You should make a variety of choices once you retire, and among the many largest is what to do along with your office retirement financial savings. No matter how a lot cash you will have or how you propose to speculate it, it’s important to first select the place your nest egg will dwell.

You have 4 primary selections.

- Remain in your employer’s plan and simply let the cash develop till it’s important to begin taking the required minimal distributions (RMDs).

- Remain in your employer’s plan whereas taking installment funds.

- Roll over the property to an IRA at an establishment of your selecting.

- Take the account stability in money and pay tax on the distribution to both spend it or roll it right into a Roth IRA.

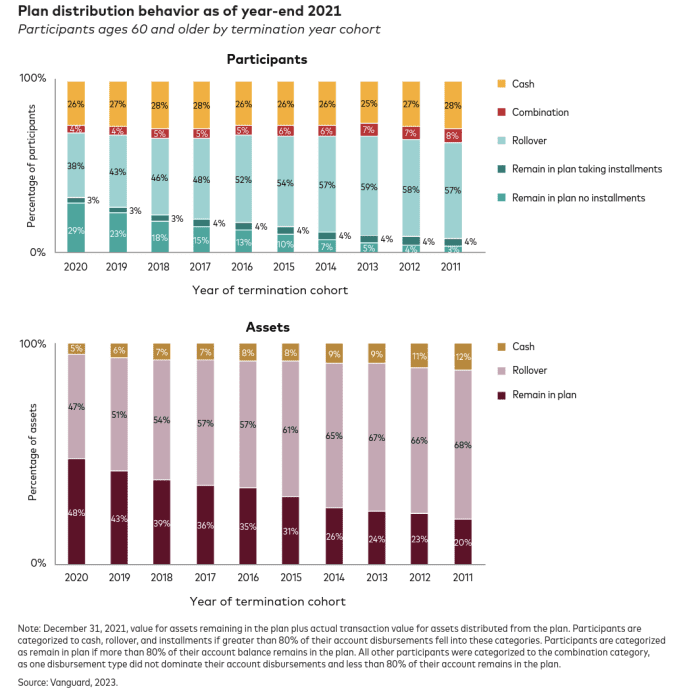

The good news, in keeping with current analysis from Vanguard, is that most individuals confronted with this resolution over 10 years, from 2011 to 2021, had been in a position to protect their retirement {dollars}. Seven out of 10 saved their property in a tax-deferred surroundings, and 90% of the cash stayed invested, and presumably, grew a bit. Average balances ranged from $239,300 to $418,900.

“More and more investors are on the right road to having a good experience with accumulations. We’re seeing improvements,” says Matt Brancato, chief shopper officer for Vanguard Institutional.

But, Brancato provides, “the average doesn’t tell you about individual experience.”

And for that, it’s important to take a look at among the much less good news, which is that Vanguard discovered that 30% cashed out their financial savings at age 60 or later, most with smaller balances. The common quantity of those accounts was $39,700. Some had probably merely saved much less, and a few had been with the corporate plan for a short while, so had not amassed a big quantity.

The peril of cashing out

Cashing out a small stability might sound inconsequential to you on the time. The account could possibly be one in all many that you’ve got, and the tax burden may not appear an excessive amount of so that you can bear. Or you could possibly be meaning to pay the revenue tax due on the distribution and roll the cash right into a Roth IRA in a conversion. Or the money is likely to be attractive – after which it’s gone.

“First of all, ‘small’ is a relative term,” says Brancato. “The dollar amount has to be proportionate to the intent. It’s a highly individualized decision.”

One necessary step if you happen to’re considering of cashing out is to think about how the quantity concerned may probably develop over time and add to your retirement revenue afterward. If your stability is $39,700 now and also you assume that isn’t a lot, it could possibly be $78,000 in 10 years, if it grows at 7%.

At Ascensus, one other massive retirement plan administrator, they show these numbers to folks once they provoke a call that will affect their retirement financial savings, like lowering their 401(okay) contribution. “We serve up a very quick estimate to connect the dots between what seems like a small amount to a much larger amount of money you’d forgo in retirement as a result,” says David Musto, CEO of Ascensus. After seeing that info, “30% of people ultimately choose not to reduce 401(k),” he provides.

That identical type of info might also assist folks decide between staying of their office plan after retiring or transferring the cash to a rollover IRA. While most finally transfer cash over to their very own account inside 5 years, Vanguard’s examine exhibits that the numbers are shifting up for these staying of their office plan even after they retire.

Brancato sees the motive force of that being versatile plan design, recommendation and financial-wellness instruments that could be a part of an employer package deal. If you need to faucet into your cash earlier than it’s important to take RMDs, as an illustration, your plan must permit it, and Vanguard notes that the variety of plans providing this practically doubled prior to now 5 years.

“It’s increasingly retiree-friendly,” Brancato says.

Got a query about the mechanics of investing, the way it suits into your general monetary plan and what methods might help you take advantage of out of your cash? You can write me at beth.pinsker@marketwatch.com.

Source web site: www.marketwatch.com