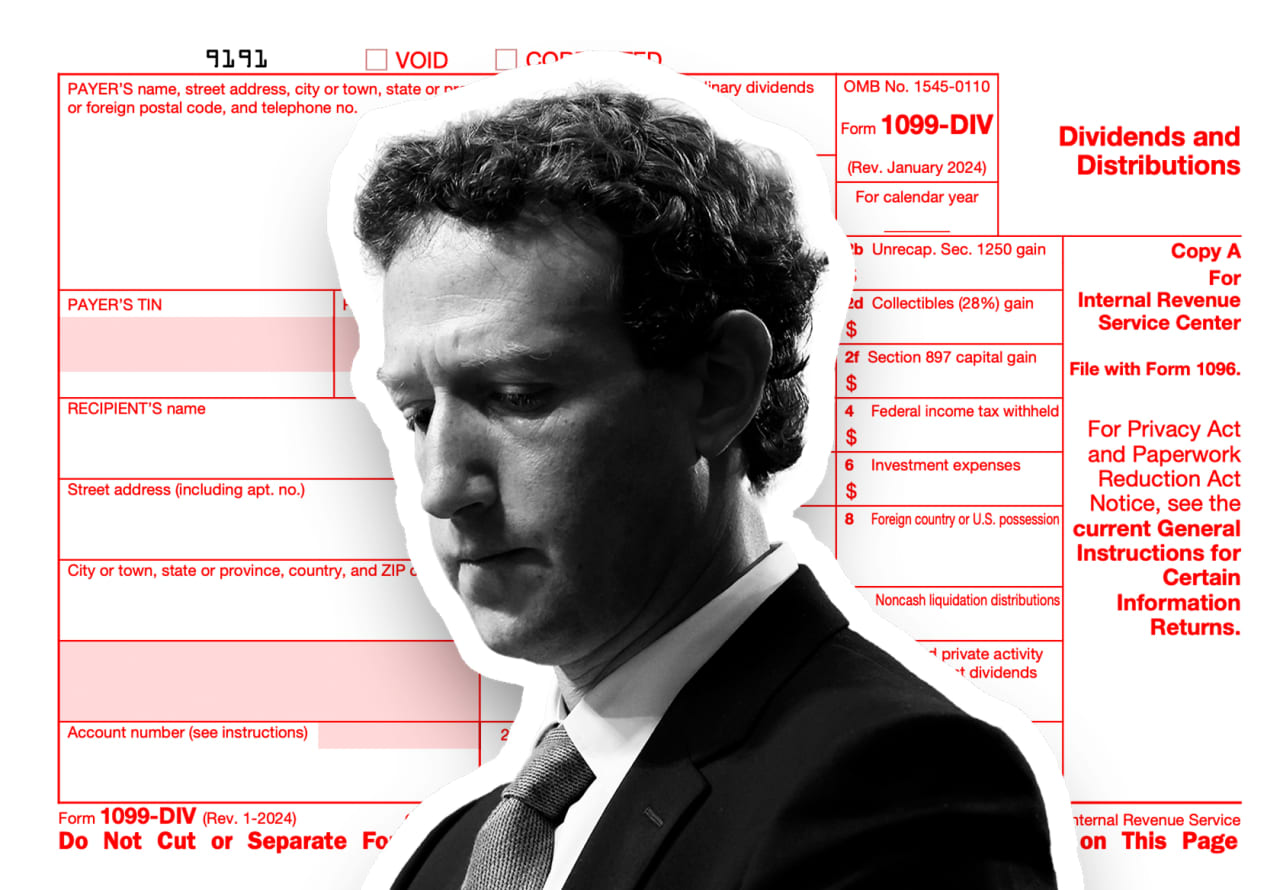

Mark Zuckerberg delighted Meta shareholders and Wall Street this week with news of the social media big’s first-ever dividend.

The IRS may be pleased, now that it’s looking at tens of millions in taxes on the Meta inventory dividends certain for Zuckerberg’s portfolio.

Zuckerberg, the CEO of Meta Platforms Inc.

META,

is poised to make $700 million in dividends yearly. He owns practically 350 million shares, in line with FactSet, and the corporate will begin paying a quarterly dividend of fifty cents a share.

That would yield practically $167 million in federal taxes yearly, after a qualified-dividend tax of 20% and one other 3.8% tax on the funding returns of wealthy households, two accounting specialists mentioned.

California revenue taxes of 13.3% on the dividends may value Zuckerberg one other $93.1 million, mentioned Andrew Belnap, an accounting professor on the University of Texas at Austin’s McCombs School of Business.

All in, that’s a mixed $259.7 million in federal and state taxes yearly on the Meta dividends, Belnap estimated.

For context, U.S. taxpayers reported over $285 billion in qualified-dividend revenue to the IRS although mid-November 2023, in line with company statistics. Nearly 30 million tax returns reported certified dividends by way of that point.

Meta mentioned it plans a quarterly money dividend going ahead, with the primary such fee in March.

Meta shares soared 20.5% on Friday, ending with a record-high shut of $474.99. The Dow Jones Industrial Average

DJIA,

S&P 500

SPX

and Nasdaq Composite

COMP

all closed greater Friday.

‘Zuck is getting a major break’

Meta introduced the dividend fee in its earnings outcomes Thursday, on the identical week that Americans started submitting their revenue taxes.

A have a look at Zuckerberg’s dividends and their tax implications provide a peek on the debate concerning the various methods wages and wealth are taxed.

“Zuck is getting a major break,” mentioned Andrew Schmidt, an accounting professor at North Carolina State University’s Poole School of Management who additionally crunched the numbers for MarketWatch.

Approximately $167 million “seems like a high tax bill,” he mentioned. But if Zuckerberg obtained the $700 million as a straight wage, Schmidt estimated he’d be a roughly $259 million tax invoice on the wages after they have been taxed on the prime marginal price of 37%.

Federal revenue tax brackets run from 10% to 37%.

Meanwhile, the IRS taxes certified dividends and capital good points at 0%, 15% and 20%, relying on revenue and family standing. The web funding revenue tax provides one other 3.8% for people making at the least $200,000 or married {couples} value $250,000.

For federal and state taxes on the Meta dividends, Zuckerberg would face a mixed price of 37.1%, Belnap famous. “His tax rate on this is actually fairly high,” he mentioned.

The hole in tax charges on revenue derived from wages and investments “has been a big criticism with U.S. tax policy,” Schmidt mentioned, particularly as lawmakers search for methods to provide you with extra tax income.

Regular retail traders take pleasure in the identical preferential charges on capital good points and dividends as the highest 1% of taxpayers, Schmidt added. The challenge is that these dividends and inventory earnings are a smaller a part of their revenue whereas salaries, taxed at greater charges, are an even bigger proportion.

Belnap famous that California’s state tax guidelines don’t present particular therapy to dividends.

Read additionally: Where Trump, Biden and Haley stand on capital good points, the kid tax credit score and different key tax questions

Zuckerberg obtained a $1 base wage in 2022, a determine that hasn’t modified in a number of years. He is now value $142 billion, in line with the Bloomberg Billionaires Index, making him the fifth-richest particular person on this planet.

Meta didn’t instantly reply to a request for remark.

Taxes on the Meta dividends is not going to be one thing Zuckerberg, or any Meta shareholders huge or small, must cope with till subsequent 12 months’s tax season, Belnap and Schmidt noticed.

But as taxpayers amass their 1099-DIV varieties on dividend revenue, IRS figures present that it’s principally upper-echelon taxpayers reaping the rewards on the preferential charges for certified dividends.

Households value at the least $1 million accounted for 40% of the approximate $285.3 billion in certified dividends reported by way of mid-November, in line with company figures.

For much less prosperous traders, “it’s usually a nice supplement, but I’d say very few people are living off dividends,” Belnap mentioned.

Source web site: www.marketwatch.com