Shares of not too long ago debuted Jet.AI Inc. greater than doubled Friday after the aviation-booking platform introduced its AI-based reserving app was obtainable on Apple Inc.’s App Store.

Jet.AI

JTAI,

shares soared as a lot as 117% to an intraday excessive of $8.40 Friday, proper after the announcement, and have been final up 75% heading into the shut, following commerce halts resulting from volatility throughout the session. More than 4.2 million shares exchanged arms within the ultimate hour of buying and selling, in contrast with a 10-day common each day quantity of round 356,000 shares, in line with FactSet knowledge.

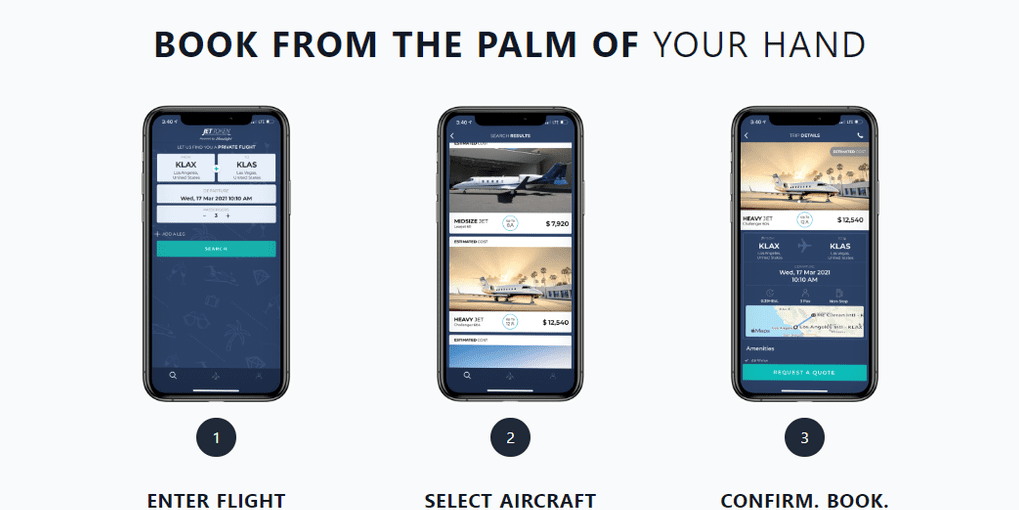

On Friday, Jet.AI mentioned its CharterGPT AI-powered charter-flight reserving app was obtainable for Apple

AAPL,

iOS units, and {that a} model for customers of Alphabet Inc.’s

GOOG,

GOOGL,

Android OS will likely be obtainable “in the coming weeks.”

FactSet

“Customers now have the power and convenience of an impressive, real-world application of transformative AI technology that is efficient, knowledgeable and fun to use,” Mike Winston, Jet.AI’s founder and chair, mentioned in a press release. “We’re at the vanguard of bringing AI to the aviation industry. Private aviation is a great place to start where we can control more, understand more, establish credibility and scalability before we expand to broader applications in aviation.”

The firm mentioned the following iteration of the app, which is due out in September, will incorporate fintech service Stripe Inc. for funds.

The service permits clients to e book personal jets starting from light-weight fashions — just like the Citation Mustang from Textron Inc.’s

TXT,

Cessna unit or Honda Motor Co.’s

7267,

HondaJet — as much as long-range, heavier fashions like Bombardier Inc.’s

BBD.A,

BBD.B,

Challenger 850 or Global 6000.

Jet.AI shares dropped 29% after debuting final Friday on the Nasdaq, after the corporate mixed with blank-check firm Oxbridge Acquisition, shares of which started buying and selling in October 2021 at $9.82, in line with FactSet knowledge.

Source web site: www.marketwatch.com