“Is Nvidia today’s Cisco? It’s possible. If so, then it has a lot more upside before it crashes — if it crashes.”

Is it attainable that the meltup part of the bull market (which began on Oct. 12, 2022) has begun already — having began following the correction low on Oct. 27, 2023? Yes, it’s attainable.

Since that current low, traders have change into a lot much less involved about such adversarial macro points as a recession, larger rates of interest, persistent inflation, and the federal authorities’s deficit. Instead, they’re excited concerning the chance that the U.S. Federal Reserve will reduce rates of interest this yr as inflation continues to subside. They are additionally exuberant concerning the potential affect of synthetic intelligence (AI) on the earnings of expertise corporations.

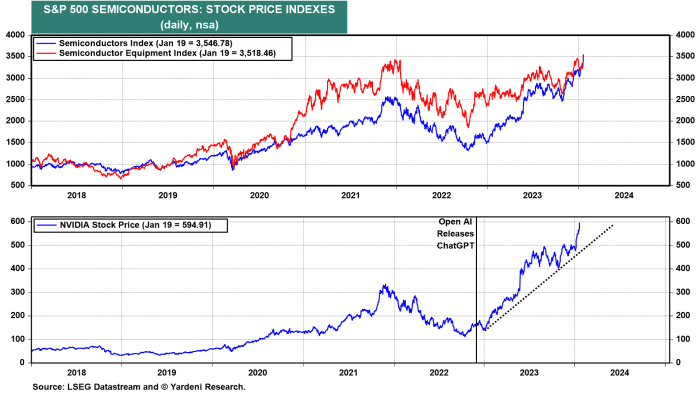

Their exuberance for AI began when OpenAI launched ChatGPT on Nov. 30, 2022. Since then, Nvidia’s

NVDA,

inventory is up greater than 250% as a result of it’s the main semiconductor producer of AI chips. It has led the S&P 500 Semiconductor inventory value index to a achieve of 108% since then.

Nvidia’s share value efficiency is beginning to remind us of the parabolic ascent of Cisco Systems

CSCO,

inventory through the tech bubble of the late Nineteen Nineties. The firm manufactured key gear essential to develop the web, and its share value elevated eightfold from the top of 1997 via March 2000. The inventory then crashed, despite the fact that the web continued to proliferate quickly.

Is Nvidia at this time’s Cisco? It’s attainable. If so, then it has much more upside earlier than it crashes — if it crashes.

Fed Chair Jerome Powell has studied the historical past of Fed chairs, particularly Paul Volcker. Unlike Volcker, Powell may reach bringing inflation down with out a recession. The monetary markets predict him to decrease rates of interest this yr now that his inflation mission is almost completed. Indeed, he and different Fed officers have opined that they could should decrease the federal funds fee to maintain the inflation-adjusted federal funds fee from rising as inflation falls additional.

“When bubbles inflate to a certain point, it doesn’t take much to pop them.”

In this state of affairs, Powell dangers fueling irrational exuberance, a phenomenon former Fed Chair Alan Greenspan mentioned in his well-known Dec. 5, 1996 speech titled “The Challenge of Central Banking in a Democratic Society.” He was merely pondering out loud, musing Hamlet-like over an essential query: “How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions … ? And how do we factor that assessment into monetary policy?” But that time period “irrational exuberance” struck a chord with traders and have become a self-fulfilling prophecy. When bubbles inflate to a sure level, it doesn’t take a lot to pop them.

The monetary press not too long ago reported that cash market mutual funds (MMMF) have attracted a document $6.0 trillion in property, with $2.3 trillion in retail MMMF and $3.6 trillion in institutional accounts. If the Fed lowers rates of interest, numerous that cash may transfer into the bond and inventory markets, fueling meltups in each markets, particularly the inventory market.

Over the years, we’ve realized that recessions might be attributable to bursting speculative bubbles. If Powell and his colleagues take a victory lap and rejoice their success at bringing down value inflation with out inflicting a recession by reducing rates of interest, they run the chance of fueling asset inflation. When that bubble bursts, a recession most probably would ensue.

The Fed’s final massive mistake was falling behind the inflation curve in 2021 and early 2022. The Fed’s subsequent massive mistake might be inflating a speculative inventory market bubble. Powell should know that. If so, then he ought to reiterate that he’s in no rush to decrease rates of interest.

So as an alternative of a repeat of the inflationary Seventies or a replay of the productivity-led growth of the Nineteen Twenties, the present decade has the potential to play out just like the tech-led inventory market occasion of the Nineteen Nineties. To quote Prince: “Let’s party like it’s 1999.”

Ed Yardeni is president of Yardeni Research Inc., a supplier of world funding technique and asset-allocation analyses and proposals. This article is excerpted from Yardeni Research’s “Deep Dive” for Jan. 26, 2024. Individual traders can learn Yardeni’s analysis right here. Follow him on LinkedIn and his weblog.

More: 12 the reason why you’ll see the S&P 500 at 5,400 in 2024

Plus: 5 actual dangers that would crush shares in 2024 — and why they gained’t

Source web site: www.marketwatch.com