The Federal Reserve could also be mistaken, however at the very least officers there received’t be flying blind now that the federal government will keep open, retaining the nation’s move of financial information nonetheless operating. In the early going, there was one thing of a aid rally, although it shortly evaporated.

As the fourth quarter begins, a brand new observe from Goldman Sachs technique staff, led by Cormac Conners, makes the case that the Magnificent Seven shares are actually trying … low cost.

The grouping — Apple

AAPL,

Microsoft

MSFT,

Amazon

AMZN,

Alphabet

GOOGL,

Nvidia

NVDA,

Tesla

TSLA,

and Meta Platforms

META,

— has seen their subsequent 12 month price-to-earnings ratio fall to 27 from 34. The S&P 493, nonetheless, has seen their price-to-earnings ratio fall extra narrowly, to 16 from 18.

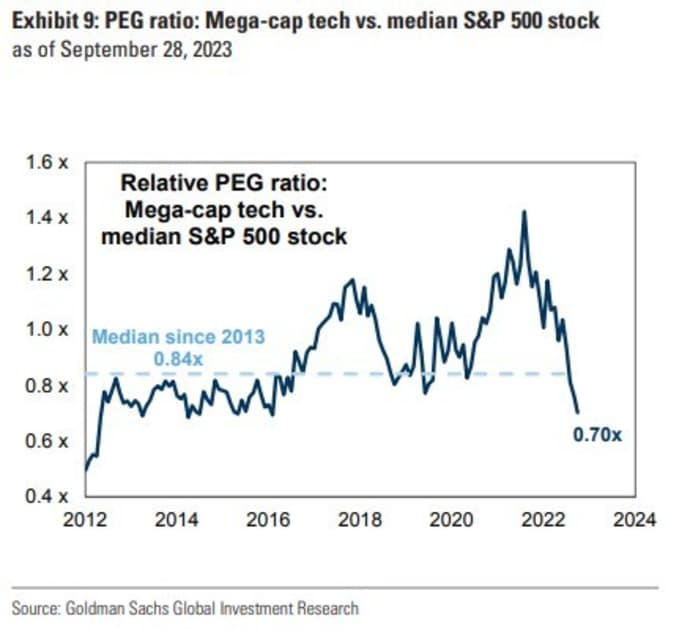

Put a unique method, the biggest tech shares commerce on the most cost effective valuation relative to the median inventory in over six years, the strategists say. The Magnificent Seven commerce at 1.3 instances their PEG ratio (price-to-EPS-to-long-term development), versus 1.9 for the median S&P 500 inventory. That low cost, the strategists say, has been reached solely 5 instances within the final decade. As lately as January, they traded on an 18% premium in PEG phrases.

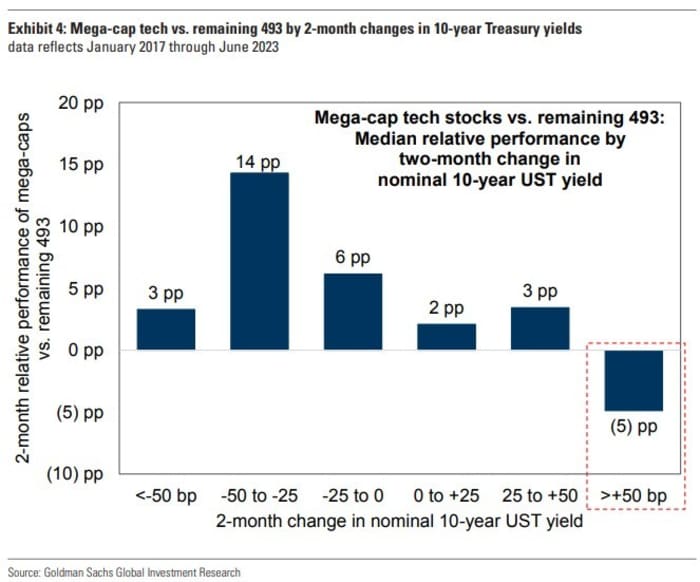

So why did the mega-cap techs fall within the first place? One key driver, the strategists say, was the rise in long-term yields. “The underperformance of the largest long duration tech stocks in the face of soaring Treasury yields is consistent with the trading pattern of the last five years: The largest stocks have tended to struggle in the face of greater than 50 bp increases in the nominal 10-year yield over two months,” they are saying. This time across the 10-year yield rose 62 foundation factors in two months. Goldman’s personal forecast for the 10-year to dip marginally, to 4.3% by the tip of the 12 months, after which rise once more to 4.6% within the first quarter.

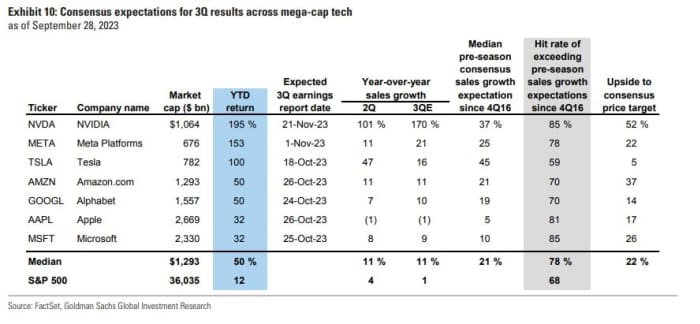

But that’s not the one constructive driver for the Magnificent Seven. In the upcoming third-quarter earnings season, the biggest tech firms are anticipated to register 11% gross sales development, in comparison with simply 1% for the S&P 500 as a complete. Historically, the megacap tech shares have crushed so-called preseason gross sales expectations greater than the broader market has, the strategists added.

The markets

U.S. inventory futures

ES00,

NQ00,

had been flat, after the S&P 500

SPX

fell 3.7% final quarter. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

reached 4.64%. Que sera, sera.

The buzz

The U.S. Congress surprisingly prevented a shutdown, with 45 days of funding at current ranges.

The ISM manufacturing report is due at 10 a.m. Eastern, with building spending additionally set for launch.

Fed Chair Jerome Powell is because of communicate at a York, Pa. roundtable with Philadelphia Fed President Patrick Harker, in response to reviews. The Fed’s calendar has Vice Chair for Supervision Michael Barr talking on financial coverage and monetary stability.

Sphere Entertainment

SPHR,

shares rose 8% after the profitable opening of the Las Vegas Sphere.

The 5 weirdest tales about Sam Bankman-Fried that Michael Lewis advised “60 Minutes.”

Random reads

Does China’s property bust make a monetary disaster inevitable?

Why central banks will quickly lend to hedge funds.

Why frequent-flier miles are not price bothering with.

Top tickers

Here had been the highest stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NIO, |

Nio |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

TTOO, |

T2 Biosystems |

|

PLTR, |

Palantir Technologies |

|

NKLA, |

Nikola |

|

AMZN, |

Amazon.com |

The chart

Peter Tchir of Academy Securities stated sensible debtors have made Fed coverage laggier. That is, firms and households who locked in low rates of interest previous to the Fed charge hike cycle have diminished the impression of the Fed’s tightening marketing campaign. Here he charts the typical coupon in Bloomberg’s Corporation Bond index. He has additionally a unique chart displaying how investment-grade issuance peaked in 2020, and has dropped three straight years.

Random reads

Former President Jimmy Carter, who has defied consultants together with his continued longevity, is seemingly having fun with “Law and Order” and Atlanta Braves baseball along with retaining with up the news.

These cost-conscious Australian retirees booked 51 consecutive cruises, as a result of it’s cheaper than a retirement residence.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e-mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com