A comparatively wholesome U.S. economic system is unlikely to see inflation fall again to 2% “without some amount of pain,” and monetary markets are in all probability pricing in too many charge cuts.

That’s based on James Solloway, chief market strategist and senior portfolio supervisor at SEI

SEIC,

which oversees about $1.3 trillion in property from Oaks, Pa. His views got here throughout every week through which tensions continued to flare within the Middle East and U.S. information pointed to a labor market that appears to be holding up and Americans’ willingness to spend regardless of 5%-plus rates of interest.

One of Solloway’s greatest takeaways is that wage pressures throughout main economies are unlikely to subside by sufficient to be in keeping with central banks’ inflation mandates. He is skeptical that U.S. inflation will settle across the Federal Reserve’s 2% goal primarily based on a couple of assumptions, one among which is that oil worth declines seen over the previous 12 months aren’t probably be repeated in 2024. Solloway additionally questions the necessity for any charge cuts by the Federal Reserve.

“The risks of an escalation in the Middle East are still higher than anybody should feel comfortable with, and actual military conflict could certainly lead to a sharp, short-term rise in oil prices and another supply shock,” Solloway stated through cellphone on Thursday. Such a provide shock “could lead to a ratcheting up of inflation expectations.”

Following the December U.S. consumer-price index studying on Jan. 11 and Thursday’s preliminary jobless claims information, “there doesn’t seem to be much weakness in the economic numbers looking out for the next six months,” he stated. “Inflation between 3% and 4% is a more-than-likely event, and markets are not prepared for that after the last six months of good inflation readings.”

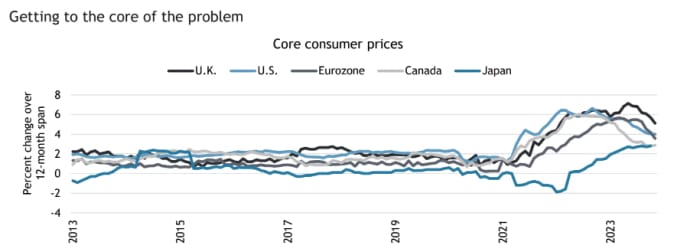

Indeed, core inflation measures, which strip out risky meals and power costs, for the U.S., U.Ok., Canada, the eurozone, and Japan counsel that central banks can’t but declare mission achieved, based on an 18-page report posted to SEI’s web site this month.

Sources: FactSet, SEI. Data as of Dec. 31, 2023.

In Solloway’s view, inflation nonetheless has room to run due to underlying value pressures ensuing from larger compensation charges, amongst different issues. In addition, the Israel-Hamas warfare may escalate, resulting in a spike in power costs, whereas this 12 months’s presidential election “could be a source of market instability.”

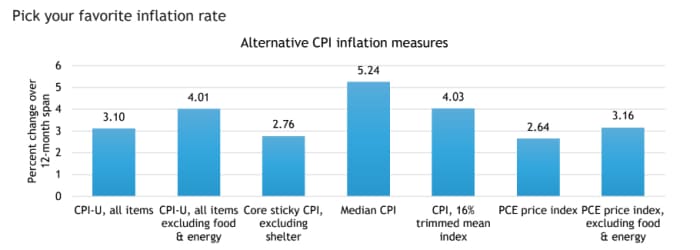

A 3% U.S. inflation charge alone “is not necessarily problematic,” Solloway informed MarketWatch. “What is problematic is market expectations, which seem to be pointing toward a return to the environment we had prior to Covid. We’re in a new regime here where inflation tends to be higher and, as a result, interest rates have to stay higher over time.”

Sources: U.S. Bureau of Labor Statistics, Federal Reserve Board of Cleveland, SEI. Data as of Dec. 31, 2023.

See additionally: Financial markets could also be overlooking ‘one remaining ember’ that might reignite inflation

On Thursday, oil futures climbed after struggling for course as merchants assessed the menace to produce from Middle East tensions. Crude, nevertheless, has struggled to construct in a geopolitical threat premium because the begin of the Israel-Hamas warfare in October, with U.S. benchmark WTI

CL00,

CL.1,

buying and selling round $20 a barrel under its 2023 peak set in late September.

See: Here’s what’s been holding a lid on oil costs regardless of dangers of a wider warfare within the Middle East

Earlier within the day, Edoardo Campanella, a global and power economist for UniCredit Bank in Milan, stated he expects Brent costs

BRN00,

BRNH24,

to be pushed into the $80-$85 a barrel vary, however sees some threat that these costs may go above $100 if the U.S. steps up sanctions on Iranian oil, the Iran-backed Houthis insurgent group begins concentrating on services in Saudi Arabia, or there’s rising instability within the Strait of Hormuz close to Iran.

Meanwhile, the bottom stage for preliminary U.S. jobless claims in 16 months pushed 10-

BX:TMUBMUSD10Y

and 30-year Treasury yields

BX:TMUBMUSD30Y

to their highest ranges of the brand new 12 months. In addition, Treasury’s $18 billion public sale of 10-year TIPS drew sturdy demand from buyers Thursday afternoon — indicating a necessity for inflation safety, based on Tom di Galoma, co-head of world charges buying and selling for BTIG in New York.

Fed-funds futures merchants nonetheless continued to cling to expectations for 5 to seven quarter-point charge cuts from the Fed by December, regardless of the energy of latest U.S. information. And U.S. shares

DJIA

SPX

COMP

moved largely larger forward of the ultimate hour of buying and selling in New York.

Changing perceptions in regards to the path of inflation, central banks’ responses, financial development, and the company revenue outlook have the potential to upend monetary markets, nevertheless. Solloway informed MarketWatch {that a} 10% correction within the S&P 500 can’t be dominated out.

In his report, he wrote that “inflation is far from dead, in our opinion.”

“We maintain our position that inflation will not fall all the way back to central banks’ target without some amount of pain,” the strategist wrote. “We think that economies globally will need to endure a prolonged period of subpar growth or outright contraction before labor markets can ease enough to exert enough downward pressure on wages to be consistent with a sustained 2% inflation rate.”

Source web site: www.marketwatch.com