Moderna Inc.’s inventory soared 10% Tuesday to guide S&P 500 index gainers, after Oppenheimer upgraded the inventory to the equal of purchase and stated it expects the biotech to have 5 merchandise permitted by 2026.

Analysts led by Hartaj Singh upgraded the inventory

MRNA,

to outperform from carry out and stated it expects it to carry out higher this 12 months than the dismal exhibiting recorded in 2023.

The firm presently has only one permitted product, its mRNA-based COVID-19 vaccine, which has already handed peak gross sales. But it has a number of promising merchandise in its pipeline, together with vaccines for flu and RSV, or respiratory syncytial virus, which Oppenheimer is anticipating will win regulatory approval within the medium time period.

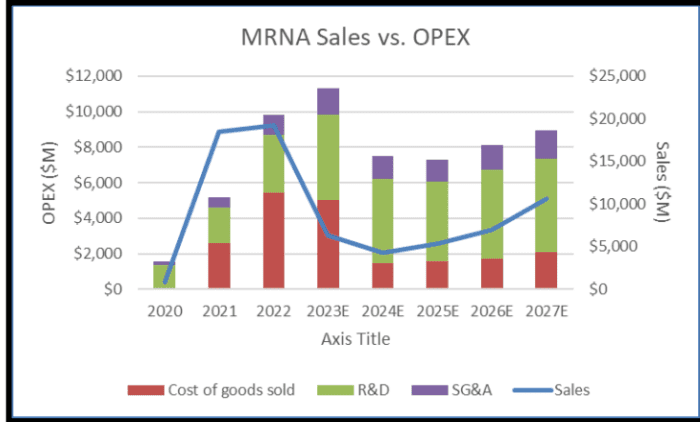

“We see top-line sales starting to grow in 2025E, with multiple product launches next 12-18 months (RSV, Influenza). We also expect material clinical and regulatory catalysts (INT, CMV) in this time frame, making us bullish on the name again,” the analysts wrote in a observe to purchasers.

CMV, or cytomegalovirus, is a member of the herpes household. Moderna can be creating a most cancers vaccine that may initially goal melanoma sufferers.

See additionally: Moderna’s inventory boosted by constructive information from trial of melanoma therapy mixed with Merck’s Keytruda

Oppenheimer downgraded Moderna in August due to considerations about pipeline progress, however stated the corporate has since addressed them, the analysts wrote. And whereas the inventory is down 40% over the past 12 months due to COVID vaccine gross sales compression, the analyst group is anticipating these gross sales to succeed in a low in 2024 earlier than ticking up once more in 2025, amid elevated training and spending on consciousness of the necessity for boosters.

Moderna’s working bills are prone to decline considerably in 2024 and 2025, earlier than choosing up once more after that, the analysts wrote. The firm will stay loss-making via 2026, they estimate, whereas the Bloomberg consensus is for losses to stretch into 2027.

“We should note that MRNA has indicated that if sales progression flattens or stalls, the company will adjust OPEX accordingly,” stated the observe.

Moderna gross sales versus working prices

Oppenheimer & Co., Bloomberg.

The analysts assigned the inventory a $142 12- to 18-month worth goal, equal to upside of greater than 30% over its present worth.

See now: Moderna reorganizes to sharpen concentrate on vaccine gross sales, chief industrial officer to go away firm

Moderna’s positive aspects despatched shares of different vaccine and drug makers greater. Bristol-Myers Squibb Co.

BMY,

was up 4%, Pfizer Inc.

PFE,

was up 3.9% and Merck & Co.

MRK,

was up 2.9%.

Source web site: www.marketwatch.com