It have to be the “worst economic time in American history.” The costs of vehicles and houses are “worse than 1930.” How is anyone “affording life right now”?

By most conventional measures, the U.S. economic system is in a good place proper now: employers are nonetheless hiring; GDP is rising; and although it won’t all the time really feel prefer it, worth will increase have eased.

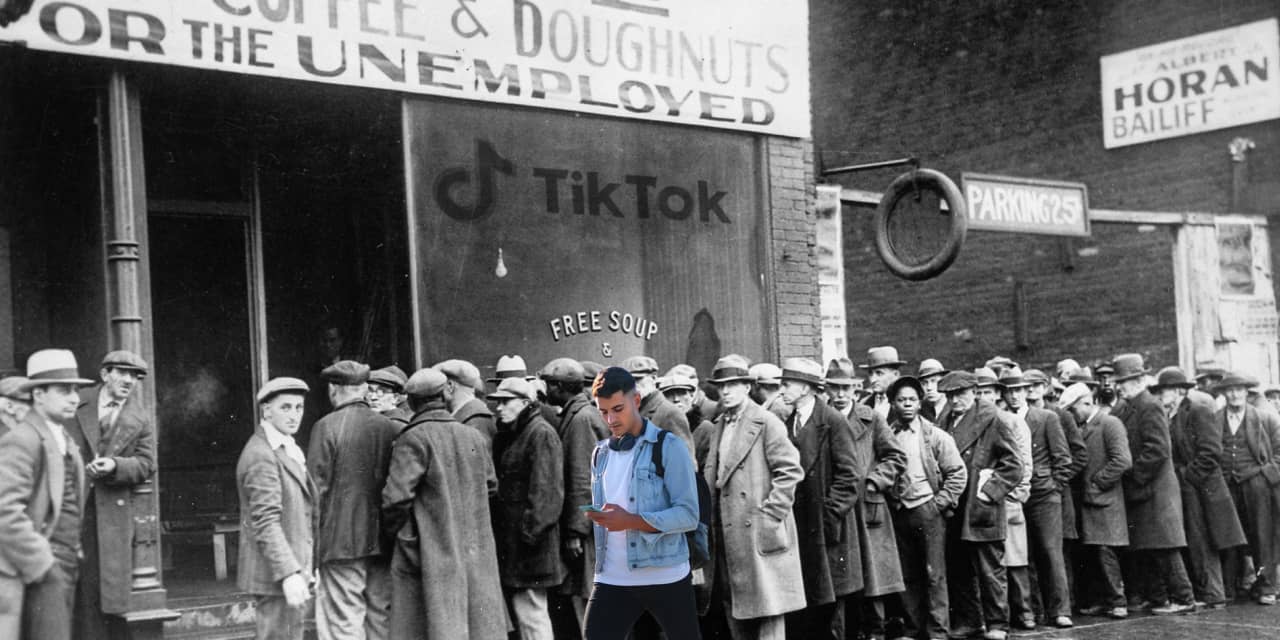

You wouldn’t essentially know that from scrolling by TikTookay, the place dozens of viral movies bemoan excessive costs and housing prices and expressions of financial angst abound.

Some customers have gone a step past simply lamenting the present price of residing. Instead, their movies argue, the nation is affected by one thing a lot worse: a “silent depression” that’s inserting ranges of financial pressure on Americans similar to — and even worse than — these seen throughout the Great Depression.

“Americans are being gaslit into thinking we’re just getting lazier,” one person says, in a video that’s acquired greater than 13 million views and two million likes on the app. “We’re in the worst economic time in American history. We have the lowest purchasing power we have ever had.”

“The point that I make in (my) video is that we are facing a new kind of challenge today,” Freddie Smith, whose video describing the “silent depression” has practically 9 million views, informed MarketWatch in an e mail. “People are working longer hours, but keeping less of their money, due to the high cost of housing, daycare, student debt and consumer debt.”

But whereas the frustration these movies handle is actual, historians and economists informed MarketWatch, lots of them are lacking some key context. Here’s a better have a look at whether or not claims of a “silent depression” stand as much as scrutiny — and what they do get proper about immediately’s economic system.

Is the U.S. actually in a ‘silent depression’? Or any type of despair?

A “depression” is often outlined by economists as a pointy, sustained downturn in financial exercise, that includes excessive charges of joblessness and declines in inventory markets.

Does that definition match the present state of the U.S. economic system? “Absolutely and emphatically no, not by any definition of those words,” stated Christopher Clarke, an assistant professor of economics at Washington State University. He’s made his personal TikToks responding to movies making the claims.

In a number of methods, the economic system is in “the exact opposite” of a despair, he stated. To fall right into a recession or despair, the economic system has to contract, which means financial development has to say no, for a chronic interval.

But the American economic system grew 5.2% within the third quarter, based on revised estimates. In 2021 and 2022, actual GDP elevated 5.7% and a pair of.1%, respectively.

By distinction, U.S. GDP contracted by about 25% from 1929 to 1933, stated Phil Powell, a professor of enterprise economics and public coverage on the Indiana University Kelley School of Business.

“The economy we have right now in no large way is parallel to the economy that we saw in 1929,” he stated. “The reality is that the U.S. economy (right now) is much more resilient than it feels.”

Powell additionally pointed to the job market. The US unemployment price has hovered close to historic lows for about two years now, and at present sits at round 3.7%, after dipping barely in November.

By distinction, in 1933, a couple of quarter of Americans had been out of labor.

There are different key variations between 2023 and 1929, stated John Moser. He’s a historical past professor at Ashland University and the writer of the guide “The Global Great Depression and the Coming of World War II.”

The Great Depression additionally fueled financial institution failures, and hundreds of thousands misplaced their life financial savings in a single day. Foreclosures — on houses and the household farms the place many Americans nonetheless grew their very own meals — had been widespread.

Households confronted all these challenges with none of the federal help shoppers don’t have entry to immediately, Moser famous. Programs like unemployment advantages, meals stamps or deposit insurance coverage from the FDIC didn’t exist throughout the Great Depression.

The dimension and the dimensions of the ensuing devastation could be tough for many Americans immediately to think about, he stated.

“I can’t see how anybody who has studied the history of the Great Depression could think that what’s happening today is comparable,” he stated.

Did Americans have extra buying energy in 1930 than they do now?

Some TikToks have claimed that Americans within the trough of the Great Depression, throughout the 12 months 1930, earned extra in actual phrases — or may afford extra with a median revenue — than they do immediately.

The most generally seen, from a TikTookay person who calls himself “Average Joe,” claimed that in 1930, the common web yearly revenue within the U.S. was $4,887. When adjusted for inflation, that involves about $88,000 in immediately’s {dollars}.

The video in contrast that wage to the median U.S. revenue in 2019, which was $31,133, arguing that the standard American had extra actual revenue and buying energy than these immediately.

The creator of the unique video didn’t reply to a request for remark.

But, based on Clarke, evaluating a median from one 12 months to the median of one other may be deceptive. He additionally famous that the info cited in that video might not mirror essentially the most correct image of the standard American’s revenue in 1930.

He defined that the $4,887 quantity comes from IRS estimates — however within the early twentieth century, far fewer American households filed federal revenue taxes. Those that did had been wealthier, Clarke stated.

According to information from the St. Louis Federal Reserve, wage and wage accruals per full-time equal worker totaled $1,392 in 1930 — about $25,000 in immediately’s {dollars}.

In 2022, full-time equal employees took residence $78,465, based on the St. Louis Fed.

“Silent depression” movies additionally are inclined to cite previous costs for a home or a automobile, arguing these bills had been extra reasonably priced for the common household 90 years in the past.

Clarke stated these comparisons additionally pass over some essential context. At the beginning of the Thirties, just one in 5.5 Americans owned a automobile. Houses had much less insulation and lacked conveniences which are widespread immediately, comparable to air con or indoor plumbing.

“The real standard of living is four times better,” he stated.

Economic information may be finicky, Clarke stated, particularly when wanting again so far as the Depression period. He discovered that plenty of “silent depression” movies on TikTookay misread that information.

“I do think a lot of these people are being genuine, and I want to encourage exploration,” he stated. “My review of (these examples) from a technical perspective is that they’re relying on comparing apples with oranges, and claiming everything is the same.”

Why do Americans really feel like they’re in a despair?

So if claims of a so-called silent despair don’t maintain up, why have they resonated so broadly on TikTookay? And why achieve this many Americans nonetheless really feel so dangerous in an economic system that — at the very least judging by conventional markers — appears so good?

The diminishing affordability of housing is one concern usually cited in TikTookay customers’ complaints. That’s a really actual downside, and one that’s most likely weighing closely on the minds of many Americans, Powell stated.

One of the one items of the economic system that appears comparable from 1930 to 2023 is revenue inequality, Clarke stated. The share of revenue going to the highest 10% of earners within the U.S. has been steadily rising for 4 a long time.

“That affects peoples’ feelings: You feel like you can’t keep up with your neighbors, you can’t keep up with those who are doing well. You don’t have the same opportunities that you thought you should,” he stated. “That’s a real sentiment.”

Clarke suspects viewers are hungry for a story that validates the monetary pinch they could be feeling proper now.

“Viral misinformation that confirms our feelings goes way more viral than the complicated truth,” Clarke stated. “And none of us are getting tens of millions of views when we correct it.”

TikTookay is very common amongst younger adults, 32% of whom say they commonly get their news from the app.

If these younger individuals are evaluating their financial actuality to that of their dad and mom, it’s utterly comprehensible that they could really feel that sure items of the American dream have stretched additional out of their attain, Mose stated.

“I could see how the generation coming of age could look to their parents’ generation and say ‘It’s harder now,’” he stated. “It is harder now than it was.”

But lately, Americans may be positive their cash is protected within the financial institution. Their homes are prone to have AC and a fridge and an indoor rest room. With a couple of place open for each job seeker available in the market, the chances skew of their favor in the event that they’re in search of work. And in the event that they fall on onerous instances, they will declare unemployment advantages, or qualify for Medicaid, or apply for meals stamps.

None of these issues assure monetary safety for everybody — however their existence nearly definitely means most Americans are higher off immediately than those that lived 90 years in the past, Moser stated.

“I look back at the struggles that our ancestors had to endure, and I feel so fortunate,” he stated. “It doesn’t mean there aren’t problems in the economy, but come on — the Great Depression? Let’s get real.”

Source web site: www.marketwatch.com