Traders predict the Federal Reserve to get nearer to 2% inflation subsequent 12 months, as measured by annual core and headline readings from the consumer-price index.

Derivatives-like devices generally known as fixings are round ranges which suggest that core CPI will are available in at a 2.6% annualized fee over the primary 10 months of 2024, merchants mentioned. The fixings market issues as a result of it has been extra correct than many within the monetary market in regards to the likeliest path of inflation, notably throughout the 2021-2022 runup in value good points.

Fixings merchants additionally anticipate annual headline inflation to fall again to the Fed’s 2% goal by subsequent October, after factoring in a flat path for power costs due to uncertainty over which means they’ll go.

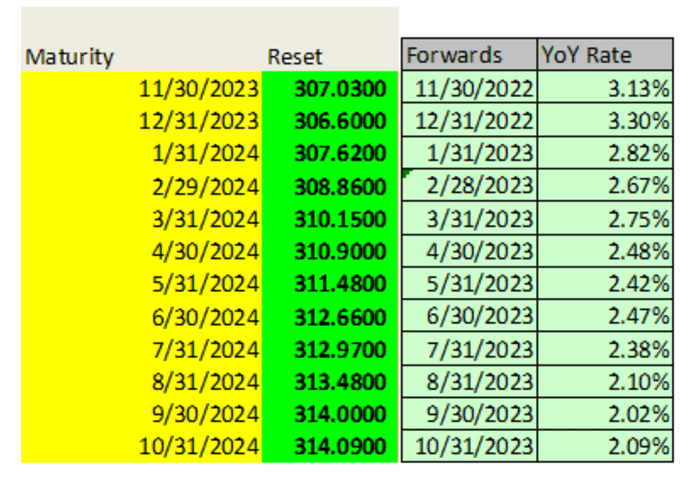

Market-implied expectations for the annual headline fee of CPI from fixings merchants. The maturity column displays the month and 12 months that the CPI year-over-year projection is predicated upon. The forwards column displays the year-earlier start line for every YoY forecast.

Bloomberg

Fed coverage makers usually base their 2% inflation goal on the annual change of their most popular gauge, generally known as the private consumption expenditures value index. But they’ve many different methods to measure value good points. They take note of headline CPI due to its means to affect family expectations, and regard core charges as a greater reflection of underlying tendencies.

As of Monday, fed funds futures merchants had been pricing in a 72.8% probability of three to 5 quarter-point fee cuts by December 2024. Fed officers launch their subsequent spherical of interest-rate projections on Wednesday, when they’re additionally anticipated to take no motion and hold borrowing prices between 5.25%-5.5%.

“The market appears to be expecting the Fed to still cut rates methodically,” maybe as a risk-management technique like 2019’s trio of preemptive fee cuts that had been designed to maintain the U.S. out of a recession, mentioned Gang Hu, an inflation dealer at New York hedge fund WinShore Capital Partners.

Given what number of cuts are priced in and the uncertainty over the longer term path of inflation, Fed officers are “not going to show too much incentive to cut immediately,” Hu mentioned by way of cellphone on Monday. “In fact, their chief concern now is probably to firmly control inflation expectations to avoid wage inflation spiral, so I think they are more likely to push back on rate-cut expectations and be behind the curve.”

Tuesday’s CPI knowledge for November is anticipated to mirror a 0.3% month-to-month rise in core inflation versus the 0.2% acquire seen in October, and to depart the annual core fee at an elevated 4%. Meanwhile, falling gasoline costs final month have been nudging headline inflation decrease.

Read: Falling gasoline costs will assist ease shopper inflation once more in November

Also learn: Gas costs could fall under $3 a gallon, a ‘nice surprise’ for vacation vacationers

Treasury yields completed Monday’s New York session little modified as merchants turned their consideration to Tuesday’s November CPI report. Meanwhile, all three main U.S. inventory indexes

DJIA

SPX

COMP

closed increased for a 3rd straight session.

Source web site: www.marketwatch.com