JPMorgan on Friday pounded the desk for power shares, as higher-for-longer rates of interest additional squeezes the move of capital into new provide.

Europe’s power shares

XX:SXEP

have solely gained 10% whereas oil costs

CL.1,

have jumped 30%. JPMorgan mentioned it’s recommending the majors over midcaps, upgrading Eni

ENI,

to chubby, reiterating overweights on Shell

SHEL,

TotalEnergies

TTE,

and Neste

NESTE,

and lifting Repsol

REP,

to impartial. The financial institution raised its ranking on international power shares to chubby from impartial, because it sees an rising supply-demand hole past 2025, coupled with strengthening sector fundamentals.

Globally, it mentioned the important thing shares to outperform are Eni, Shell, TotalEnergies, Saudi Aramco

2222,

Exxon Mobil

XOM,

Marathon Petroluem

MPC,

Tenaris

TS,

Baker Hughes

BKR,

Cenovus

CVE,

Prio , PetroChina

601857,

Beach Energy

BPT,

and Ampol

ALD,

“Dear generalists, put your seatbelts on,” mentioned analysts led by Christyan Malek. “While we believe the sector is in a structural up-cycle and oil should normalize higher, we expect prices and by extension energy equities to trade in a wider range, discounting an effective higher weighted average cost of capital associated with elevated price volatility and concerns around ESG/peak demand.”

The analysts don’t share the height demand fears, no less than on its funding horizon that runs by way of 2030, saying the clear power system shouldn’t be mature sufficient to seize and distribute it to finish prospects. “As a result, this places greater pressure on traditional fuels to fill the gap and meet rising EM-led demand growth. However, without increasing oil and gas capex, we risk energy deficits and acute inflation across the commodities complex.”

“This may lead to multiple oil-led energy crises in this decade, potentially much more severe than the gas crisis seen in Europe in 2022. Moreover, it serves to position OPEC firmly at the steering wheel of the global oil market, to take greater share of demand growth, while helping mitigate sharp price moves in either direction.”

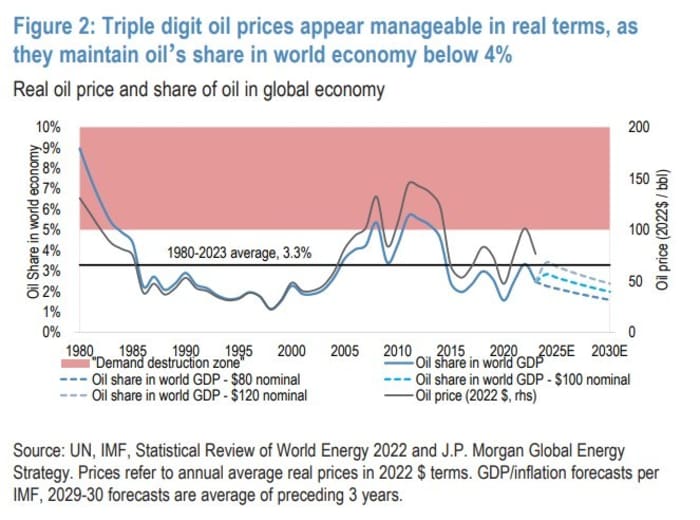

One attention-grabbing observe is that the analysts don’t discover oil costs within the $100-to-$120 vary to be demand damaging, as it will nonetheless suggest oil’s share of the world financial system beneath 4%.

Friday noticed a catching down of European shares to the sharp decline on Thursday on Wall Street, although U.S. inventory futures pointed to a stronger begin.

The U.Okay. FTSE 100

UK:UKX

was flat whereas the German DAX

DX:DAX

fell 0.5% and the French CAC 40

FR:PX1

misplaced 0.9%.

Ubisoft Entertainment shares

UBI,

rose 4% after the U.Okay. competitors regulator provisionally blessed the Microsoft-Activision deal that will see the French video video games maker get cloud rights to Activision

ATVI,

video games.

AstraZeneca inventory

AZN,

added 2% because it and accomplice Daiichi Sankyo mentioned a Phase III trial of a breast most cancers drug confirmed statistically vital progression-free survival profit. “This was another pivotal readout for [datopotamab deruxtecan] and could reinvigorate sentiment about this drugs broader potential to replace systemic chemotherapy across a range cancers whilst also providing another important read on safety,” mentioned Dr. Sean Conroy, an analyst at Shore Capital.

Source web site: www.marketwatch.com