A pointy rise in rents over the previous few years has left tens of millions of tenants spending an excessive amount of of their incomes on housing prices, pushing the share of so-called rent-burdened households to an all-time excessive, based on a brand new report.

In an annual report by the Joint Center for Housing Studies of Harvard University launched Thursday, researchers discovered that in 2022 the variety of renters in America who have been spending greater than 30% of their incomes on hire and utilities hit a document excessive of twenty-two.4 million.

Housing is usually thought of inexpensive if it prices not more than 30% of 1’s gross revenue. People who spend greater than which might be often known as “rent burdened” or “cost burdened.” Half of U.S. renters in 2022 have been spending greater than 30% of their incomes on hire and utilities, based on the Harvard joint heart, up 3.2 proportion factors from earlier than the pandemic in 2019.

Among these renters, an all-time excessive of 12.1 million have been severely “cost burdened,” the group mentioned, spending greater than half of their incomes on housing.

Even higher-income households have been experiencing elevated pressure: Those households noticed their burdened fee enhance by 2.2 proportion factors. Households with incomes of $75,000 or extra are thought of higher-income for Harvard’s calculations.

To be clear, hire will increase, after rising almost 20% between 2021 and 2022, have slowed considerably since 2022 as extra flats and homes are being constructed.

See: Renters and residential consumers are getting some shelter from inflation

Also: It’s been years since customers felt this good about the place inflation might go subsequent, N.Y. Fed says

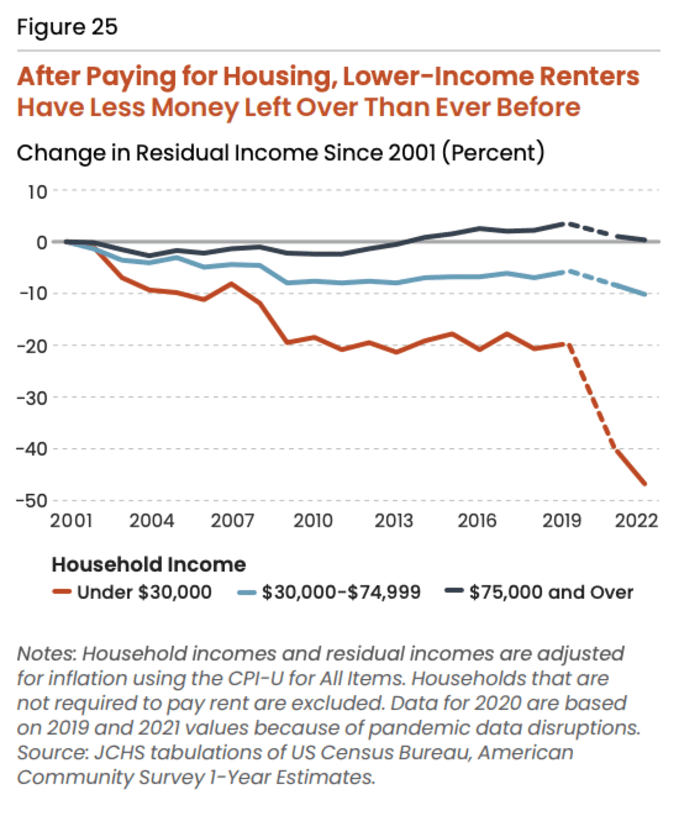

But wages haven’t stored tempo with rising rental prices, based on the Harvard heart. “Though median rents have risen 21 percent in inflation-adjusted terms since 2001, median annual income has risen just 2 percent during the same period,” the researchers famous.

Lower-income renters making lower than $30,000 a yr noticed their cost-burdened fee rise by 1.5 proportion factors to 83%. About a 3rd of renters had family incomes under $30,000 in 2022, they usually had median money financial savings of simply $300 and median web wealth of $3,200, based on the Harvard report.

After paying hire, cost-burdened lower-income households have median residual revenue of simply $170, the researchers discovered.

“Rent is the largest expense for most households and often takes priority because the consequences of not paying rent could include eviction and homelessness,” the Harvard researchers mentioned.

Evictions are additionally on the rise, the middle mentioned, with homelessness rising to the best degree on document.

An all-time excessive of 653,100 folks have been homeless as of January 2023, based on the report. That’s up by almost 71,000 folks in a single yr’s time. In 2023 the full variety of folks experiencing homelessness in unsheltered areas reached an all-time excessive of 256,610, the report famous.

Since pandemic-era insurance policies such because the eviction moratorium and hire reduction ended, “the housing safety net is once again overwhelmed and underfunded,” Chris Herbert, managing director of the Joint Center for Housing Studies, mentioned in a press release.

“And while states and localities have acted to fill some of the gaps, a larger commitment from the federal government is required to expand housing supports and preserve and improve the existing affordable stock,” Herbert mentioned. “Only then will the nation finally make a meaningful dent in the housing-affordability crisis making life so difficult for millions of people.”

Source web site: www.marketwatch.com