After a banging begin to the week, shares look able to promote at Tuesday’s begin on stronger-than-expected retail gross sales, with bond yields on the march increased.

If you’re among the many buyers fearing a stock-market failure, our name of the day has some concepts that aren’t going to interrupt the financial institution, given the place these shares in query have been buying and selling up to now this yr.

Those concepts come from Phoenix-based Smead Capital Management, which has laid out its evaluation of the place issues stand in a brand new investor letter. The yr has been robust for worth managers like Smead, whose worth fund SVFAX, is up about 2% year-to-date as of Sept. 30, however an annualized 16.7% over three years.

Lead portfolio supervisor Bill Smead and his son, co-portfolio supervisor Cole Smead, assume this yr will find yourself within the historical past books for a mania/bubble over Magnificent 7 tech shares and AI.

And whereas that can “end badly,” they see a number of the capital tied up in that making its manner “into whatever investors gravitate toward in the future.”

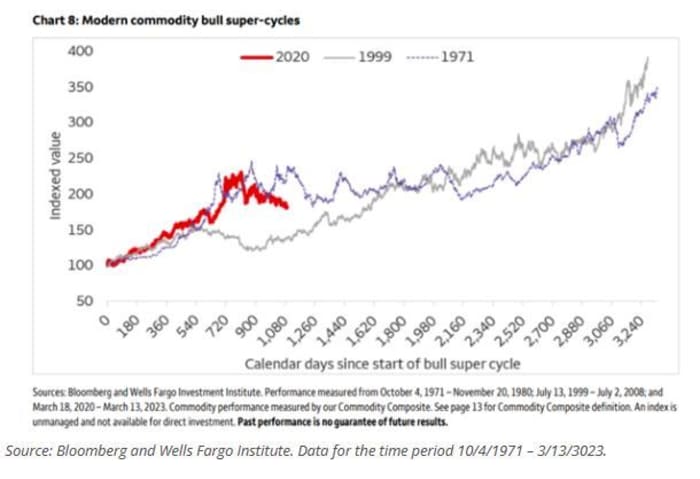

They consider the market is within the “early stages of a commodity supercycle,” with a “once-in-a-lifetime opportunity in oil and gas shares.” Those shares have “dramatically underperformed the price of oil this year and have created what we believe is an excellent short-term buying opportunity of the industry,” they are saying.

Here’s their chart exhibiting the place the present supercycle is monitoring:

They spotlight shares akin to Occidental Petroleum

OXY,

and ConocoPhillips

COP,

up 0.7% and 4.6% up to now this yr, and held of their worth fund.

The second name from the Smead managers seems to money in on the “upcoming dominance” of the social-media technology — the millennials who signify a hefty and largest 72.24 million chunk of the inhabitants as of 2022.

“The inverted yield curve and the Fed tightening are scaring people away from economically sensitive businesses that should benefit the most from the fact there are 40% more millennials in the 27-42 year-old age group than the Gen Xers who preceded them.

“Any economic contraction that would bring interest rates down would kick in strong economic activity from this powerhouse population group,” say the Smead managers.

And whereas the housing market is hard for each consumers and sellers proper now, due to excessive rates of interest, the managers are betting on house builders, monetary establishments and retail-oriented firms to “feed off the millennial move to the suburbs.”

Their picks embody: D.R. Horton

DHI,

which is down 2.7% this yr, American Express

AXP,

up 2.4% and U-Haul

UHAL,

unchanged this yr. If that decision is true, then certainly it might be an affordable time to choose up these millennial bets.

“This era is providing us the opportunity to own high return-on-equity companies trading at very depressed prices relative to the average stock and at a huge discount to the shares dominating the S&P 500 index,” say Smead.

The markets

Stock futures

ES00,

NQ00,

are extending losses after that retail gross sales information, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

climbing. Oil

CL.1,

is edging increased. Bitcoin

BTCUSD,

is hovering at simply over $28,000 — one analyst sees $45,000 doubtless as soon as the SEC approves an ETF.

Read: What Israel-Hamas battle means for gold as buyers search security

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Retail gross sales rose 0.7%, stronger than the 0.3% acquire that was anticipated for September. Industrial manufacturing is due at 9:15 a.m., adopted by a house builders confidence index at 10 a.m. A handful of Fed audio system are additionally forward,

Bank of America

BAC,

and Bank of New York Mellon

BK,

are up on earnings beats, and Goldman Sachs

GS,

beat Wall Street’s pared estimates, however shares are flat. Johnson & Johnson inventory

JNJ,

is climbing after beating forecasts and lifting steerage. And analysts are upbeat forward of Netflix’s

NFLX,

earnings on Wednesday.

Check out MarketWatch’s dwell earnings protection right here.

Tupperware shares

TUP,

are rallying on news CEO Miguel Fernandez is being changed after simply over 3 years on the job.

Read: Fannie Mae’s CEO says house consumers, house owners each trapped by excessive charges

Iran’s overseas minister has warned of “pre-emptive action” towards Israel within the coming hours over its bombardment of Gaza. President Joe Biden heads to Israel and Jordan on Wednesday to fulfill Israeli and Arab leaders as considerations develop of an increasing battle.

A House speaker vote is coming at midday, with Ohio Rep. Jim Jordan stacking up the votes.

Best of the online

Venezuela is ready for a ‘long journey’ to spice up oil output if U.S. eases sanctions

The world’s finest and worst pensions for 2023

Biden opened an account on former President Donald Trump’s “Truth Social” platform, for amusing.

The chart

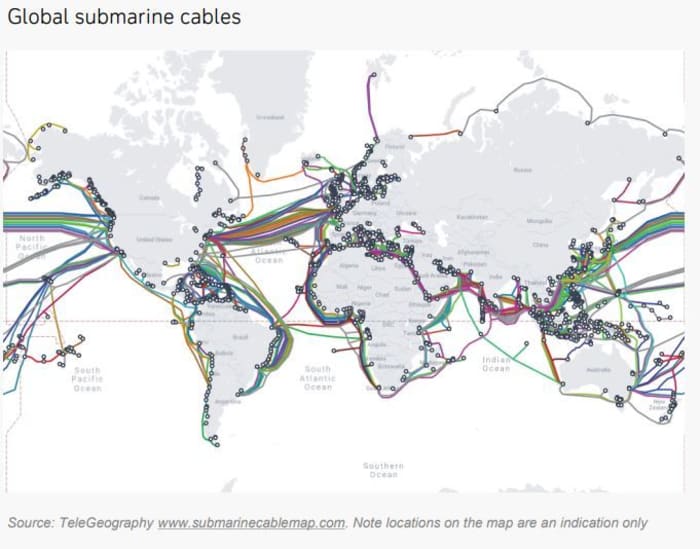

Deutsche Bank has decided what it says are the 5 weakest hyperlinks within the international economic system.

No. 1 is information cables: “As much as 99% of international digital communications – and $10 trillion of financial transactions a day — pass through fibre optic cables draped on the sea bed. There are about 550 active and planned cables stretching

1.4 [million kilometers]. Many are barely thicker than a garden hose,” says a workforce led by strategist Adrian Cox, who provides that they “have limited bandwidth and can be interrupted.”

The different 4 weak hyperlinks? Roads, rivers and rails, sea straits, sky corridors and satellites.

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

TPST, |

Tempest Therapeutics |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

JAGX, |

Jaguar Health |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

Random reads

Goldman Sachs CEO David Solomon exits the DJ enterprise, not less than for public occasions.

Barbie is the Halloween queen.

Missing: A $3.6 million statue in Glasgow.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com