A drone assault that killed three U.S. service members in northern Jordan, blamed by the White House on Iran-backed militants, marks a serious escalation of tensions within the Middle East and appeared probably to attract a response when monetary and commodity markets open for the week.

Oil costs are prone to rise when futures buying and selling begins Sunday night, analysts stated.

Much will finally rely on the U.S. response and whether or not Iran takes motion aimed toward shutting down the Strait of Hormuz, Tariq Zahir, managing member at Tyche Capital Advisors, instructed MarketWatch on Sunday afternoon.

“We are on the cusp of this escalating, which could seriously impact the flow of crude oil,” he stated.

Three U.S. service members had been killed and greater than two dozen injured in a drone strike on a U.S. base in northeast Jordan, in accordance with U.S. Central Command. They had been the primary U.S. fatalities in months of assaults on U.S. bases by Iran-backed militias for the reason that begin of the Israel-Hamas conflict in October.

President Joe Biden attributed the Sunday assault to an Iran-backed militia group and stated the U.S. “will hold all those responsible to account at a time and in a manner (of) our choosing.” News experiences stated U.S. officers had been nonetheless working to conclusively establish the exact group accountable for the assault, however have assessed that one in all a number of Iranian-backed teams is in charge.

Some congressional Republicans known as for direct retaliation on Iran.

“We must respond to these repeated attacks by Iran & its proxies by striking directly against Iranian targets & its leadership. The Biden administration’s responses thus far have only invited more attacks. It is time to act swiftly and decisively for the whole world to see,” wrote Sen. Roger Wicker of Mississippi, the senior Republican on the Senate Armed Services Committee, in a put up on X.

Oil futures rallied final week, however with positive aspects attributed partly to manufacturing outages within the U.S. and extra upbeat expectations round financial development.

Oil costs have seen short-lived rallies round developments within the Middle East for the reason that begin of the Israel-Hamas conflict, however have didn’t construct in a long-lasting geopolitical threat premium. West Texas Intermediate crude

CL00,

CL.1,

the U.S. benchmark, stays round $15 under its 2023 peak within the mid-$90s set in late September. Brent crude

BRN00,

the worldwide benchmark, pushed again above $80 a barrel final week.

Attacks by Iran-backed Houthi militants on Red Sea delivery have compelled a rerouting of tankers and cargo ships. For crude, that’s had implications for the bodily market however hasn’t interrupted the circulate of crude from the Middle East.

A transfer by Iran aimed toward closing off the Strait of Hormuz, the world’s greatest oil-transportation chokepoint, stays a high fear.

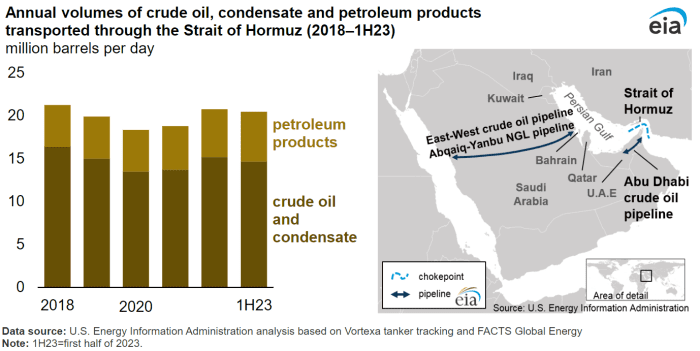

The strait is a slim waterway that hyperlinks the Persian Gulf with the Gulf of Oman and the Arabian Sea. At its narrowest level, the waterway is simply 21 miles huge, and the width of the delivery lane in both route is simply two miles, separated by a two-mile buffer zone.

Energy Information Administration

Around 21 million barrels a day of crude moved by way of the waterway within the first half of 2023, equal to round a fifth of day by day international consumption, in accordance with the U.S. Energy Information Administration.

The U.S. inventory market has largely seemed previous Middle East tensions, with the S&P 500

SPX

returning to report territory this month, whereas the Dow Jones Industrial Average

DJIA

has additionally set a collection of information.

Read: Stock-market rally faces Fed, tech earnings and jobs knowledge in make-or-break week

Away from oil, markets shall be watched for any knee-jerk rallies in belongings and devices that historically function havens in periods of elevated geopolitical pressure, together with U.S. Treasurys

BX:TMUBMUSD10Y,

the U.S. greenback

DXY

and gold

GC00,

—Associated Press contributed.

Source web site: www.marketwatch.com