Don’t be too fast to promote the shares which have carried out the worst thus far this 12 months, since they’re more likely to be among the many U.S. market’s finest performers in January.

That’s as a result of these loser shares can be subjected to 2 completely different sources of synthetic promoting stress in coming weeks, neither of which has something to do with fundamentals or earnings potential. That stress involves an finish on Dec. 31, which is why these shares are more likely to bounce again in a giant manner in January.

One supply of promoting pressures is end-of-year window dressing, through which portfolio managers promote their losers with a purpose to keep away from the embarrassment of getting to listing them of their end-of-year reviews. The different is tax-loss promoting, through which traders promote a few of the shares they’re holding at a loss with a purpose to offset a few of the capital good points taxes they must pay in 2024.

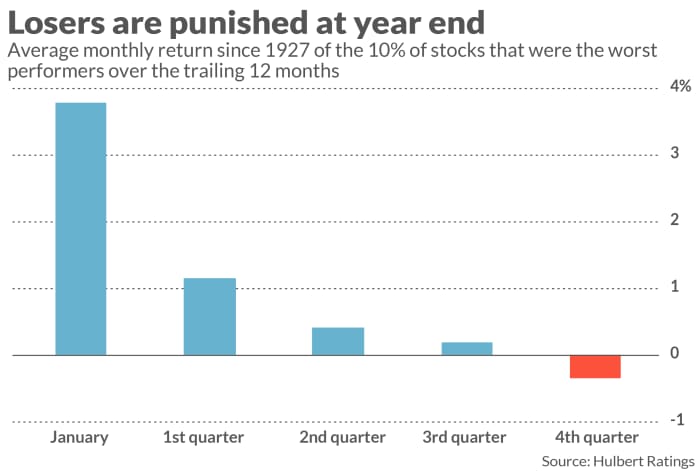

The chart under illustrates this January bounce-back sample, based mostly on knowledge since 1927 (courtesy of Dartmouth College’s Ken French). It plots the return of a hypothetical portfolio that, every month, invests within the 10% of shares with the worst trailing-year returns. Notice that the strongest common returns are in January and the worst on the finish of the 12 months.

To exploit this sample, begin by trying by means of a listing of the most important year-to-date losers. Pick out a handful that entice you, and place purchase orders on them at costs well-below the place they’re at present buying and selling. If you’re fortunate, year-end window dressing and tax-loss promoting will depress costs sufficient that just a few of your orders are crammed. Come January you stand an excellent likelihood of pocketing some outsized good points.

I illustrated this method a 12 months in the past by taking the ten% of S&P 1500 shares with the worst year-to-date efficiency and narrowing the listing to incorporate simply those who have been additionally really useful by any of the funding newsletters my agency screens. The 20 shares that survived this winnowing course of gained 21.8% in January of this 12 months, on common, far outpacing the S&P 500’s

SPX

6.3%.

The listing under repeats this course of with this 12 months’s listing of worst year-to-date performers within the S&P 1500 thus far this 12 months. Each of the next is really useful by at the very least one of many funding newsletters by agency screens.

| Stock | YTD return (through 10/20) |

| Advance Auto Parts, Inc. (AAP) | -64.5% |

| First Horizon Corporation (FHN) | -55.3% |

| Moderna, Inc. (MRNA) | -55.2% |

| Dollar General Corporation (DG) | -52.7% |

| AES Corporation (AES) | -50.9% |

| Methode Electronics, Inc. (MEI) | -46.0% |

| Newell Brands Inc (NWL) | -45.1% |

| Estee Lauder Companies Inc. Class A (EL) | -44.1% |

| Macy’s, Inc. (M) | -42.6% |

| Northfield Bancorp, Inc. (NFBK) | -42.5% |

| Premier, Inc. Class A (PINC) | -42.2% |

| Concentrix Corporation (CNXC) | -41.8% |

| UGI Corporation (UGI) | -41.7% |

| Sealed Air Corporation (SEE) | -40.9% |

| Illumina, Inc. (ILMN) | -40.8% |

| Walgreens Boots Alliance, Inc. (WBA) | -40.4% |

| Comerica Incorporated (CMA) | -40.4% |

| KeyCorp (KEY) | -40.3% |

| Foot Locker, Inc. (FL) | -39.5% |

| Bank of Hawaii Corp (BOH) | -38.7% |

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He may be reached at mark@hulbertratings.com

More: JPMorgan’s Dimon and BlackRock’s Fink each see parallels to the Seventies

Also learn: Fear not: U.S. recessions don’t final lengthy, they usually ‘can be favorable entry points’ for shares, says B. of A.

Source web site: www.marketwatch.com