This is the time that the 60 million-plus Medicare beneficiaries can swap from conventional Medicare to a Medicare Advantage plan (or vice versa), swap between Medicare Advantage plans, and elect or swap between Medicare Part D prescription drug plans.

How ought to Medicare beneficiaries go about evaluating plans and deciding what’s of their greatest curiosity?

Review your ANOC

In September, it’s best to have acquired your annual discover of change (ANOC) and your Evidence of Coverage (EOC). And, when you haven’t reviewed your ANOC already, it’s best to accomplish that now. The ANOC lists the modifications in your plan, such because the premium and copays, and can evaluate the advantages in 2024 with these in 2023, based on Mitchell Clark, the director of digital technique and communications at Medicare Rights Center.

Compare plans

Next, it’s best to evaluate your Medicare protection with different obtainable choices to make sure you get one of the best plan tailor-made to your wants. You can do that utilizing Medicare’s plan comparability software.

Of word, seven in 10 beneficiaries, particularly these with decrease incomes, Hispanic ethnicity, older age, or twin eligibility, usually overlook this annual evaluation, based on KFF. And this oversight can result in elevated prices, restricted supplier entry, insufficient drug protection, and potential late enrollment penalties.

“We know most people on Medicare do not switch Medicare Advantage or Part D plans and find the process of reviewing options tedious and intimidating, but for some, the juice is worth the squeeze,” mentioned Tricia Neuman, a senior vice chairman with KFF.

“With so many Medicare plan options now available, it’s generally a good idea for beneficiaries to take a look at other available plans because they may find a plan that provides better coverage for lower costs,” mentioned Neuman.

The ever-changing and aggressive nature of the Medicare market is the main motive for evaluating plans. Plans change their prices and advantages yearly, and new plans could also be obtainable.

Not evaluating plans may imply lacking out on higher advantages at comparable and even decrease prices, based on Jae Oh, creator of Maximize Your Medicare.

Clark additionally emphasised the significance of purchasing round, as plans steadily change, and final 12 months’s most suitable choice won’t be essentially the most appropriate for the approaching 12 months. “Shop around to find a plan that best meets your needs and makes the most financial sense to you,” he mentioned.

Beneficiaries needs to be particularly conscious of the brand new plans from their present insurer or the brand new plans from different insurers launched annually. “The Medicare market is very competitive among insurers, and they frequently introduce new, enticing plans to attract new people without specifically offering them to their existing customers,”mentioned Elaine Floyd, creator of Savvy Medicare Planning for Boomers.

The activity of trying to find and choosing a plan isn’t simple, particularly now, because the regular competitiveness amongst plans is accelerating. “If anything, more carriers will be entering into more locations, there are going to be additional benefits which can be useful to certain people based on the plan that you select,” Oh mentioned.

In reality, beneficiaries shouldn’t count on to see the identical previous plans they reviewed when choosing a plan in 2023. “There are going to be new entrants into new locations,” he mentioned. “And the role for the beneficiary is to make sure they’re getting the most for their hard-earned dollar.”

Beneficiaries with unique Medicare, a Medigap plan and a Part D prescription drug plan don’t actually need to evaluation their Medigap plan throughout Medicare’s annual election interval if they’re happy with their Medigap plan, mentioned Joanne Giardini-Russell, the proprietor of Giardini Medicare, an unbiased Medicare insurance coverage company. They ought to, nevertheless, evaluate Part D prescription drug plans. “The only thing I want my Medigap people to do is pay attention to their drug plan and make sure that’s going to be accurate for 2024,” she mentioned.

Read: Have you accomplished your yearly Medicare Plan evaluation?

A frightening activity

Using Medicare’s plan comparability software can be a frightening activity. The common Medicare beneficiary in 2023 has entry to 43 Medicare Advantage plans, the biggest variety of choices ever, based on KFF.

Plus, beneficiaries in every state had the selection of a number of stand-alone prescription drug plans, starting from 19 in New York to twenty-eight in Arizona. 22 million seniors have stand-alone Medicare drug plan protection (Part D).

There are additionally Medigap plans at present provided in a lot of the U.S., although two are not obtainable for brand new enrollees below age 65.

Add to this the truth that you’re solely allowed to check Medicare Advantage plan towards Medicare Advantage plan, or drug plan towards drug plan, or Medigap coverage towards Medigap coverage. There’s no manner, utilizing the plan comparability software, to check one Medicare Advantage plan towards an unique Medicare plan with a Medigap and stand-alone Part D plan.

“Medicare’s Plan Compare tool is the best in class,” mentioned Katy Votava, president of Goodcare.com and creator of Making the Most of Medicare: A Guide for Baby Boomers. “That said, the class is woefully behind the curve…It is the best of the worst.”

So, given the complexity of the duty (and the truth that only one in 10 beneficiaries swap Medicare Advantage plans annually), what must you give attention to? Experts say there are 5 issues to contemplate when evaluating choices and deciding which plan to pick for 2024.

Make positive you perceive how any plan you might be contemplating works and that you simply take the time to ask questions.

Coverage and advantages

Beneficiaries ought to evaluate the protection and advantages provided by totally different plans to find out which plan greatest meets their wants.

Some beneficiaries, for instance, may have a plan that covers dental or imaginative and prescient care or health club membership or transportation, advantages provided by Medicare Advantage plans however not coated by unique Medicare. Others may have a plan that covers particular prescribed drugs and nonetheless others, those that have a power or disabling situation resembling stroke, most cancers, or dementia, may have a particular wants plan.

Beneficiaries ought to particularly evaluation their Medicare Advantage and/or Part D plan even when they’re pleased with their present protection and advantages. “Plans change their costs and benefits every year,” mentioned Clark.

Network of docs and hospitals

Beneficiaries can use the Medicare plan comparability software to seek for plans that embody their most well-liked docs and hospitals. And they need to affirm their specialists and pharmacies are in-network for the brand new plan. That’s particularly necessary for beneficiaries preferring Medicare Advantage over unique Medicare.

In addition, verify whether or not docs and different suppliers within the plan’s community are taking new sufferers. Check too if referrals are required to see specialists for the totally different plans.

“If you want to be able to see any doctor who accepts Medicare, stick with original Medicare and a good supplement like Plan G,” Floyd mentioned. (Plan G is a Medigap plan that covers almost all gaps in Original Medicare protection aside from the Part B deductible.)

Read: How to discover a Medigap coverage

Of word, some physicians are opting out of the Medicare program, based on KFF. About 1% of all non-pediatric physicians have formally opted-out of the Medicare program in 2023, with the share various considerably by specialty sort, and highest for psychiatrists (7.7%).

Prescription drug protection

Beneficiaries ought to evaluate the formularies of various plans to make it possible for all their prescribed drugs are coated and the way a lot they may value.

They also needs to evaluate drug prices resembling copays and coinsurance between plans. And they need to verify, if there’s value to their medicine, to notice how prices could differ from one pharmacy to a different.

Clark additionally mentioned beneficiaries with Part D plans might decrease their prices by purchasing amongst plans annually. “There could be another Part D plan in your area that covers all of the medications you take with fewer restrictions and/or lower prices,” he mentioned.

Read: Choosing Medicare drug protection.

You can use Medicare’s planning software to search out the stand-alone drug plan or Medicare Advantage plan with a prescription drug plan that has the bottom out-of-pocket prices for the medicine you are taking.

Of word, the Inflation Reduction Act impacts Part D protection in some ways, based on KFF. For occasion, the regulation provides a tough cap on out-of-pocket drug spending below Part D of $2,000 in 2025. And Part D enrollees pay not more than $35 per 30 days for coated insulin merchandise in all Part D plans.

Read: Save in your Medicare drug prices with Extra Help

Costs and premiums

Beneficiaries ought to evaluate the premiums, deductibles, copays, coinsurance, and the utmost out-of-pocket prices related to totally different Medicare Advantage plans, in addition to the worth of additional advantages.

Some Medicare Advantage plans, for example, provide further advantages, resembling prescription drug protection or dental, imaginative and prescient, listening to, transportation, health advantages, telehealth, worldwide emergency and over-the-counter medicine at no further value.

Beneficiaries also needs to evaluate what, if any, prescription drug protection prices there are.

Floyd famous that whereas Medicare Advantage plans usually have decrease month-to-month premiums in contrast with Medigap insurance policies, “those with conditions requiring frequent doctor visits and tests might face higher out-of-pocket costs with a Medicare Advantage plan.”

For occasion, in 2023, the utmost out-of-pocket for Medicare Advantage Plans was $8,300, based on Medicare Interactive. By distinction, the typical month-to-month premium for Medigap plans ranges from $150-$200 per 30 days on common, or $2400 per 12 months.

Review how a lot it can value to see your main care doctor in addition to specialists.

Plan scores and opinions

Beneficiaries can evaluate the standard scores of various Medicare plans on the Medicare web site. Medicare makes use of scores from 1–5 stars that will help you evaluate plans based mostly on high quality and efficiency.

Star scores are given yearly to measure the standard of well being and drug providers acquired by shoppers enrolled in Medicare Advantage and Prescription Drug Plans, mentioned Giardini-Russell.

The star scores for Medicare Advantage with prescription drug protection plan are based mostly on a number of high quality measures resembling client satisfaction, complaints towards the plan, members’ issues getting providers, and the like. “The higher the star rating, the higher the quality bonus payments to the carrier,” she famous. “But carriers can attempt to increase the ratings since they know it’ll increase funds and gain new members at the same time.”

For instance, she famous {that a} plan can provide a financial bonus for somebody getting a bodily and folks adhering to getting physicals generally is a part of reaching larger star scores.

“We just suggest that people don’t ‘chase’ 5-star plans unnecessarily and realize that a 3½ -star plan can work very well for them. Focus on the plan offerings, your doctor accepting the plan and your medication pricing before focusing on star ratings.”

Of word, if a Medicare Advantage Plan, Medicare drug plan, or Medicare Cost Plan with a 5-star high quality ranking is offered in your space, you should utilize the 5-star Special Enrollment Period to change out of your present Medicare plan to a Medicare plan with a 5-star high quality ranking.

Convenience

Beneficiaries might also wish to contemplate elements resembling how simple it’s to get customer support and whether or not the plan gives on-line options resembling the power to view claims and prescription drug protection.

Medigap plans

A Medicare beneficiary doesn’t want to check or consider their Medigap plan throughout Medicare’s annual election interval, based on Medicare Interactive. The annual election interval is primarily for making modifications to Medicare Advantage or Part D plans.

Read extra about Medigap buying particulars

But specialists say coverage house owners ought to evaluation their Medigap plan a minimum of yearly or as circumstances change.

Things to contemplate

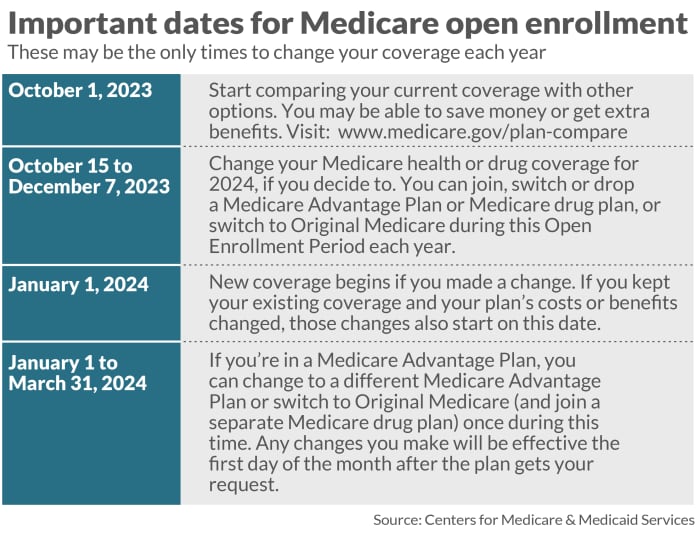

- New protection begins on Jan. 1, 2024, when you made a change. And, when you stored your current protection and your plan’s prices or advantages modified, these modifications additionally begin on this date.

- When you might be selecting between conventional Medicare and Medicare Advantage or between Medicare Advantage Plans, there’s a protracted listing of questions to contemplate. When selecting amongst Medicare Advantage plans versus conventional Medicare, most beneficiaries give attention to premiums, mentioned Neuman. “But premiums are a lousy proxy for annual costs,” she mentioned.

-

Those who’re enrolled in a Medicare Advantage plan can swap again to unique Medicare and, if desired, enroll in a stand-alone Part D prescription drug plan. But those that do “must undergo an intricate dance” and “take on a big financial risk without a Medigap plan,” mentioned Votava. She recommends the next sequence for individuals who switching:

- Look first to see in case you are eligible for a assured difficulty Medigap. The guidelines differ by state and different circumstances.

- If an individual shouldn’t be eligible for assured difficulty Medigap, they may nonetheless qualify for protection.

- Apply for Medigap first, be accepted, then enroll in Medicare Part D.

- If you’re planning to change to conventional Medicare solely or a Medicare Advantage plan with no prescription-drug plan, word that you simply will be unable to “restart” that simply, mentioned Oh. “You’ll have to wait until the next year, and then the late enrollment penalty will be assessed,” he mentioned, noting that there’s a sophisticated components to calculate the Part D late enrollment penalty.

- If you’re eager about switching from a Medicare Advantage plan to unique Medicare with a Medigap plan, Neuman mentioned you ought to be aware of Medigap guidelines that enable insurers to disclaim protection for folks with pre-existing circumstances. “This is an important consideration for people first going on Medicare but could also be an issue for people thinking about switching to traditional Medicare,” she mentioned.

- Outside of the annual election interval, beneficiaries could qualify for particular enrollment intervals if they’ve sure life occasions like transferring residences or shedding different protection.

- Beneficiaries who’re planning to journey ought to contemplate selecting a plan that has a nationwide community of suppliers.

Source web site: www.marketwatch.com