The resilience of the U.S. financial system has been a shock to Wall Street, and the Federal Reserve, for properly over a yr now, and the most recent GDPNow estimate from the Atlanta Fed suggests the primary quarter may as soon as once more handily beat Wall Street’s estimates.

The main idea on why the financial system has been so robust, even amid a surge in inflation after which a steep rise in rates of interest, is the facility of fiscal spending. One paper final yr prompt that except the federal government pays down the debt — no danger of that with this Congress — extra financial savings will proceed to “trickle up,” for a interval of 5 years.

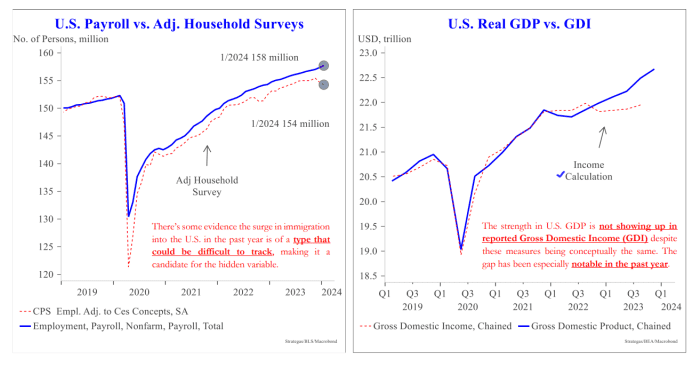

Analysts at institutional brokerage Strategas led by Don Rissmiller agree that what they name “big fiscal” — the big finances deficits being run at a time of full employment — is a serious driver of the financial system. But in addition they level to a different issue at work: immigration. “There are good reasons to believe the U.S. has benefited from positive supply effects, ie, there’s surprisingly solid real economic growth (~3%) along with more tame inflation (~3%) as we start 2024,” they are saying in a presentation. And the upside actually seems to be U.S. particular slightly than international.

Disinflation, they are saying, isn’t nearly provide chains bettering. Measures of stress, they observe, counsel the supply-chain-disruption story largely ended by the center of 2023. They additionally pour chilly water on the vitality shock receding, mentioning that occurred by the top of 2022.

So that’s the place immigration performs a task, serving to to offset the ageing of the U.S. workforce. “To the extent U.S. immigration has been tough to fully measure in recent years, the reported data may be underestimating this boost. The policy enacted by some states to relocate migrants from the southern border to larger cities may have also had the (likely unintended) effect of matching individuals to regions where there was an ability to work, even if informally. Such an occurrence could then help explain other U.S. data anomalies (e.g., missing workers in the household employment survey, missing income in the gross domestic income calculation)”

Immigration is the supply of a discrepancy between the Congressional Budget Office, which estimates the U.S. inhabitants rose by 0.9% final yr, and the Census Bureau, which estimates a 0.5% rise. “It’s tough to know for sure, but if there’s uncertainty around how many people are in the country it wouldn’t be a big stretch to think that some of the income is also not being reported correctly,” they are saying.

What are the market implications? “My most immediate concern is that if there’s a substantial change in the U.S. government’s policy regarding the border, that could set the stage for a second wave of inflation,” mentioned Rissmiller in a follow-up e mail. “Given how out-of-consensus that seems vs. expectations of central bank policy (easing) this year, that would pressure both bonds and stocks.”

A change doesn’t seem like imminent: a bipartisan border invoice collapsed this week amid stress from former President Donald Trump.

The market

The massive query for Thursday is whether or not the S&P 500 index

SPX

will take out the 5,000 mark — within the early going, there was little motion in futures contracts

ES00,

NQ00,

Related: S&P 500 seems accident susceptible because it nears milestone

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,995.06 | 1.81% | 4.49% | 4.72% | 22.38% |

| Nasdaq Composite | 15,756.64 | 2.57% | 5.25% | 4.96% | 33.65% |

| 10 yr Treasury | 4.115 | 23.78 | 14.47 | 23.53 | 45.37 |

| Gold | 2,050.90 | -1.03% | 0.87% | -1.01% | 9.48% |

| Oil | 74.45 | 0.72% | 2.20% | 4.37% | -4.13% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

The buzz

The U.S. financial calendar is on the sunshine facet on Thursday, with jobless claims the spotlight, forward of Friday’s seasonal adjustment revisions to shopper costs. There’s a $25 billion public sale of 30-year bonds at 1 p.m. Eastern. China’s CPI noticed the largest drop in practically 15 years.

There are 32 S&P 500 firms set to launch outcomes.

Walt Disney inventory

DIS,

rose on better-than-expected earnings because it restarted inventory buybacks.

ARM Holdings shares

ARM,

surged because the microchip designer lifted its earnings and income steerage for this yr.

PayPal

PYPL,

issued a cautious outlook on earnings and didn’t challenge income steerage for the complete yr.

Mattel

MAT,

is trying to minimize prices after the ‘Barbie’ growth.

The Supreme Court will hear arguments on the eligibility of Trump to run for president.

Best of the online

Investors are nearly at all times mistaken concerning the Fed.

Nvidia is near overtaking Amazon by market worth.

Here’s what historical past says a couple of megacap meltdown.

Top tickers

Here have been probably the most energetic stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

PYPL, |

PayPal |

|

PLTR, |

Palantir Technologies |

|

HOLO, |

MicroCloud Hologram |

|

ARM, |

Arm Holdings |

|

DIS, |

Walt Disney |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

BABA, |

Alibaba |

The chart

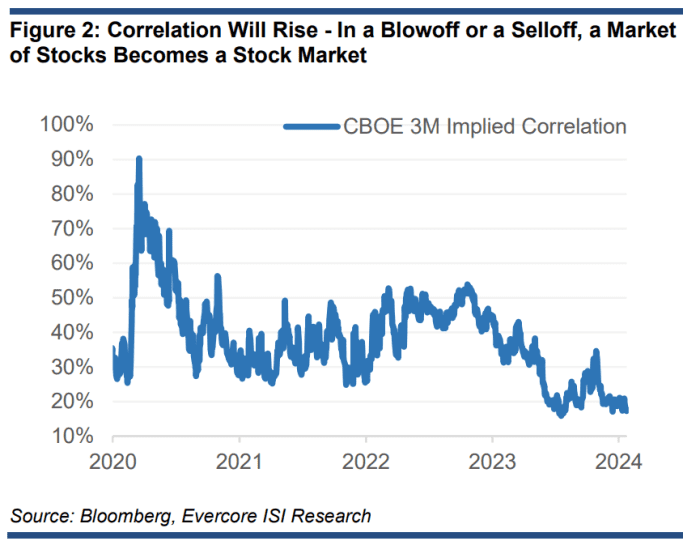

It’s a real market of shares, as this chart exhibiting low correlation between S&P 500 firms demonstrates. “Earnings reactions from stocks like Snap and Ford illustrate that correlations are low and it has been a market of stocks. For now,” say strategists at Evercore led by Julian Emanuel. He says the transfer to five,000 on the S&P 500 will increase the probability of sustained volatility in each instructions. Since December, shares and volatility have risen, which is a uncommon mixture that’s solely occurred twice since 2000, and each instances resulted in sell-offs.

Random reads

The land of Ferrari and Lamborghini imposes a 20 mile-per-hour velocity restrict.

This 285-year-old lemon was auctioned for a fairly candy £1,416 ($1,787).

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast concerning the monetary news we’re all watching — and the way that’s affecting the financial system and your pockets.

Source web site: www.marketwatch.com