Student loans are a trillion-dollar drawback dealing with some 44 million federal pupil mortgage debtors within the U.S., however this cash accounts for under a small portion of the overall value of school. A a lot greater portion comes straight out of the pockets of fogeys, in keeping with the most recent “How America Pays for College” examine by student-loan lender Sallie Mae, and that burden hasn’t shifted in a long time.

“Parent income and savings always lead the pack. The numbers fluctuate here or there, but when it comes to paying for college, families consistently dip into their own pockets,” says Rick Castellano, vp of company communications at Sallie Mae.

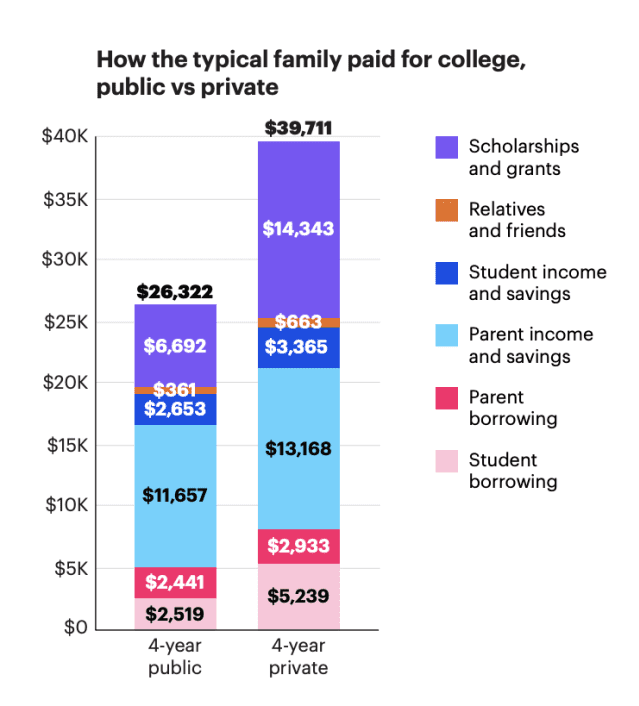

This 12 months’s report exhibits that folks pay the vast majority of faculty prices for these attending four-year public faculties, averaging $11,657 per 12 months from their revenue and financial savings. Student borrowing, then again, was $2,519 per 12 months, and guardian borrowing was $2,441.

Sallie Mae

For these attending four-year non-public faculties, the parental contribution averaged $13,168, and borrowing jumped to $5,239 for college students and $2,933 for fogeys. At these establishments, scholarships and grants counted for extra present {dollars}. But that could be only a displacement of spending for fogeys, too, as a result of that “earned” cash little doubt got here on the again of years of piano classes, membership sports activities, SAT tutors and the like.

“The planning doesn’t necessarily start in junior or senior year of high school,” says Castellano. “Some of that has to do with researching and finding scholarships and setting up appropriate extracurricular activities well in advance.”

Borrowing is rarer than you suppose

Sallie Mae

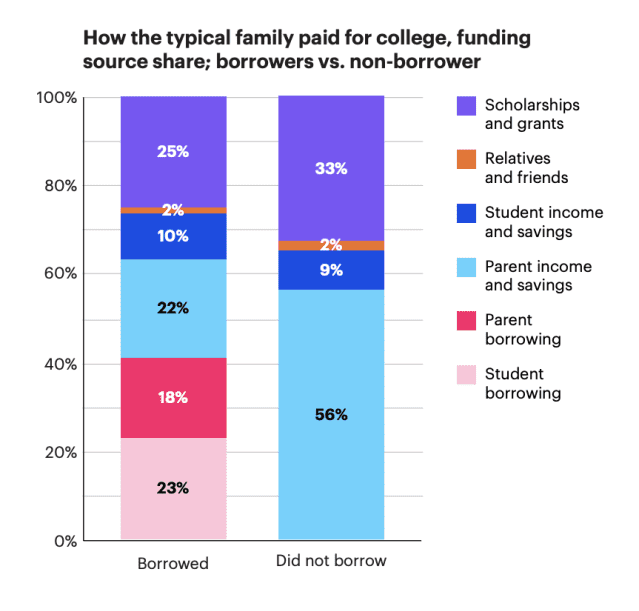

There are some demographic variations between debtors and non-borrowers, however the variations aren’t all that statistically vital, in keeping with Jenny Berg, vp at Ipsos, which administered the survey. The imply revenue of the households not borrowing is about $10,000 greater than the households that borrow. But on the identical time, non-borrowers had been additionally extra more likely to attend two-year applications as an alternative of four-year ones, so had been spending a lot much less.

Only 4 out of 10 households borrow for faculty, and never each household borrows for yearly of tuition, in keeping with Sallie Mae. The examine discovered that for the 2022-2023 educational 12 months, 28% of households used pupil borrowing and 18% used guardian borrowing, and solely 5% used each on the identical time. For people who weren’t borrowing, the cash that made up the distinction got here out of guardian spending.

What dad and mom can do

Student mortgage repayments are getting many of the consideration right now, as a result of the pause of federal loans lifts on Oct. 1. That isn’t more likely to alleviate the parental tuition burden, however there are some self-help steps that households can take to alleviate the monetary pressure of paying for faculty.

The first, notes Castellano, is to fill out the Free Application for Federal Student Aid, even in case you don’t suppose you qualify. The Sallie Mae survey discovered that solely seven out of 10 households full the shape. “It’s the gateway to federal grants and aid,” he says.

Ironically, whereas the Education Department is making an attempt to simplify the shape, the rollout is inflicting extra confusion than ordinary, as a result of 72% of these surveyed don’t even know when the shape goes to be accessible – together with Castellano – as a result of there’s no remaining date. The FAFSA moved to an Oct. 1 launch in 2016, however this 12 months will probably be accessible someday in December. The earlier you fill out the shape the higher, as a result of some state assist is given out on a first-come-first-serve foundation.

Another parameter in dad and mom’ management is the place children apply to varsity. Castellano suggests having an sincere dialog about this as early as attainable – even years forward of any functions being due. And one factor to be clear about is who’s paying for these pupil loans – some 44% of households by no means focus on this, in keeping with Sallie mae. “You have to come into the process with eyes wide open. If you haven’t had that conversation and made a budget, no time like the present,” says Castellano.

Perhaps most vital, attempt to win some cash outdoors of the school utility course of. Scholarships don’t have to simply come from the school a pupil goes to attend. There are tens of millions of {dollars} accessible for each attainable curiosity group. “The last thing any family wants to do is leave free money on the table,” says Castellano.

More from Beth Pinsker

Source web site: www.marketwatch.com