Intel Corp. shares completed decrease Friday, snapping their longest successful streak in almost three years, however at the very least one analyst puzzled why extra traders aren’t bullish on the inventory given the prospect a commerce conflict between the U.S. and China may disrupt semiconductor “fab” operations in Asia, leaving Intel in a plum manufacturing place domestically.

Intel

INTC,

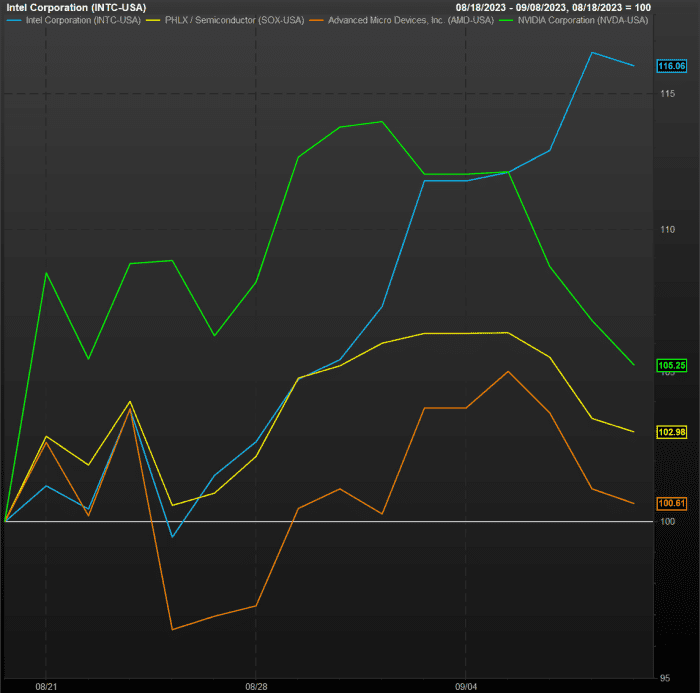

shares closed down 0.5% at $38.01 Friday, snapping a nine-day successful streak that produced a 17.2% achieve. For the holiday-shortened week, nevertheless, shares completed up 3.8%, whereas the PHLX Semiconductor Index

SOX

completed the week down 3.2%.

Given the nine-day successful streak, Mizuho analyst Jordan Klein requested in a notice earlier Friday: “How long can long-only managers continue to underweight or avoid INTC?”

Klein reasoned that Intel, whereas bruised and battered over the previous few years, remains to be a $160-billion-market-cap inventory that’s not solely up greater than 40% 12 months to this point, however has outperformed Nvidia Corp.’s

NVDA,

inventory by greater than 1,000 foundation factors over the previous three weeks.

The Mizuho analyst additionally famous that Intel’s 3.2% achieve on Thursday versus the PHLX Semiconductor Index’s 2% decline got here as China more and more targets U.S. firms like Apple Inc.

AAPL,

Read: Here’s why Wall Street could also be overreacting about Apple’s China’s challenges

FactSet

Intel “owning the biggest U.S. semi fab could be increasingly valuable,” Klein mentioned, additionally declaring that at the very least one competitor, GlobalFoundries Inc.

GFS,

rose 1.3% Thursday. On Friday, GlobalFoundries shares completed up 2.6%.

Read: Intel’s inventory logs longest successful streak in almost 3 years

Like chip makers Texas Instruments Inc.

TXN,

and Micron Technology Inc.

MU,

Intel operates fabrication services often called “fabs” that etch designs of nanometer-sized transistors onto silicon disks that turn into completed semiconductors. Many chip makers, nevertheless, like Advanced Micro Devices Inc.

AMD,

and Nvidia, in addition to firms like Apple that design their very own chips, are “fabless,” which means they depend on third-party fabs like Taiwan Semiconductor Manufacturing Co.

TSM,

SK Hynix Inc.

000660,

and Samsung Electronics Co.

005930,

to make the bodily chips.

While TSMC has moved to open fabs within the U.S., the majority of its services are in Taiwan and China. As evidenced through the COVID pandemic and associated China shutdowns, any disruption of the semiconductor provide chain in Asia can have far-reaching penalties for an trade that depends on chips. In reality, Intel just lately moved into the third-party fab enterprise with Intel Foundry Services, however the enterprise arm has but to call a high-profile buyer.

Read from December: Apple, AMD verify they’re amongst TSMC’s first Arizona prospects, whereas Intel preps for return to innovative in 2023

Klein admitted that Intel’s administration and inventory efficiency “still has a long road ahead to fully convince a highly skeptical [long-only] investor community, but I hear more and more hedge funds buying into this rally on view it’s a safe place to hide into Sept. [third quarter] results,” Klein mentioned, particularly as a “perceived ‘domestic semi winner’ if U.S.-China trade war intensifies.”

Of the 44 analysts who cowl Intel, 9 have purchase scores, 28 have maintain scores, and 7 have promote scores, together with a median value goal of $36.91.

Read additionally: Intel will get shock data-center tailwind because it seems to be towards ‘meaningful’ AI development subsequent 12 months

Source web site: www.marketwatch.com