Lemonade Inc. shares fell within the prolonged session Wednesday after the mobile-based insurance coverage firm’s outcomes and outlook got here in barely above Wall Street expectations following a robust rally by the inventory this 12 months.

Lemonade

LMND,

shares fell greater than 6% after hours, following a 2.4% loss to $22.07 in Wednesday’s common session, placing the inventory at a year-to-date achieve of 61.3%, in contrast with the S&P 500 index’s

SPX

17.6% achieve.

The firm reported a second-quarter lack of $67.2 million, or 97 cents a share — in contrast with a lack of $67.9 million, or $1.10 a share, within the year-ago interval — as whole income rose to $104.6 million from $50 million within the year-ago quarter.

Analysts surveyed by FactSet had forecast a lack of $1.03 a share on income of $97.6 million.

Lemonade expects income of $102 million to $104 million for the third quarter, and $402 million to $408 million for the 12 months. Analysts forecast income of $102 million for the third quarter, and $397.7 million for the 12 months.

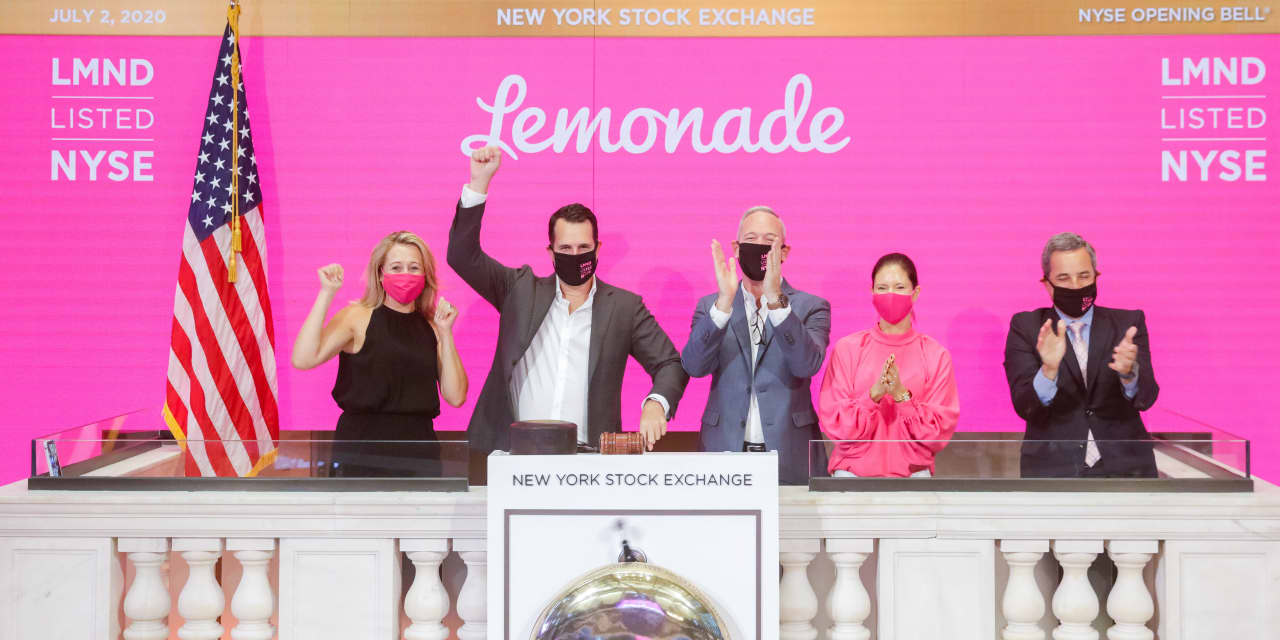

A bit greater than three years after its IPO, Lemonade shares completed Wednesday’s common session practically 24% beneath the unique IPO value of $29. The inventory ranked as the perfect IPO of 2020, debuting 139% above its preliminary pricing.

Source web site: www.marketwatch.com