A high economist at JPMorgan Chase & Co.

JPM,

not expects a recession to reach within the U.S. earlier than the top of 2023. He doesn’t anticipate one in 2024 both, however stated the chance of a possible downturn stays elevated.

Michael Feroli, chief U.S. economist at JPMorgan, on Friday formally deserted the financial institution’s earlier recession forecast, placing the biggest U.S. financial institution by belongings extra in step with others on Wall Street in pondering {that a} recession is likely to be prevented despite the fact that the Federal Reserve has elevated charges to a 22-year excessive.

Explaining his view in a Friday consumer be aware, Feroli cited enhancing third-quarter knowledge, waning inflation and the growing probability that the Fed will achieve its effort to tame inflation with out cracking the U.S. financial system.

Congress’s momentary decision of the debt-ceiling standoff in June, in addition to U.S. authorities’ efforts to shore up the U.S. banking system following the collapse of Silicon Valley Bank, additionally factored into Feroli’s determination.

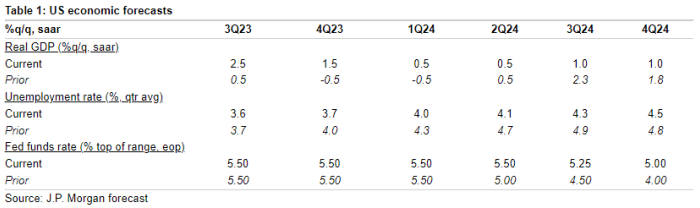

In specific, he cited robust productiveness knowledge launched earlier this week as one instance of how labor provide is returning to a state of equilibrium. All of those developments helped encourage his determination to lift his forecast for third-quarter GDP development to 2.5% from 0.5%.

The productiveness of American staff and firms rebounded within the second quarter and grew at a 3.7% annual tempo, in response to official authorities knowledge.

The fee surpassed economists expectations. According to Feroli, U.S. shares could already be anticipating an additional enhance to productiveness pushed by the appearance of the artificial-intelligence craze.

While Feroli has eliminated the recession name from his base case, he acknowledged that dangers of a downturn persist. Should inflation reaccelerate, it might provoke the Fed into extra interest-rate hikes, which might carry down the financial system.

“While we and the markets think it is done, it probably wouldn’t take much of an upside inflation surprise for the FOMC to deliver the extra rate hike that was signaled in the June dots, with perhaps even more to come,” he stated.

To make certain, even when a recession is prevented, Feroli expects development to sluggish to a “subpar” tempo as tighter bank-lending requirements and fewer bountiful authorities spending take a toll.

As for the Fed coverage, Feroli expects the central financial institution will begin reducing charges once more within the third quarter of 2024.

“The Fed reliably cuts rates in recessions. However, last week Chair Powell indicated that with rates now in restrictive territory, even absent a recession they have scope to adjust the funds rate lower in the event inflation comes down — which both he and we project,” he stated.

“So while we don’t foresee a rapid cutting cycle we do look for policy rates to be adjusted lower beginning in 3Q24.”

Here’s a breakdown of Feroli’s revised forecasts for unemployment, GDP development and the fed-funds fee:

JPMORGAN

A recession name had been a bedrock of JPM’s home views for months, with it codified in Feroli’s 2023 outlook printed late final 12 months. It was integral to the banks’ fairness strategists bearish outlook on the inventory market.

See: Goldman chief economist sees lowered probability of recession and dismisses inverted-yield-curve worries

The financial institution isn’t alone. Economists and strategists at Goldman Sachs Group

GS,

Apollo

APO,

and elsewhere have dropped or tempered their recession calls, which have been a consensus view amongst Wall Street economists heading into 2023.

Stocks closed decrease Friday, with the Dow Jones Industrial Average

DJIA

and S&P 500

SPX

posting their first weekly loss in three weeks, shedding 1.1% and a pair of.3%, respectively, since Monday. The Nasdaq Composite Index

COMP

booked its largest weekly proportion drop since March 10, falling 2.9%, in response to Dow Jones Market Data.

Source web site: www.marketwatch.com