Inflation fell to its lowest annual charge in additional than two years throughout June, the product each of some deceleration in prices and simple comparisons in opposition to a time when value will increase have been working at a greater than 40-year excessive.

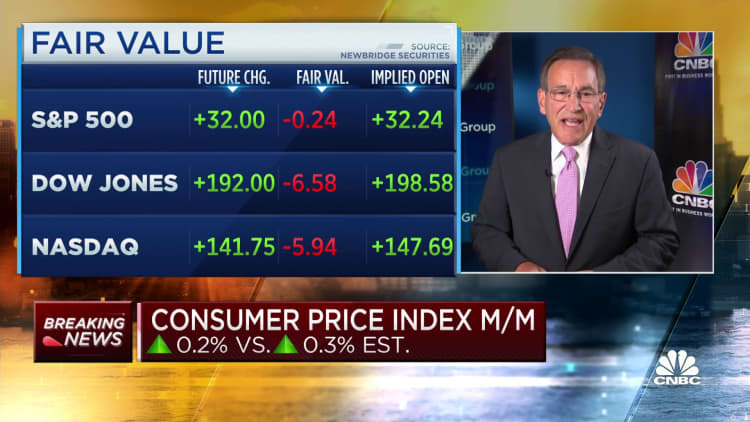

The client value index, which measures inflation, elevated 3% from a 12 months in the past, which is the bottom degree since March 2021. On a month-to-month foundation, the index, which measures a broad swath of costs for items and providers, rose 0.2%.

That in contrast with Dow Jones estimates for respective will increase of three.1% and 0.3%.

Stripping out unstable meals and vitality costs, the core CPI rose 4.8% from a 12 months in the past and 0.2% on a month-to-month foundation. Consensus estimates anticipated respective will increase of 5% and 0.3%. The annual charge was the bottom since October 2021.

In sum, the numbers may give the Federal Reserve some respiratory room because it seems to be to deliver down inflation that was working round a 9% annual charge right now in 2022, the very best since November 1981.

“There has been significant progress made on the inflation front, and today’s report confirmed that while most of the country is dealing with hotter temperatures outside, inflation is finally cooling,” mentioned George Mateyo, chief funding officer at Key Private Bank. “The Fed will embrace this report as validation that their policies are having the desired effect – inflation has fallen while growth has not yet stalled.”

However, central financial institution policymakers are inclined to look extra at core inflation, which continues to be working effectively above the Fed’s 2% annual goal. Mateyo mentioned the report is unlikely to cease the central financial institution from elevating charges once more later this month.

Fed officers anticipate the inflation charge to proceed falling, significantly as prices ease for shelter, which makes up about one-third of the weighting within the CPI. However, the shelter index rose 0.4% final month and was up 7.8% on an annual foundation. That month-to-month achieve accounted for about 70% of the rise in headline CPI, the Bureau of Labor Statistics mentioned.

“Housing costs, which account for a large share of the inflation picture, are not coming down meaningfully,” mentioned Lisa Sturtevant, chief economist at Bright MLS. “Because rates had been pushed so low by the Fed during the pandemic and then increased so quickly, the Federal Reserve’s rate increases not only reduced housing demand — as intended — but also severely limited supply by locking homeowners into homes they would have otherwise listed for sale.”

Wall Street reacted positively to the report, with futures tied to the Dow Jones Industrial Average up almost 200 factors. Treasury yields have been down throughout the board.

Traders are nonetheless pricing in a robust risk that the Fed will enact 1 / 4 proportion level charge hike when it meets July 25-26. However, market pricing is pointing towards that being the final enhance as officers pause to permit the sequence of hikes to work their approach by way of the economic system.

When inflation first started to speed up in 2021, Fed officers and most Wall Street economists thought it will be “transitory,” or more likely to fade as soon as components particular to the Covid pandemic wore off. They included surging demand for items over providers and provide chain clogs that created shortage for important objects equivalent to semiconductors.

However, when inflation proved extra cussed than anticipated, the Fed started mountaineering, finally elevating benchmark charges by 5 proportion factors by way of a sequence of 10 will increase since March 2022.

The muted enhance for the headline CPI got here despite the fact that vitality costs elevated 0.6% for the month. However, the vitality index decreased 16.7% from a 12 months in the past, a time when gasoline costs on the pump have been working round $5 a gallon.

Food costs rose simply 0.1% on the month whereas used car costs, a major supply for the inflation surge within the early a part of 2022, declined 0.5%.

Airline fares fell 8.1% on the month and now are down 18.9% on an annual foundation.

The easing within the CPI helped increase employee paychecks: Real common hourly earnings, adjusted for inflation rose 0.2% from May to June and elevated 1.2% on a year-over-year foundation. During the inflation surge that peaked final June, employee wages had run persistently behind the cost-of-living will increase.

Correction: Airline fares fell 8.1% on the month and now are down 18.9% on an annual foundation. An earlier model misstated the odds.

Source web site: www.cnbc.com