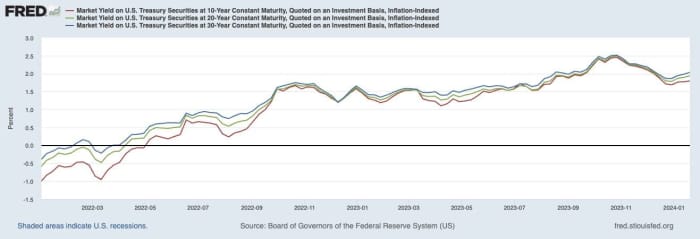

Inflation is slowing down, hopefully for good. But actual rates of interest — what you’ll be able to earn from investing in secure authorities bonds over and above inflation stay excessive. Since 2022 actual yields on Treasury inflation-protected securities (TIPS), also called inflation-indexed bonds, have gone from under zero to roughly 2%. Where savers had been as soon as prepared to lend their cash to the U.S. authorities in alternate for limiting their loss, they’re now being compensated fairly handsomely.

Figure 1. Real rates of interest have risen dramatically over the previous few years

Board of Governors of the Federal Reserve System

For these making ready for or already in retirement, that is particularly good news. Buying particular person TIPS that mature throughout totally different years — a method referred to as constructing a TIPS ladder – might help you lock in a stream of inflation-adjusted earnings for so long as 30 years.

Let’s put this into perspective. When actual charges had been 0% again in early 2022, it price about $1 million to construct a TIPS ladder producing $100,000 of inflation-adjusted earnings annually for the subsequent 10 years. Now, with actual charges close to 2%, the identical decade of $100,000 of annual inflation-adjusted earnings prices about $900,000.

Think about that for a minute. The similar stream of {dollars}, exactly the identical buying energy, now prices $100,000 much less, letting you spend $10,000 extra a 12 months.

Learn extra: How to make use of TIPS to construct up retirement wealth

Your monetary plan

What does this imply to your monetary plan? Now’s a great time to construct your TIPS ladder. Doing so might help you lock in a better dwelling normal with out taking pointless threat.

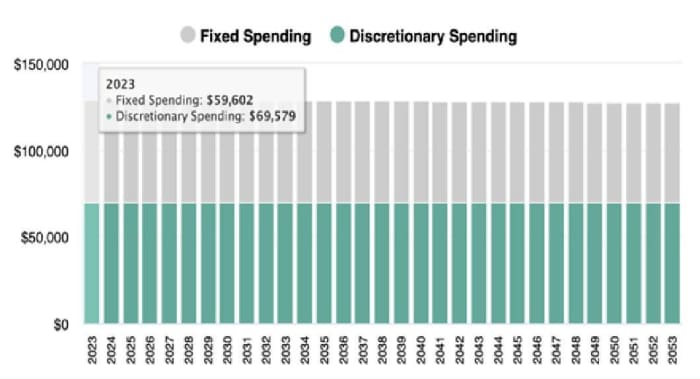

Let’s be extra concrete. Consider the Johnsons, a 70-year-old retired couple with $40,000 a 12 months in Social Security earnings and $2 million in financial savings, together with $1 million in retirement accounts and $1 million in taxable investments. Back in early 2022, when actual charges had been 0%, if they’d created a monetary plan utilizing a planning instrument similar to MaxiFi Planner, an software bought by an organization I run after I’m not instructing, they may have constructed a TIPS ladder to help their spending over the subsequent 30 years. They might safely afford to spend about $49,671 on discretionary spending, adjusted for inflation, annually via age 100. Discretionary spending is spending on high of fastened bills, like housing, taxes and Medicare premiums.

Now, with actual charges at about 2%, the Johnsons, with the very same monetary targets and assets, can safely afford to spend $69,579. In impact, the upper actual return on TIPS has safely elevated their discretionary spending in retirement by $19,908 yearly for all times. That is a 40% enhance of their lifestyle.

Figure 2. Higher actual charges have elevated how a lot the Johnsons can safely afford to spend on their dwelling normal

Check out: MarketWatch’s How to Invest part

How to construct a TIPS ladder

In apply, constructing a TIPS ladder means shopping for inflation-indexed Treasury bonds of various maturities, both out of your common property or a brokerage account in your IRA. The purpose is to have the TIPS present inflation-adjusted earnings — a mixture of curiosity and principal funds — in annually to fulfill some or your whole spending wants.

Figuring out how a lot actual annual earnings you want the ladder to provide, and for a way lengthy, might be an important query to deal with first. Start by contemplating easy methods to construct a TIPS ladder that produces at the very least sufficient earnings along with Social Security (and another assured earnings you might have, like a pension or annuity) to cowl all of your fastened prices in retirement.

Building a ladder is comparatively easy. Use a web-based software like Tips Ladder to find out the very best bonds to your scenario, after which purchase these bonds via your low cost dealer. It could be accomplished in a day — though getting an actual human on the cellphone is normally greatest.

Let’s contemplate the hypothetical Johnson household once more. Between paying their taxes and overlaying housing and Medicare-related prices in retirement, their annual fastened spending is projected to be about $60,000, adjusted for inflation, for the subsequent 30 years.

Figure 3. The Johnsons anticipate to spend about $60,000 a 12 months on fastened bills in retirement

With $40,000 of inflation-adjusted annual Social Security earnings, this implies the Johnsons would require a further $20,000 of inflation-adjusted annual earnings for the subsequent 30 years to cowl all of their fastened spending ($60,000 — $40,000 = $20,000). At in the present day’s actual charge of two%, it will price them about $450,000. (Note that when TIPS charges had been 0%, the equal ladder price $600,000.) If they needed to cowl some portion of their discretionary spending as properly — the turquoise bars in determine 3 — they may make investments much more into their TIPS ladder.

Plus: Annuities, Social Security, inheritance: How a lot cash do I must retire?

Upside investing fundamentals

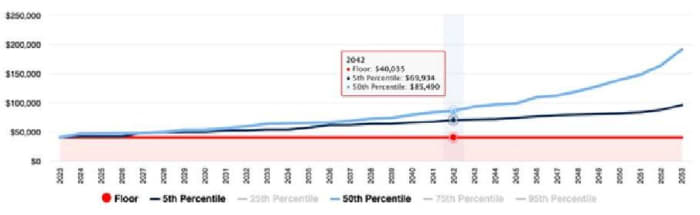

Let’s say you need to use TIPS to soundly cowl your whole fastened spending plus some minimal acceptable stage of discretionary spending in retirement — what we’ll name your living-standard ground. Having locked on this living-standard ground now you can have interaction in so-called upside investing, by investing your remaining financial savings in dangerous property like shares.

If the shares underperform (or go to zero) you’ll be able to nonetheless safely keep your living-standard ground. And, in the event that they carry out as (or higher than) anticipated you’ll be able to safely enhance your living-standard ground annually by changing a portion of the shares to TIPS over time. Let’s contemplate the Johnsons once more.

The Johnsons need a discretionary spending ground of about $40,000 a 12 months, adjusted for inflation. To accomplish this, along with overlaying all their fastened spending in retirement not already lined by Social Security, they make investments about $1.35 million of their financial savings right into a TIPS ladder that produces about $60,000 of annual actual earnings for 30 years ($40,000 to pay for his or her living-standard ground and $20,000 to cowl their residual fastened spending).

Then, they take their remaining $650,000 of financial savings and make investments it in shares, like a low-cost S&P 500 index fund. Each 12 months they promote a portion of the inventory — steadily, so they don’t threat exhausting this cushion earlier than they die.

Invest that capital acquire in TIPS and you’ll persistently elevate your living-standard ground all through retirement. If shares carry out poorly (see darkish blue line in Figure 4), the Johnsons’ dwelling normal ground could not rise a lot. But, if shares carry out as anticipated (see gentle blue line), the Johnsons will be capable to spend properly above their ground by capturing the upside.

Figure 4. The Johnsons use TIPS to lock in a $40,000 dwelling normal ground, after which make investments the remaining in shares, hoping to extend discretionary spending sooner or later.

In a way, upside investing is like having your cake and consuming it too. By utilizing TIPS to cowl your fastened spending and lock-in a desired living-standard ground in retirement, you’ll be able to safely put money into shares for his or her potential upside. The decrease you set your dwelling normal ground, the higher is your potential upside, and vice versa.

Also learn: As you close to retirement, scrutinize your Social Security assertion. Here’s what catches an adviser’s eye.

Summarizing the technique

With actual (inflation-adjusted) rates of interest increased than they’ve been for the reason that 2007-09 recession, now you can safely afford to spend extra with out having to take pointless threat. This technique includes constructing a “TIPS ladder” — that’s, a portfolio of particular person Treasury inflation-protected securities that mature on totally different dates over the approaching years.

Locking-in a stream of actual earnings funds in retirement by way of a TIPS ladder can each safely cowl your fastened spending and create a dwelling normal ground. Surprisingly, this method may make investing in shares much less dangerous from a dwelling normal perspective. By setting a snug living-standard ground utilizing TIPS, you’ll be able to successfully afford to take extra threat along with your remaining investments in hopes of accelerating your dwelling normal all through retirement.

Jay Abolofia, a Ph.D. economist and Certified Financial Planner, is president of Lyon Financial Planning in Waltham, Massachusetts.

Laurence Kotlikoff is a co-author of “Get What’s Yours from Social Security” and a professor of economics at Boston University.

This article is reprinted by permission from NextAvenue.org, ©2024 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

Source web site: www.marketwatch.com