There was new knowledge out of the U.Ok. on Wednesday morning, displaying costs falling greater than anticipated, additional proof {that a} world disinflationary pattern is below method.

How far and the way lengthy inflation will final are the important thing questions now for a inventory market that has thrived in 2023, with the S&P 500

SPX

surging 24%.

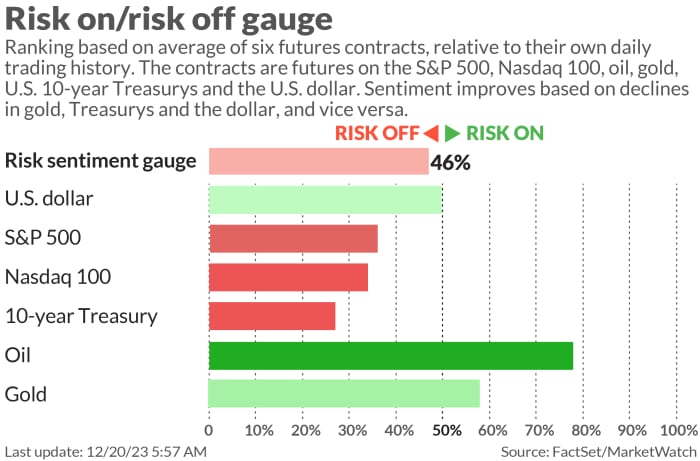

Analysts at 22V Research led by Dennis DeBusschere have set out a playbook on how the market will react. They notice that the Fed expects core PCE — 3.5% 12 months over 12 months as of October, with new knowledge out Friday — will fall to 2.4% by the top of 2024.

In the primary state of affairs, development stays above the two% pattern, wages take longer to disinflate and core PCE tracks a bit over 2.4%, however not above 2.75%.

In that setup, the Fed would nonetheless reduce charges, maybe not by three or 4 instances, although, says 22V. That would favor deeper cyclicals — power, supplies, industrials — “or make them tougher shorts,” and likewise make it robust to quick the U.S. greenback or guess on U.S. Treasury yields declining, they are saying.

A second state of affairs would see core inflation monitoring above 3% — Treasury yields and the U.S. greenback

DXY

would transfer larger, and risk-off elements would profit, they predict.

Under a 3rd state of affairs, inflation would head to 2.4% nicely earlier than the top of 2024. That would imply 4 to 5 Fed price cuts, extra draw back dangers to the greenback and Treasury yields and additional easing in monetary situations.

“Stocks do very well assuming we move below 2.4% on core PCE WITHOUT an increase in the unemployment rate,” they are saying.

22V’s broader message although is that the businesses which have lagged, like small caps, ought to proceed to catch up.

“Into 12 months finish we aren’t involved a few sharp pullback, however with the VIX

VIX

sub-13, credit score spreads of their 18th %tile (very tight), the S&P [price/earnings] over 19.5 instances, and traders sentiment (AAII) in its 98th percentile, the scope for additional S&P positive factors is narrowing. Internals rotations stay a greater option to play for positive factors into 12 months finish,” stated DeBusschere and the workforce.

Read: This is an effective time to put money into a bond fund. One supervisor has a bonus over his largest rivals.

The markets

Stock futures

ES00,

YM00,

NQ00,

are drifting south, with bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

dropping and monitoring U.Ok. yields

BX:TMBMKGB-10Y

after a sharper-than-forecast fall in inflation for that nation. The pound

GBPUSD,

is taking successful on that. Brent crude

BRN00,

is again above $80 a barrel, with merchants monitoring Red Sea disruptions.

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,768.37 | 2.68% | 5.07% | 24.19% | 24.77% |

| Nasdaq Composite | 15,003.22 | 3.23% | 5.66% | 43.35% | 42.25% |

| 10 12 months Treasury | 3.911 | -11.43 | -50.14 | 3.11 | 23.75 |

| Gold | 2,053.40 | 0.50% | 3.11% | 12.20% | 12.57% |

| Oil | 74.43 | 6.53% | -3.11% | -7.55% | -5.09% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors. | |||||

The buzz

FedEx inventory

FDX,

is dropping after the package-delivery large reduce its full-year gross sales forecast over worries about subdued demand for vacation delivery.

General Mills inventory

GIS,

is down on a income miss and lowered outlook for the consumer-foods firm.

Tesla

TSLA,

has reportedly instructed some staff it is not going to grant advantage inventory awards this 12 months.

Read: Investor who referred to as year-end inventory rally says ‘Magnificent 7’ might proceed to guide in 2024

Alibaba

BABA,

CEO Eddie Wu will take over the Chinese web group’s e-commerce enterprise.

The NYSE is suspending Farfetch shares

FTCH,

over a liquidation warning.

U.S. present account knowledge for the third quarter is due at 8:30 a.m., current dwelling gross sales and shopper confidence are anticipated at 10 a.m.

A divided Colorado Supreme Court barred former President Donald Trump from the state’s presidential main poll citing an rebellion clause. Trump’s attorneys say they are going to attraction.

Best of the online

The hedge fund merchants dominating an enormous guess on bonds

Red Sea delivery assaults might undercut monetary market’s prevailing theme of the brand new 12 months

Cubicles are making a comeback.

The chart

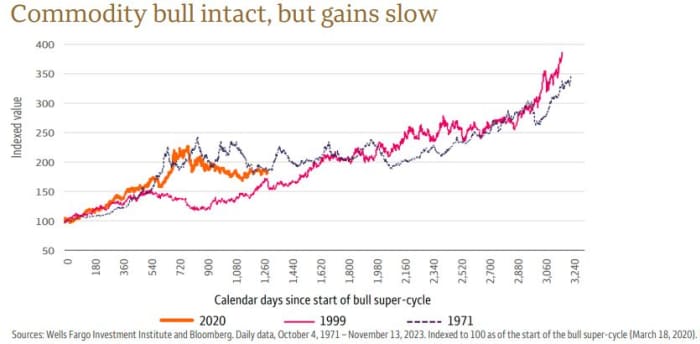

Three years on, with a lot of commodity costs at decade highs, the commodity bull supercycle seems to have slowed, however Wells Fargo Investment Institute’s head of worldwide actual asset technique John LaForge says traders shouldn’t quit on the asset class.

He gives the beneath chart:

“These long cycles have typically experienced periods of consolidation as persistently rising prices have led to added supply or slow demand, and they are often followed by a reassertion of the bull super-cycle,” LaForge tells shoppers. Any pullback is a shopping for alternative, and whereas he likes power and treasured metals, suggests traders keep diversified and never stick with only one a part of the house.

Top tickers

These have been the top-searched inventory market tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MARA, |

Marathon Digital |

|

BABA, |

Alibaba |

|

AAPL, |

Apple |

|

PLTR, |

Palantir |

|

COIN, |

Coinbase Global |

Random reads

Woman will get a potato as a bonus — and is taxed on it.

Microsculpter’s nativity scene options an eyelash.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com