Investors should wait till at the very least July for these extensively anticipated interest-rate cuts, in line with one Federal Reserve president’s outlook.

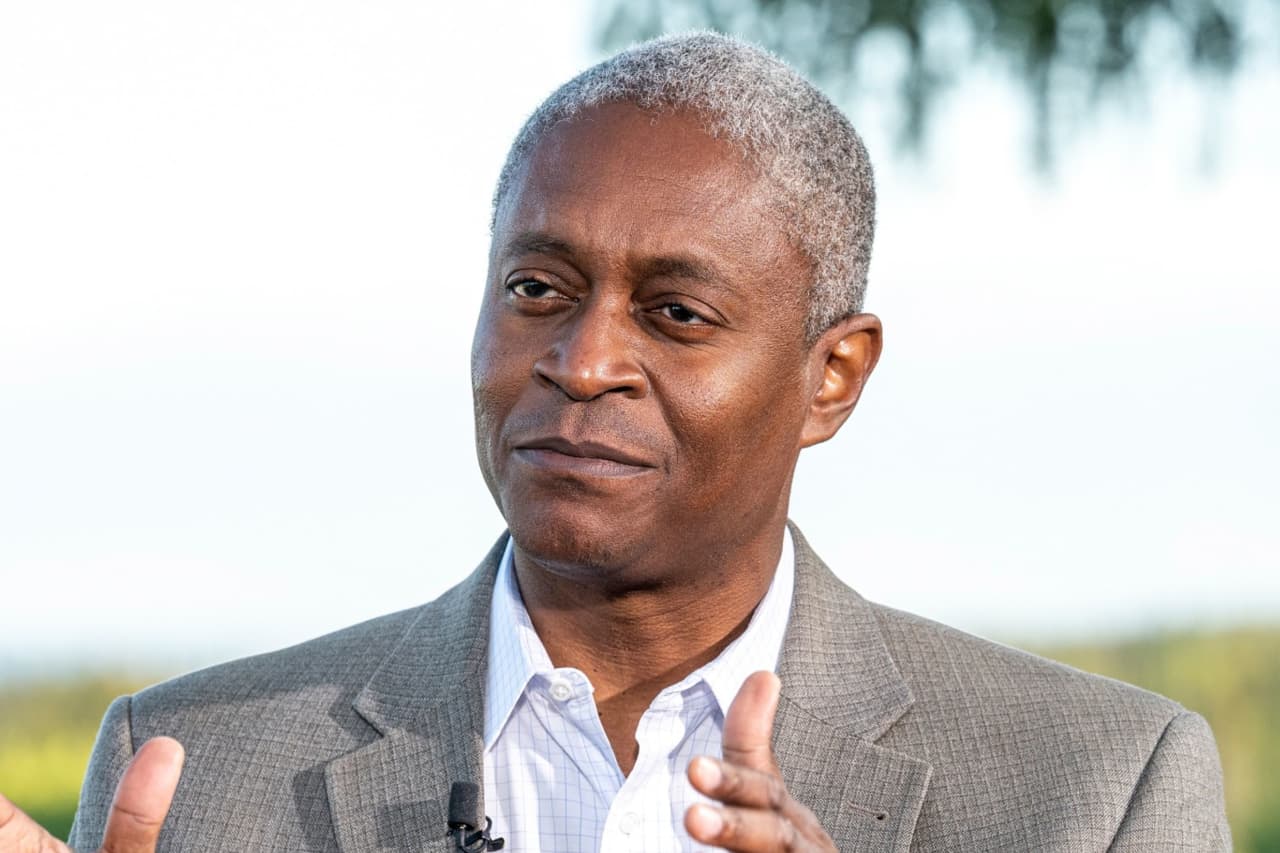

Atlanta Fed President Raphael Bostic mentioned charge cuts most likely wouldn’t be appropriate till the third quarter given the present power of the financial system.

That’s 1 / 4 sooner than he initially predicted, Bostic mentioned, thanks to simply how rapidly inflation is slowing. Bostic added that he’s anticipating two charge cuts in 2024.

“If inflation continues going down faster than I expected, then I’ll adjust and adapt,” Bostic mentioned, chatting with the Money Marketeers of New York University. “But I want to be sure… that we’re getting true signals, as opposed to volatility.”

He mentioned the course of the inflation charge over the 12 months is more likely to be “directionally the same but bumpy.”

Bostic, who’s voting on the Federal Open Market Committee’s coverage selections this 12 months, mentioned he’s “grateful” the financial system has maintained robust development and a sturdy labor market even because the inflation charge falls.

Yet he mentioned he stays “vigilant” over the danger of slicing charges too quickly and spurring a re-acceleration in inflation.

“The stronger the economy is, the harder it’s going for prices to fall rapidly,” he mentioned. “I do think that in the set of [potential] problems to have, this is one of the better ones.”

Inflation eased in January however got here in above Wall Street

DJIA

expectations, with client costs up 3.1% from the identical month a 12 months earlier. That higher-than-expected studying jolted the markets Tuesday and dashed buyers’ hopes that officers may begin slicing rates of interest as early as the following Fed assembly in March.

Bostic echoed Fed Chair Jerome Powell’s earlier public feedback that officers might want to see extra proof that inflation is beneath management earlier than they transfer to chop charges, particularly given the CPI report.

He added that bringing the inflation charge all the way down to the Fed’s 2% goal stays the highest precedence.

“That’s got to be job number one. I don’t want to make this too complicated,” he mentioned. “I worry we underestimate the cost and the pain that high inflation imposes on people.”

He additionally warned towards counting on assumptions drawn from the previous historical past when attempting to plot the course for 2024. Current situations defy prior conventions of how financial coverage impacts the financial system, he mentioned.

“Economic history does not seem to be repeating itself,” he mentioned. “If there is an overarching lesson I’ve taken from the pandemic experience, it is humility: to expect to be surprised.”

Source web site: www.marketwatch.com