Moody’s Investors Service on Tuesday lower the outlook on China’s debt to unfavorable from secure citing expectations that the nationwide authorities must step in to rescue regional and native governments.

Moody’s stored China’s long-term ranking at A1.

“The change to a negative outlook reflects rising evidence that financial support will be provided by the government and wider public sector to financially-stressed regional and local governments and state-owned enterprises, posing broad downside risks to China’s fiscal, economic and institutional strength,” mentioned the word.

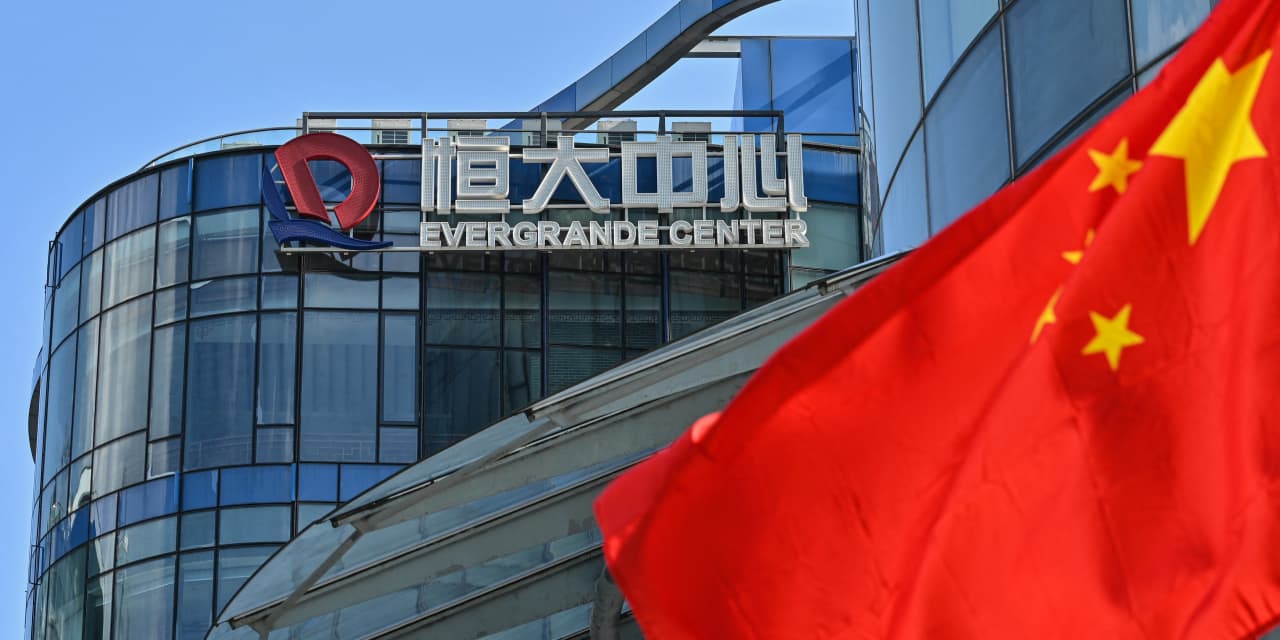

China’s property troubles imply that regional and native governments face a lack of land sale income, which accounted for 37% of their income in 2022 outdoors of central authorities transfers. Moody’s says areas that relied most closely on land gross sales gained’t be capable of offset that income loss from different sources.

Moody’s estimates one-third of state-owned enterprises debt — some 40% of GDP — has an curiosity protection beneath 1, which signifies weak debt sustainability. “While not all [state-owned enterprises] are likely to need direct government support, even a moderate proportion doing so over the medium term would represent a significant crystallization of contingent liabilities for the sovereign, increasing the costs of financial support and diminishing fiscal strength,” mentioned Moody’s.

In a tough day for Chinese shares, the Hang Seng

HK:HSI

fell 1.9%, and the Shanghai Composite

CN:SHCOMP

dropped 1.7%.

Source web site: www.marketwatch.com