A pleasant trifecta of things is telling traders that vitality shares are a purchase: Investors hate them; insiders love them. And they’re low cost.

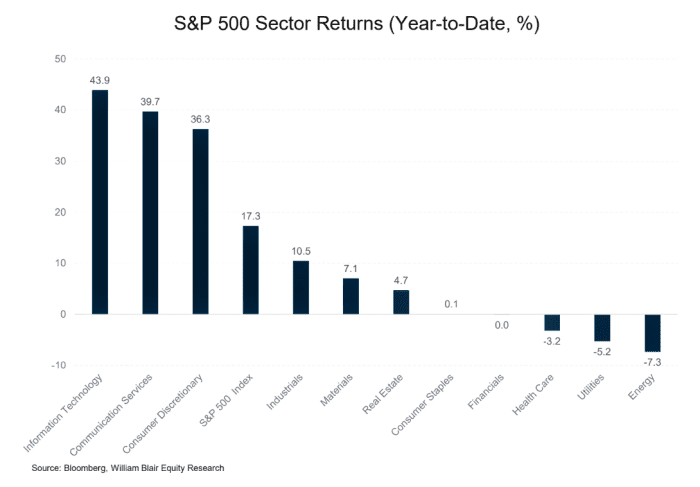

Energy is the U.S. inventory market’s worst-performing group yr up to now. It stands out as the one cyclical group within the dumps.

Moreover, company insiders are shopping for the pullback. The vitality sector noticed essentially the most corporate-insider shopping for essentially the most relative to promoting earlier in July, in keeping with Vickers Weekly Insider revealed by Argus. Argus cited Texas Pacific Land Corp.

TPL,

Occidental Petroleum

OXY,

), which Warren Buffett has been shopping for in measurement, and ProFrac Holding

ACDC,

), which supplies fracking providers

Plus, vitality shares are low cost. Many vitality shares commerce at 30% to 80% reductions to their five-year common price-to-earnings ratio. You see this throughout market caps. Exxon Mobil

XOM,

for instance, lately had a trailing p/e of seven, a 59% low cost to its trailing five-year common. Occidental Petroleum additionally had a trailing p/e of seven. That’s a 51% low cost.

As for smaller names, two vitality shares lately prompt in my inventory letter are up 20% since then, however they nonetheless look low cost. Matador Resources

MTDR,

lately traded at a trailing p/e of 5.7, a 46% low cost to the previous 5 years. At its latest trailing p/e of simply 2.4, natural-gas producer Comstock Resources

CRK,

) trades at a 87% low cost.

“The space continues to trade at the low end of its historical range,” says Ben Cook, portfolio supervisor of the Hennessy BP Midstream Fund

HMSFX,

Reasons to be bullish

Here are two the explanation why vitality shares will advance from right here.

First, vitality costs are going up. OPEC+ has been reducing manufacturing to spice up oil costs, to no avail. Here’s why these cuts haven’t had a big effect — at the least up to now. Oil provide has been up quite a bit due to report U.S. strategic petroleum reserve (SPR) releases and upside manufacturing surprises from U.S. corporations and sanctioned producers in Russia and Iran, says Goldman Sachs analyst Bruce Callum.

Callum says the SPR and the U.S. manufacturing headwinds will flip into average tailwinds because the SPR progressively refills and U.S. provide progress slows. Supply progress is impaired as a result of international oil funding was 40% decrease final yr than in 2014. Cullen says an vitality deficit within the second half ought to push Brent oil

BRN00,

to $86 a barrel by the tip of the yr, from latest ranges of slightly below $82.

Cook, on the Hennessy BP Midstream Fund, agrees. The supply-demand stability will shift within the second half of this yr and subsequent, he says, driving oil costs greater. “If you believe the global economy will hold up, and we do, we will be in deficit and prices will be elevated,” Cook says. He sees West Texas Intermediate buying and selling at between $80 and $100 later this yr and in 2024, versus a latest $79.

Medium time period, look for a similar value development, says worth investor William Nygren, who manages the Oakmark Investor Fund

OAKMX,

He expects 3% annual international GDP progress over the following 5 years, Since the business has been underinvesting, this could trigger vitality value will increase, he says. Nygren is price listening to as a result of his fund outperforms its benchmark and competing funds, says Morningstar Direct.

Read: 6 low cost shares that famed value-fund supervisor Bill Nygren says may help you beat the market

As for pure fuel, the U.S. Energy Information Agency estimates international liquid pure fuel demand will roughly double to 700 million tons each year (MPTA) by 2040 from 380 MPTA in 2021. Baker Hughes

BKR,

CEO Lorenzo Simonelli is much more bullish. “We stay very much with the view that we’re going to need in excess of 800 MTPA by 2030,” Simonelli mentioned in his firm’s July 19 earnings name. “We continue to see the potential for this LNG cycle to extend for several years.” This would enhance pure fuel costs within the U.S.

Second, the renewables overhang could fade. Many traders keep away from vitality shares on fears that renewables will ramp up sharply, displacing fossil fuels. This is unlikely. The media and different commentators are overestimating how briskly various gas sources will come on line, Nygren says. This misperception ought to drive investor curiosity in vitality shares.

Besides, historical past reveals that even when the preferred gas sources (like wooden and coal) get changed by new sources, we nonetheless use extra of the displaced fuels years later, in comparison with once they had been the highest gas in use, Nygren says. “It is reasonable to think that fossil fuels go the same way.”

Energy shares to contemplate

Nygren owns three primary vitality corporations in his fund. They are EOG Resources

EOG,

), APA

APA,

and ConocoPhillips

COP,

— his most up-to-date addition within the second quarter. These shares have 4 interesting traits:

1. A protracted runway of underappreciated stock within the type of untapped vitality property within the floor. “That’s less capital they will have to spend to replace assets and grow their businesses,” says Nygren.

2. These corporations are lower-cost producers however are usually not rewarded for this, since they commerce at about an business a number of.

3. They are returning money to shareholders through buybacks and dividends. For instance, EOG pays a 2.7% yield, COP pays a 4.7% yield and APA pays a 2.6% yield. “The willingness of management to return capital to shareholders is a very important characteristic for us,” Nygren says. “Over the next 10 years, we believe ConocoPhillips will be able to return over 100% of its current market capitalization to shareholders via dividends and share repurchases while growing its production at a mid-single-digit annual pace.”

4. The shares look low cost. On a trailing p/e foundation, EOG trades at a 63% low cost, ConocoPhillips goes for a 36% low cost APA trades at an 82% low cost to its trailing five-year common.

Two vitality revenue performs

A safer solution to put money into vitality is to personal the midstream pipeline and infrastructure corporations. These corporations earn a price for gathering and transporting gas to vitality hubs. So, they’re much much less uncovered to vitality value volatility than producers. But they will see earnings progress as volumes decide up.

A easy solution to get diversified publicity to this group could be to personal the Hennessy BP Midstream Investor Fund. It outperforms competing funds by 4 proportion factors, annualized, over the previous three years, in keeping with Morningstar Direct. The trailing 12-month yield is 10.65%, Morningstar experiences.

Cook singled out Plains GP Holdings

PAGP,

It dominates gas gathering and transport out of the Permian Basin, the best shale basin within the U.S.

Since the corporate’s community connects Permian producers to the Gulf Coast, it stands out as a giant beneficiary of accelerating overseas demand for U.S. oil and pure fuel. As geopolitical tensions rise, overseas vitality consumers worth U.S. producers much more as clear, and dependable suppliers. This boosts demand for U.S. vitality.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned TPL, MTDR, CRK and EOG. Brush has prompt TPL, OXY, XOM, MTDR, CRK, EOG, APA, COP and PAGP in his inventory publication, Brush Up on Stocks. Follow him on X (previously Twitter) @mbrushstocks

More: Why are fuel costs going up once more? Brace for additional will increase, analysts say

Also learn: Feds suggest 18% fuel-economy improve — to 43.5 MPG — for brand spanking new automobiles by 2032

Source web site: www.marketwatch.com