Investors have been looking out for a weakening labor market for the reason that Federal Reserve embarked again in March 2022 on its most aggressive marketing campaign of rate of interest hikes for the reason that Nineteen Eighties.

Now, one distinguished economist is seeing indicators that mass layoffs have lastly begun, which might quickly be mirrored in key financial knowledge collection which might be carefully monitored by the market.

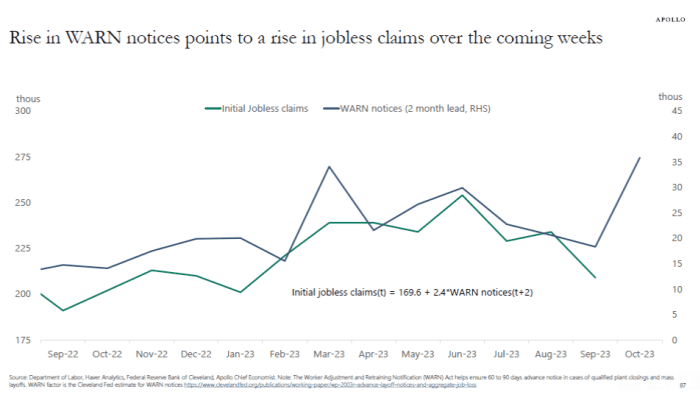

Data collected in accordance with the Worker Adjustment and Retraining Notification Act — higher generally known as the WARN Act — has proven a rise in corporations giving advance discover to workers about pending plant closures and layoffs, stated Torsten Slok, chief economist at Apollo Global Management, in emailed commentary.

Slok used a easy statistical mannequin to mission that rising layoffs will quickly manifest in weekly jobless claims knowledge, which tracks the variety of Americans making use of for unemployment advantages on a weekly foundation.

“Running a regression using WARN notices to predict unemployment shows that initial jobless claims in October will rise over the coming weeks to a level between 250K and 300K,” Slok stated.

APOLLO

Such a rise can be tough for Wall Street to disregard. According to the newest accessible knowledge, the variety of Americans who utilized for unemployment advantages through the week earlier than final rose barely to 207,000, however in any other case remained close to pandemic-era lows.

That got here on the heels of month-to-month knowledge from the Labor Department exhibiting the U.S. economic system added 336,000 new jobs in September, far surpassing the forecast of 170,000. While the tempo of wage progress, seen as a key enter into inflation, slowed, jobs knowledge from prior months have been revised increased, breaking a streak of downward revisions.

The knowledge have been interpreted by some economists as supporting the notion that the Fed will reach guiding the U.S. economic system towards a “soft landing,” one the place they handle to tame inflation with out considerably disrupting the labor market and economic system.

Any signal that layoffs are starting to mount might materially affect buyers’ expectations about the place the U.S. economic system is headed, which in flip might affect markets, notably the markets for Treasurys and shares.

The S&P 500

SPX

has rallied almost 14% in 2023, however the large-cap benchmark has set again since its late July excessive as Treasury yields moved shortly increased. The Dow Jones Industrial Average

DJIA

is up 2.5% within the 12 months so far.

Historical knowledge reveals that layoffs are likely to snowball as soon as they get going. Claudia Sahm, an influential former Fed economist, used this sample as the idea for what’s generally known as the Sahm Rule.

The rule is comparatively simple: it’s triggered when unemployment jumps 50 foundation factors from its 12-month low, and was meant to be an early indicator for coverage makers to assist them act extra swiftly and aggressively to assist the economic system and staff.

Many giant employers are required by the WARN Act, which dates again to the late Nineteen Eighties, to offer 60 to 90 days of discover of impending mass layoffs to staff and state governments. The knowledge cited by Slok was based mostly on an estimate from the Federal Reserve Bank of Cleveland.

Source web site: www.marketwatch.com