Goldman Sachs this week elevated its default forecast for U.S. high-yield, or “junk-rated,” company bonds this 12 months to 4% from 2.8% after extra corporations this 12 months have been buckling below their money owed.

The cloudier outlook for junk bonds comes as Wall Street feels the squeeze of tighter credit score situations, whereas bracing for the financial backdrop to worsen.

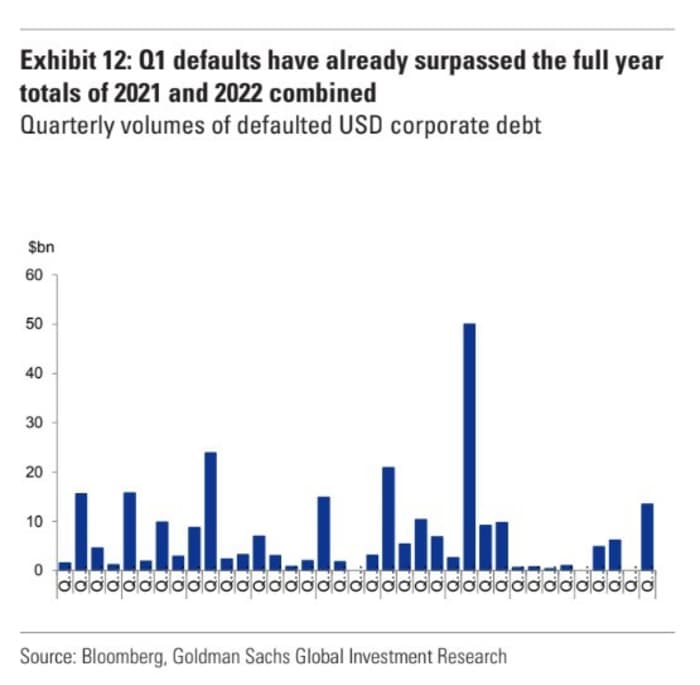

With greater than $11 billion of junk bonds topic to company defaults within the first quarter (see chart), the quantity now has surpassed the entire greenback quantity for all of 2021 and 2022.

U.S. junk-bond defaults in Q1 high final two years mixed.

Bloomberg, Goldman Sachs

Corporate defaults had been uncommon earlier than the Federal Reserve began elevating rates of interest final 12 months. Over the long run, the junk-bond sector’s common yearly default price was 4.3% for the previous 25 years, in accordance with Goldman knowledge.

Lotfi Karoui’s credit score analysis crew at Goldman stated, “many investors are asking what the forward pipeline of defaults looks like from here,” in a weekly shopper notice. Concerns have been elevated as company defaults jumped to begin 2023, with extra anticipated as credit score situations tighten after the failures of Signature Bank

SBNY,

and Silicon Valley Bank.

Distress hits $120 billion

Distressed bond provide within the U.S. junk-bond market hit about $120 billion as of every week in the past, in accordance with CreditSights. In the times earlier than the 2 banks defaulted, there have been nearly 100 issuers with debt buying and selling in distressed territory, or at a ramification of no less than 1,000 foundation factors above Treasury yield, in accordance with CreditSights.

“It’s the speed and magnitude of interest-rate hikes that made parts of the tech sector unviable, and led to the collapse of Silicon Valley Bank,” stated Evan DuFaux, a particular conditions analyst at CreditSights, by cellphone Friday.

“Those effects will be felt throughout the economy, and particularly in the case of leveraged companies.”

Separately, Goldman’s economics crew on Friday stated stress within the banking sector will tighten credit score situations, gauging the anticipated pullback from regional U.S. banks alone as equal to Fed rate of interest hikes of 25-50 foundation factors.

That was a theme Federal Reserve Chairman Jerome Powell drilled down on Wednesday in a news convention following one other Fed price hike of 25 foundation factors on Wednesday. “The question is, how significant will this credit tightening be and how sustainable it will be. That’s the issue,” Powell stated on Wednesday.

See: Fed assembly exhibits deal with tighter credit score situations after financial institution failures. They already had been at 2008 ranges.

Like U.S. owners, many corporations snapped up low cost debt throughout the pandemic to refinance at traditionally low charges after the Fed lower charges in March 2020 to just about zero and held them there for about two years. Borrowing in each sectors has slowed dramatically in latest months.

The Fed has already raised its coverage rated to a variety of 4.75 to five% in a 12 months, with a terminal price vary penciled in at 5% to five.25%.

That has harm banks’ holdings of Treasurys and mortgage bond securities, placing an estimated $620 billion of their securities underwater on a mark-to-market foundation.

Related: ‘This is a risk confronting all banks,’ ex-FDIC chief Sheila Bair tells MarketWatch

U.S. shares had been unstable up to now week, however posted weekly positive aspects. The Dow Jones Industrial Average

DJIA,

superior 0.4% Friday, the S&P 500 Index

SPX,

rose 0.6% and the Nasdaq Composite Index

COMP,

climbed 0.3%, in accordance to FactSet.

Source web site: www.marketwatch.com