Congress may solely have till this summer time to strike a deal to elevate or droop the U.S. authorities debt ceiling, prompting analysts to warn of rising dangers to international monetary markets as America strikes nearer to a possible default.

“It would cause immeasurable harm to financial markets,” Amar Reganti, a fixed-income strategist at Hartford Funds, instructed MarketWatch. If a debt-ceiling disaster isn’t averted and the federal government not can borrow to cowl bills, he stated, “there is no part of modern capital markets that offer shelter” to traders if a considerable U.S. credit standing downgrade happens.

The U.S. Treasury Department started working underneath “extraordinary measures” in January to maintain the federal government present on its payments, after it ran up towards its present debt restrict of about $31.4 trillion. Since its creation a century in the past, the U.S. debt restrict has imposed limits on how a lot the federal authorities can borrow to satisfy current obligations already permitted by Congress.

The Congressional Budget Office on Wednesday estimated that the U.S. authorities might attain its debt restrict someday between July and September.

See: CBO warns of potential for U.S. default between July and September, as debt-limit standoff persists

Reganti at Hartford Funds had a front-row seat to prior U.S. debt standoffs, whereas serving because the deputy director of the Office of Debt Management on the Treasury Department from 2011 to 2015.

For now, the roughly $24 trillion Treasury market continues to hum alongside because the world’s deepest and most liquid market. Reganti sees volatility as more likely to hit maturing Treasury payments within the coming months, if Congress fails to succeed in a debt-ceiling deal. But he sees a disaster unfolding in markets if the U.S. results in default, as a result of its debt has been “hard-wired” into the worldwide monetary infrastructure.

For these causes, monetary markets are likely to wave off the potential for a U.S. default as unthinkable, and as a substitute “rely on the fact that historically, while recalcitrant, Congress has raised the debt limit,” Reganti stated.

Stock-market fell 15% in 2011 debt-ceiling standoff

Uncertainty sometimes hasn’t been a buddy to monetary markets.

Congress already has raised the debt restrict 86 instances, 18 of which occurred underneath former President Ronald Reagan, in keeping with a tally from Invesco. The economic system again then was reeling from double-digit inflation and the Federal Reserve’s coverage rate of interest had peaked close to 19%.

U.S. inflation appears to be like to have peaked final summer time at 9.1%, whereas the Fed’s coverage price is anticipated to prime 5% on this cycle.

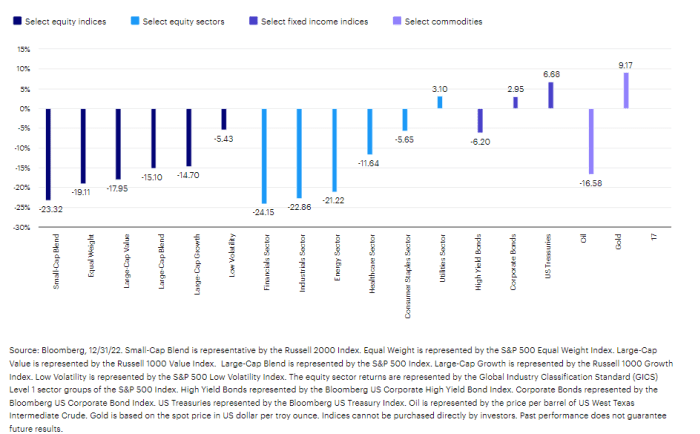

A take a look at the 2011 debt-ceiling standoff exhibits riskier property offered off (see chart), with the S&P 500 index

SPX,

tumbling about 15% from July to September, however gold

GC00,

U.S. Treasurys and extremely rated company bonds benefited from “safe haven” demand.

Gold and U.S. authorities debt benefited throughout 2011 debt ceiling deadlock

Bloomberg, Invesco

“What made 2011 so different,” stated Brian Levitt, Invesco’s international market strategist, was that Republicans held a major majority within the U.S. House of Representatives, which allowed them to extract main future spending cuts from the Obama administration in trade for a rise of the debt restrict.

That deal didn’t full “until the 11th hour,” Levitt stated, whereas including {that a} lack of a “red wave” for the Republican Party within the 2022 midterm Congressional elections probably places a brand new debt-ceiling settlement inside attain. A debt-limit invoice would want 218 votes to go the House, which is narrowly managed by Republicans. Democrats now maintain 212 seats within the chamber, and would want six Republicans to affix them in passing any laws.

However, if the present stalemate persists, Levitt foresees the same selloff in shares from the 2011 interval as seemingly. “It depends on how close to the brink we go.”

Treasury yields, a buffer?

A caveat on the present debt-ceiling standoff is that it’s the primary in additional than a decade when the upper Treasury yields now prevailing can supply traders a large “risk-free” fixed-income return, whereas additionally serving to cushion their draw back danger if shares dump sharply.

The 2-year Treasury yield

TMUBMUSD02Y,

was at 4.66% on Thursday, whereas the 10-year Treasury yield

TMUBMUSD10Y,

was at 3.84%, in keeping with FactSet. That’s up from 1.3% and a couple of%, respectively, final March.

What’s extra, liquidity within the Treasury market has held up through the previous three a long time of debt-ceiling fights in Congress, in keeping with Shankar Narayanan, head of buying and selling analysis at Quantitative Brokers.

“The visible liquidity is not affected,” Narayanan stated, pointing to historic buying and selling information for Treasury futures and money markets that sign a previous resilience in U.S. authorities debt.

“It is no different this time,” he stated. “But let’s see how that goes heading into the actual event.”

—Additional reporting by Robert Schroeder

Source web site: www.marketwatch.com