Shares of Lucid Group Inc. slumped Monday as a part of a broad selloff within the electric-vehicle sector and after the California-based EV maker lower costs on Lucid Air fashions, however as much as 11.5%.

The announcement comes forward of Lucid’s earnings report, which is due after Monday’s closing bell. Separately, Lucid additionally acknowledged a recall of 59 Air EVs, citing a defective rearview-camera picture.

The inventory

LCID,

sank 4.8% in morning buying and selling, placing it on monitor for the bottom shut since June 27. The inventory has tumbled 17.2% amid a five-day nonwinning streak, throughout which it closed unchanged on Aug. 3.

On Aug. 4, Lucid introduced its Pure Summer Event, with “limited-time” provides by Aug. 31.

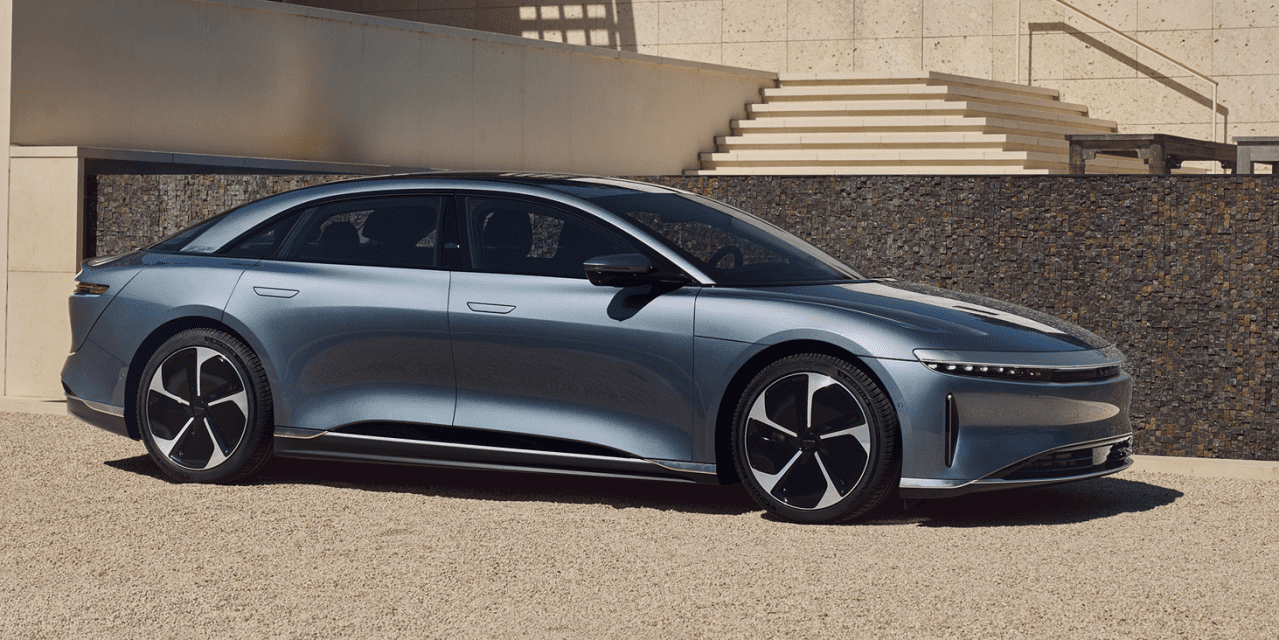

The gross sales value for the Air Pure all-wheel drive now begins at $82,400, down 5.7% from a earlier value of $87,400. A 36-month lease accessible for $749 per 30 days with $7,699 due at signing.

The Air Touring’s beginning value was lower by 11.5%, to is now accessible for $95,000 from $107,400. A 36-month lease could be had for $1,149 per 30 days, with $9,814 due at signing.

For the Air Grand Touring, the beginning value was lower by 9.4%, to $125,000 from $138,000. Or, a 36-month lease would value $1,399 per 30 days with $10,899 due at signing.

Also, the vacation spot charge was lowered by 9.1%, to $1,500 from $1,650.

For purchases, 72-month month financing is offered at an annual proportion fee of 4.99%.

Lucid’s value cuts comply with these of EV chief Tesla Inc.

TSLA,

which did so to spice up gross sales. It labored, with Tesla final month reporting second-quarter gross sales that soared 47% from a 12 months in the past, though profitability shrank because of this.

Lucid is scheduled to report second-quarter outcomes after the shut Monday, with analysts surveyed by FactSet anticipating, on common, per-share losses to widen to 34 cents from 33 cents a 12 months in the past, and for income to extend 86.6% to $181.6 million.

Separately, the corporate stated it was recalling 59 Lucid Air autos, mannequin years 2022 to 2023.

“A rearview camera image that does not display while in reverse decreases the driver’s visibility, increasing the risk of injury or crash,” in accordance with a letter from the National Highway Traffic Safety Administration.

The firm stated it has launched an over-the-air software program replace, freed from cost, with owner-notification letters anticipated to be mailed on Sept. 25.

Lucid’s inventory drop was a part of a broad selloff within the EV sector.

Among different EV makers, shares of Tesla

TSLA,

dropped 2.9% after the corporate introduced that its chief monetary officer was stepping down.

Elsewhere, shares of Rivian Automotive Inc.

RIVN,

shed 4.8%, Nikola Corp.’s

NKLA,

inventory tumbled 8.8%, Fisker Inc.

FSR,

shares slid 4% and Mullen Automotive Inc.’s

MULN,

inventory gave up 6.4%.

That compares with a 0.5% decline within the Global X Autonomous & Electric Vehicles exchange-traded fund

DRIV

and 0.7% rise by the S&P 500

SPX.

Source web site: www.marketwatch.com