The U.S. Labor Day vacation will mark one other milestone within the marathon to deliver employees again to the workplace, however it gained’t be a fast repair for landlords, based on Thomas LaSalvia, head of economic actual property economics at Moody’s Analytics.

Employers from Facebook mum or dad Meta

META,

to Goldman Sachs

GS,

lately laid out mandates for workers to return to the workplace extra ceaselessly, beginning this fall, together with the massive one — the federal authorities.

“Lots of firms are saying that after Labor Day, ‘We expect more out of you,” LaSalvia said, referring to days in the office. Still, office attendance, he argues, likely only stages a fuller comeback if a job or promotion is on the line.

Amazon.com Inc.’s

AMZN,

Chief Executive Andy Jassy has been attempting to drive residence the purpose by warning workers to return at the least three days per week, or face the results.

That might show troublesome, with Friday’s U.S. jobs report for August anticipated to indicate U.S. unemployment at a scant 3.5%, close to the bottom ranges for the reason that late Nineteen Sixties, even when hiring has been slowing. The labor market, to this point, seems unfazed by the Federal Reserve’s benchmark charge reaching a 22-year excessive.

It has been a unique story for landlords going through a roughly 19% emptiness charge nationally and piles of debt coming due, particularly for house owners of older Class B and C workplace buildings with a bleak outlook or properties in cities with wobbling enterprise facilities.

See: San Francisco’s workplace market erases all beneficial properties since 2017 as costs sag nationally

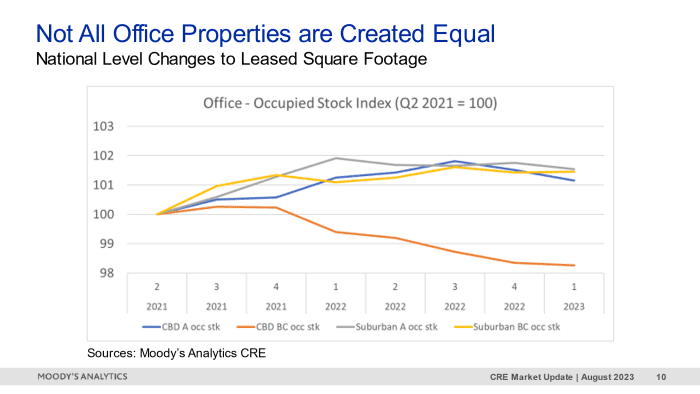

As with purchasing malls, LaSalvia stated it’s largely an issue of oversupply, with many workplace properties prone to changing into out of date as tenants flock to higher buildings and areas staging a rebirth. The development might be traced in leasing knowledge since 2021, with Class A properties in central enterprise districts (blue line) displaying a giant benefit over much less fascinating buildings within the coronary heart of cities (orange line).

Return to workplace isn’t going to save lots of the whole workplace property market

Moody’s Analytics

“Little by little, we are finding the office isn’t dead,” LaSalvia stated, however he additionally sees extra promise in neighborhoods with a brand new goal, these catering to hybrid work and communities that deliver individuals collectively.

Another manner to have a look at the development is thru rents. Manhattan’s Penn Station submarket, with its estimated $13 billion overhaul and neighboring Hudson Yards improvement, has seen asking rents leap 32% to $74.87 a sq. foot within the second quarter for the reason that fourth quarter of 2019, based on Moody’s Analytics. That compares with a 2% bump in asking rents in downtown New York City to $61.39 a sq. foot for a similar interval.

The push for a return to the workplace additionally doesn’t imply a repeat of prepandemic methods. Goldman Sachs analysts estimate that part-time distant work within the U.S. has stabilized round 20%-25%, in a late August report, however that’s nonetheless up from 2.6% earlier than the 2020 lockdowns.

Furthermore, the persistence of distant work will seemingly add one other 171 million sq. ft of vacant U.S. workplace house via 2029, a interval that additionally will see tenants’ long-term leases expire and plenty of firms choosing much less house. The further vacancies would roughly translate to 57% of Los Angeles roughly 300 million sq. ft of workplace house sitting empty.

“The fundamental reason why we had offices in the first place have not completely disintegrated,” LaSalvia stated. “But for some of those Class B and C offices, the writing was on the wall before the pandemic.”

U.S. shares had been combined Thursday, however headed for losses in a troublesome August for shares, with the S&P 500 index

SPX

off about 1.5% for the month, the Dow Jones Industrial Average

DJIA

2.1% decrease and the Nasdaq Composite

COMP

down 2% in August, based on FactSet.

Related: Some employers mandate etiquette lessons as returning workplace employees stroll barefoot, burp loudly and microwave fish

Source web site: www.marketwatch.com