mortgage-bond market since 2018, together with its large uptick in purchases through the COVID disaster.

Fed’s mortgage-bond holdings are slowly shrinking every month, however falling beneath caps set final 12 months. Higher charges for longer gained’t assist pace issues up.

Federal Reserve, Haver Analytics, Goldman Sachs Global Investment Research

The Goldman chart additionally exhibits the Fed’s sluggish progress on unwinding its holdings. Mortgage-bond runoff this 12 months has been far beneath the Fed’s $35 billion month-to-month caps, lately clocking in at about $19 billion. The Fed isn’t promoting bonds to chop the scale of its stability sheet, however letting its holdings mature.

The caps on runoff have been designed to stop shocks in monetary markets because the Fed wrestles inflation all the way down to its 2% yearly goal by means of larger charges and by unwinding its pandemic bond purchases.

“With this ‘higher for longer’ backdrop we shift our focus to the Fed’s MBS portfolio which is now running off at ~$19 billion per month currently,” Goldman credit score analysts led by Roger Ashworth, wrote in a weekly shopper be aware.

“MBS” is shorthand for mortgage-backed securities or mortgage bonds. The Goldman staff thinks charge cuts in 2025 might increase the month-to-month MBS runoff to round $25 billion a month, however count on it to take till mid-2029 for the Fed’s mortgage-bond holdings to fall beneath $1 trillion.

The Fed mentioned on Wednesday mentioned it could maintain charges regular however proceed lowering its securities holdings.

The drawback is mortgage bonds are extremely delicate to the Fed’s coverage charge. Goldman analysts pegged the Fed’s mortgage bond portfolio at a couple of 3.2% weighted common coupon, a proxy for rates of interest, making a $35 billion a month paydowns quickly “seem very unlikely.”

Mortgages are priced at a premium to the risk-free Treasury charge. The benchmark 10-year Treasury yield’s BX:TMUBMUSD10Y sharp current climb has it touching 4.51% on Monday, the best since 2007.

Stocks have been combined Monday, with the S&P 500

SPX

and Nasdaq Composite

COMP

larger after posting their greatest weekly drops because the March banking disaster. The Dow Jones Industrial Average

DJIA

was close to unchanged, because it additionally erased a modest early loss.

Read next: 10-year Treasury yield can preserve climbing from 16-year highs, says world’s largest asset supervisor

Source web site: www.marketwatch.com