Those hoping for dazzling Nvidia outcomes weren’t disillusioned and shares are pointing to a contemporary document for Thursday. And the AI chief seems to be just like the tide lifting all boats, with the tech sector set to blow up and S&P 500

SPX

achieve when Wall Street opens.

Will Nvidia drive a brand new bull marketplace for Wall Street? First, we’ll have to attend till Friday’s speech from Fed Chair Jerome Powell in Jackson Hole.

But traders seemingly have extra burning questions round Nvidia

NVDA,

and rightly so.

For our name of the day, we return to Inge Heydorn, associate on the GP Bullhound Global Technology Fund and portfolio supervisor Jenny Hardy to weigh in on the investing execs and possibly cons on Nvidia and a few of its rivals.

Their fund has been invested in Nvidia for at the very least three years, together with different massive names within the area resembling Advanced Micro Devices

AMD,

MarketWatch spoke to the pair through e-mail and phone on Thursday, with this primary massive query: Is it to late to put money into Nvidia now?

“In the next six months, I think it will be good to invest in Nvidia, but you need to be aware that the risk is quite high,” Heydorn informed MarketWatch by cellphone. Shares of the chip maker have already soared 222% this 12 months, which harks again to a 223% achieve in 2016.

However, the pair say there’s a higher various to think about. “AMD is clearly a safer play,” Heydorn says, although he thinks the “market itself around AI is going to perform very, very strongly.” Shares of AMD are up a mere 68% thus far this 12 months, not even touching an almost 300% surge in 2016.

While Nvidia is clearly the “clearest direct beneficiary of the AI build…the reality is that no hyperscaler wants to be tied into one supplier (it is no secret that Nvidia chips are very highly priced),” provides Hardy in an e-mail.

“We think that AMD is the most obvious alternative and to the extent that they can ramp supply of their GPU this year, they will absolutely benefit from the current supply shortage in the market and cement themselves as a credible alternative,” she says.

“While it’s true that Nvidia will seemingly change into the de facto normal in coaching, the inference market is probably going a lot larger with extra diverse workloads that AMD can construct a place in. More broadly Nvidia chips must be made at TSMC [Taiwan Semiconductor Manufacturing Co.

TSM,

] , utilizing ASML

ASML,

instruments, so there are clear second by-product impacts on the broader worth chain,” says Hardy. Both ASML and Taiwan Semi rose in premarket commerce.

Nvidia is seen as a frontrunner available in the market for one sort of chips, people who prepare techniques to generate fashions, whereas inference chips, interpret educated fashions and reply to consumer questions. As famous by Techspot in January, the latter section “is much bigger and no single entity, not even Nvidia, has a lock on this market.”

Opinion: These AI-chip startups hope to problem Nvidia, however it might take a while

And what about these traders who’ve been holding Nvidia lengthy sufficient to see some tidy income? How will they know when it’s time to take some revenue off the desk?

That is hard to reply, says Heydorn. But one massive promoting level for Nvidia is its “extraordinary” low leverage — the corporate had $6.8 billion in incremental income 12 months over 12 months, with lower than $100 million incremental working expenditure, he and Hardy word.

Read: Will Powell crush shares once more throughout Friday’s Jackson Hole speech? Here’s one motive traders shouldn’t fear.

The markets

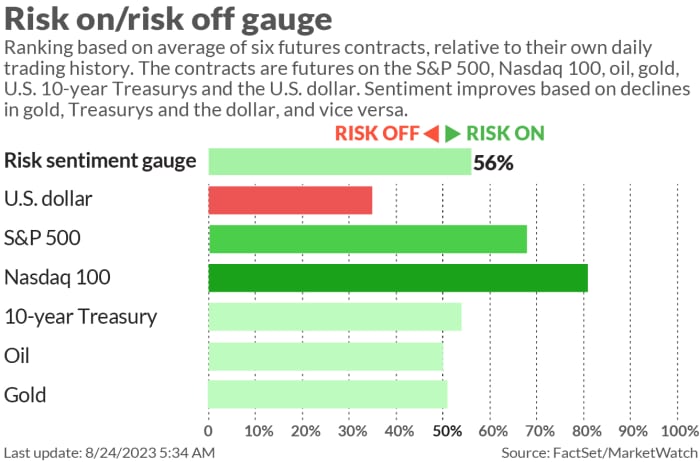

Risk on. Nasdaq 100 futures

NQ00,

are up 1.2%, with S&P 500 futures

ES00,

additionally climbing on tech-fueled momentum, whereas Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are inching up after hitting one-week highs on Wednesday. Asia shares have been larger, led by a 2% achieve for Hong Kong’s Hang Seng Index

HK:HSI.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Nvidia

NVDA,

shares are pointing to a contemporary document excessive following a 141% surge in data-center gross sales and document outcomes, and Wall Street is ratcheting up its value targets. Shares of AI-rival Advanced Micro Devices

AMD,

and semiconductor foundry Taiwan Semi

TSM,

are getting a lift as properly, together with European chip teams, resembling ASM International

ASM,

Opinion: Nvidia’s jaw-dropping income forecast won’t even be its peak

Boeing

BA,

is down 1.7% in premarket after provider Spirit AeroSystems

SPR,

mentioned there was a brand new defect on the troubled 737 Max plane. Spirit shares are down 6%.

Cut-price retailer Dollar Tree

DLTR,

fell as its present quarter earnings steerage lagged Wall Street estimates, with Ulta Beauty

ULTA,

and Intuit

INTU,

coming after the bell.

Also reporting late Wednesday, within the software program area, Splunk

SPLK,

and Autodesk

ADSK,

are surging on upbeat outcomes. Retailer Guess

GES,

rallied greater than 13% after topping Wall Street expectations.

Weekly jobless claims and sturdy items orders are each due at 8:30 a.m., with some Fed interviews from the Jackson Hole gathering anticipated round 10 a.m.

Best of the online

All the highlights from the Republican presidential main, with former Ambassador Nikki Haley amongst these scoring factors. And listed here are a few of the most viral moments.

Can BRICS dethrone the U.S. greenback? It’ll be an uphill climb, consultants say

Despite dishonest, U.S. colleges are repealing ChatGPT bans

The chart

Wall Street is ratcheting up share value targets on Nvidia. The Market Ear factors out what one bullish analyst’s name means for the inventory:

The Market Ear/Refinitiv

The tickers

These have been the top-searched tickers as of 6 a.m. Eastern:

| Ticker | Security identify |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

TSLA, |

Tesla |

|

MULN, |

Mullen Automotive |

|

APE, |

AMC Entertainment most well-liked shares |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

PLTR, |

Palantir |

|

AMD, |

Advanced Micro Devices |

Random reads

An injured Kevin Hart says he’s the ‘dumbest man alive’ for not appearing his age.

World first? Spotless child giraffe born at Tennessee zoo.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com