Over the many years, maybe you’ve been excellent at saving your cash and investing it for long-term development. But when the time comes so that you can cease working or to step again to a part-time job, you would possibly must shift your focus. It’s time to consider earnings.

When you had been many years away from retirement, you could have leaned towards a portfolio that was primarily invested within the inventory market. This was a very good technique: According to FactSet, the benchmark S&P 500

SPX

has had a median annual return of 9.88% over the previous 30 years, with dividends reinvested. Nearly 80% of shares within the S&P 500 pay dividends, and reinvestment is a core factor of the compounding that has made shares such a dependable car for long-term development.

Investing within the S&P 500 is straightforward, too, by buying shares of the SPDR S&P 500 ETF Trust

SPY

or different index funds that observe the benchmark. There are many related funds, and loads of them have very low bills.

Of course, a long-term development investor whose portfolio is especially invested within the inventory market wants to withstand the temptation to promote into declining markets. Attempts to time the market are likely to result in underperformance when put next with the S&P 500, as a result of buyers who transfer to the sidelines are likely to return too late after a broad decline has been reversed.

And brutal declines within the inventory market are typical. It’s not unusual for the market to fall by 20% or much more. But by all of it, that 30-year common return has remained near 9.9% — and for those who look even additional again, that common return has been practically the identical.

Your life has modified, and also you want earnings

Now think about that you just’re 60 years previous and it’s essential to cease working, or maybe you simply need to work half time. After many years of saving and investing for development, how do you put together for this transformation?

It’s vital to take a person strategy to your earnings wants, says Lewis Altfest, CEO of Altfest Personal Wealth Management, which oversees about $1.6 billion in property for personal shoppers in New York.

Think about what sort of accounts you might have. If your cash is in a 401(ok), IRA or one other tax-deferred account, all the things you withdraw can be topic to earnings taxes. If you might have a Roth account, for which contributions had been made after tax, withdrawals from that account gained’t be taxed. (You can examine conversions to Roth accounts right here.)

If you might have a tax-deferred retirement account that’s sufficiently massive and also you need to proceed pursuing long-term development with shares (or funds that maintain shares), you would possibly think about what’s referred to as the 4% rule, which signifies that you’ll withdraw not more than 4% of your steadiness a 12 months — so long as that is sufficient to cowl your earnings wants. You would possibly start by merely organising an automated withdrawal plan to offer this earnings. Of course, to restrict your tax invoice, it is best to withdraw solely as a lot as you want.

The 4% rule

That 4% rule is a helpful place to begin for conversations with shoppers who want to start drawing earnings from their funding portfolios, says Ashley Madden, the director of economic planning companies at Hutchinson Family Offices in Greensboro, N.C., but it surely shouldn’t be a hard-and-fast rule. “Like most financial-planning concepts, I don’t think the 4% safe-withdrawal rate is ‘one size fits all’ for all planning situations,” she says.

Rather, it is best to take into consideration how a lot you’ll must withdraw to cowl your bills, together with well being care, whereas nonetheless permitting your funding account to develop, Madden says. Consider all of your earnings sources, your anticipated bills, the forms of investments in your portfolio and even your property planning.

Madden has labored with shoppers who’ve taken rather more than 4% from their funding accounts throughout their early retirement years, which she says issues her as an adviser. She says that is when a dialogue of the 4% withdrawal idea can assist “illustrate how they are taking money out at a more rapid rate than the investments can grow.”

The concept of a 4% withdrawal fee may also assist throughout discussions with retirees who’re reluctant to withdraw any earnings in any respect from their funding accounts, Madden says.

In both situation, occupied with withdrawals as a proportion, fairly than a greenback quantity, can assist “to empower decision-making by removing some emotion from the process,” she says.

Generating earnings

When it involves producing earnings, listed here are a couple of approaches to think about:

- Investing in bonds, which make common curiosity funds till they mature. You may also pursue bond earnings by funds, which have diversified portfolios that may decrease your threat.

- Taking dividend earnings from shares you maintain, fairly than reinvesting these dividends.

- Purchasing some particular person shares with enticing dividend yields to obtain earnings whereas additionally aiming for some development because the share costs rise over the long run.

- Selecting a couple of mutual funds or exchange-traded funds that maintain shares for dividend earnings. Some of those funds may be designed to enhance earnings whereas reducing threat with covered-call methods, as described under.

As you concentrate on planning for retirement and about making modifications to your funding technique as your targets evolve, think about assembly with a monetary planner in addition to an funding adviser.

Bonds and the 60/40 allocation

You could have learn articles discussing what’s referred to as the 60/40 portfolio, which is one made up of 60% shares and 40% bonds. MarketWatch contributor Mark Hulbert has defined the long-term viability of this strategy.

The 60/40 portfolio is “a good starting point for discussions with clients” about earnings portfolios, says Ken Roberts, an funding adviser with Four Star Wealth Management in Reno, Nev.

“It is an approximation,” he notes. “If one asset class is growing, we might let it go. If there is an opportunity in another class, we might take advantage of it at the right time.”

In a January report titled “Caution: Heavy Fog,” Sharmin Mossavar-Rhamani and Brett Nelson of the Goldman Sachs Investment Strategy Group wrote that the 60/40 portfolio is “used generically by the financial industry to mean a portfolio of stocks and bonds; it does not imply that a 60/40 mix is the right allocation for each client.”

Both Roberts and Altfest level to alternatives within the bond market proper now, in gentle of the will increase in rates of interest which have pushed bond costs down over the previous 12 months. Altfest means that on this market, a portfolio of two-thirds bonds and one-third shares could be acceptable for an income-oriented portfolio, as a result of bond costs have declined as rates of interest have soared over the previous 12 months.

Altfest notes that for many buyers, taxable bonds characteristic extra enticing yields than municipal bonds.

If you purchase a bond, your yield is the bond’s annual curiosity funds (the coupon, or said rate of interest, divided by the face worth) divided by the worth you pay. And for those who purchase at a reduction to the bond’s face worth and maintain the bond till maturity, you’ll notice a capital achieve. If rates of interest rise after you purchase a bond, you might be sitting on an unrealized achieve, and vice versa.

“Bonds give you a yield now, and if we go into a recession, you become a winner as opposed to a loser with stocks,” Altfest says. In different phrases, throughout a recession, the Federal Reserve would possible decrease rates of interest to spur financial development. That would push bond costs larger, supplying you with the potential for “double-digit annual returns,” in response to Alftest.

We can not predict which method rates of interest will go, however we all know that the Fed’s coverage of lifting rates of interest to push down inflation can not go on perpetually. And whenever you issue within the present worth reductions, comparatively excessive yields and eventual maturity at face worth, bonds are compelling proper now.

It will be tough to construct a diversified bond portfolio by yourself, however bond funds can do the be just right for you. A bond fund has a fluctuating share worth, which signifies that when rates of interest rise, there may be downward stress on the share worth. But in the mean time, a lot of the bond-fund portfolios are made up of securities buying and selling at reductions to their face values. This offers draw back safety together with the potential for beneficial properties when rates of interest ultimately start to say no.

Altfest recommends two bond funds that primarily maintain mortgage-backed securities.

The Angel Oak Multi-Strategy Income Fund

ANGIX

has $2.9 billion in property below administration and quotes a 30-day yield of 6.06% for its institutional shares. It is especially invested in privately issued mortgage-backed securities.

The $33.8 billion DoubleLine Total Return Bond Fund

DBLTX

has a 30-day yield of 5.03% for its Class I shares and is a extra conservative alternative, with over 50% invested in mortgage-backed securities and authorities bonds.

For conventional mutual funds with a number of share lessons, institutional or Class I shares, which may be referred to as adviser shares, usually have the bottom bills and highest dividend yields. And regardless of the names of the share lessons, they’re accessible to most buyers by advisers, and infrequently by brokers for shoppers who don’t have an adviser.

For buyers who aren’t certain what to do instantly, Roberts factors to short-term U.S. Treasury funds as a very good various. Two-year U.S. Treasury notes

BX:TMUBMUSD02Y

now have a yield of 4.71%. “You might ride out the next couple of years and look for opportunities in the market,” he says. “But averaging in [to longer-term bonds] as the Fed gets closer to its terminal rate, before it pauses and then begins to cut, can work out quite well.”

Then there are municipal bonds. Should you think about this selection for tax-exempt earnings within the present setting?

Altfest says the unfold between taxable and tax-exempt yields has widened a lot over the previous a number of months that almost all buyers could be higher off with taxable bonds. To again that notion, think about the Bloomberg Municipal Bond 5-year index, which has a “yield to worst” of two.96%, in response to FactSet. Yield to worst refers back to the annualized yield, factoring in a bond’s present market worth, if the bond is held to its maturity date or name date. A bond could have a name date that’s sooner than the maturity date. On or after the decision date, the issuer can redeem the bond at face worth at any time.

You can calculate a taxable equal fee by dividing that 2.96% yield by 1, much less your highest graduated earnings tax fee (leaving state and native earnings taxes apart for this instance). Click right here for the Internal Revenue Service’s record of graduated tax charges for 2023.

If we incorporate the graduated federal earnings tax fee of 24% for a married couple who earned between $190,750 and $364,200 in 2023, our taxable equal for this instance is 2.96% divided by 0.76, which involves a taxable equal of three.89%. You can earn greater than that with U.S. Treasury securities of varied maturities — and that curiosity is exempt from state and native earnings taxes.

If you’re in one of many highest federal brackets and in a state with a excessive earnings tax, you would possibly discover attractive-enough tax-exempt yields for bonds issued by your state or municipal authorities inside it.

An various to bonds for earnings: Dividend yields on most well-liked shares have soared. This is how you can choose the perfect ones to your portfolio.

Stocks for earnings

There are numerous approaches to incomes earnings from shares, together with exchange-traded funds and particular person shares that pay dividends.

Remember, although, that inventory dividends will be reduce at any time. One pink flag for buyers is a really excessive dividend yield. Investors within the inventory market would possibly push an organization’s shares decrease in the event that they understand issues — typically years earlier than an organization’s administration staff decides to decrease its dividend (and even remove the payout).

But dividends (and your earnings) may also develop over time, so think about shares of sturdy corporations that hold elevating payouts, even when present yields are low. Here are 14 shares that doubled in worth in 5 years, whilst their dividends doubled.

Rather than searching for the very best dividend yields, you would possibly think about a quality-focused strategy. For instance, the Amplify CWP Enhanced Dividend Income ETF

DIVO

holds a portfolio of about 25 shares of corporations which have elevated dividends persistently and are deemed more likely to proceed to take action.

This fund additionally makes use of covered-call choices to reinforce earnings and shield from draw back threat. Covered-call choice earnings varies and is larger throughout occasions of heightened volatility within the inventory market, as we’ve seen over the previous 12 months. According to FactSet, this fund’s 12-month distribution yield has been 4.77%.

You can learn extra about how the covered-call technique works, together with an precise commerce instance from Roberts, on this article concerning the JPMorgan Equity Premium Income ETF

JEPI,

which holds about 150 shares chosen for high quality (regardless of dividends) by JPMorgan analysts. According to FactSet, this ETF’s 12-month distribution yield has been 11.35%. In a much less unstable market, buyers can anticipate distribution yields within the “high single digits,” in response to Hamilton Reiner, who co-manages the fund.

Both of those ETFs pay month-to-month dividends, which will be a bonus, as most corporations that pay dividends on shares accomplish that quarterly, as do most conventional mutual funds.

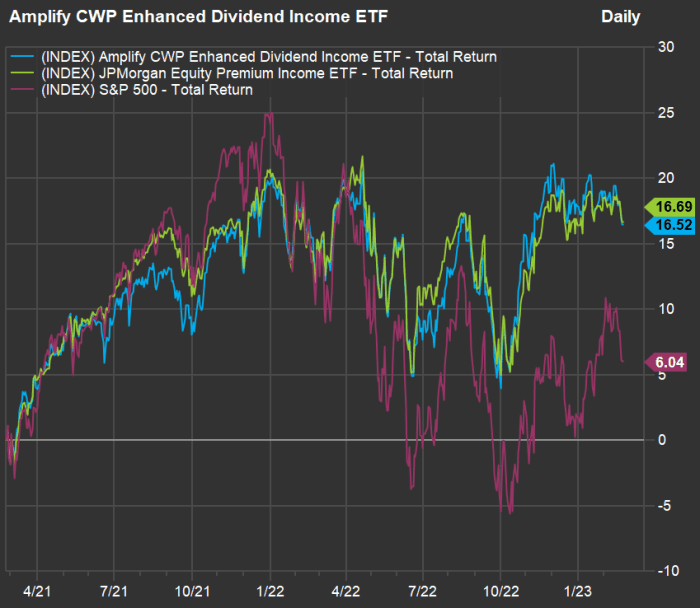

Each strategy has benefits and downsides, and JEPI is lower than three years previous. Keep in thoughts that funds that observe covered-call methods must be anticipated to outperform the broad index throughout occasions of upper volatility and to underperform, at the least barely, throughout bull markets, when dividends are included.

Here’s a two-year efficiency comparability of complete returns, with dividends reinvested, for the 2 ETFs and the S&P 500.

FactSet

For the investor who desires to shift a portfolio that’s primarily invested in shares to an earnings portfolio, Altfest leans closely towards bonds on this market however says he would nonetheless desire a shopper to be about one-third invested in shares. He would advise a shopper already holding some particular person shares to promote the extra growth-oriented corporations and maintain onto those with respectable dividend yields, whereas additionally contemplating how a lot in earnings could be taken when promoting shares that had risen significantly.

“You are more likely to keep those, because you will be saving some money in taxes for the year, than if you sell where you have built a significant nest egg with capital gains,” he says.

And a few of these shares would possibly already be offering important earnings relative to the common worth the investor has paid for shares over time.

After making changes, you would possibly nonetheless need to buy some shares for dividends. In that case, Altfest recommends going for corporations whose dividend yields aren’t very excessive, however whose companies are anticipated to be sturdy sufficient for dividends to extend over time.

To start, he recommends a display screen to slender down potential inventory picks. Here’s what occurs if we apply Altfest’s screening parameters to the S&P 500:

- Beta for the previous 12 months of 1 or much less, when put next with the worth motion of your entire index: 301 corporations. (Beta is a measurement of worth volatility, with a 1 matching the volatility of the index.)

- Dividend yield of at the least 3.5%: 69 corporations.

- Expected earnings per share for 2025 growing at the least 4% from 2024, based mostly on consensus estimates of analysts polled by FactSet. Altfest advised going out this far to keep away from the distortion of current-year estimates and precise outcomes from one-time accounting gadgets. This introduced the record right down to 46 corporations.

- Expected gross sales for 2025 growing at the least 4% from 2024, based mostly on consensus estimates of analysts polled by FactSet. The estimates for earnings and gross sales had been based mostly on calendar years, not corporations’ fiscal years, which frequently don’t match the calendar. This final filter narrowed the record to 16 shares. Alfest then culled the record additional, as defined under.

Here are the 16 shares that handed the display screen, by dividend yield:

| Company | Ticker | Industry | 12-month beta | Dividend yield | Expected 2025 EPS enhance | Expected 2025 gross sales enhance |

| Williams Cos. | WMB | Integrated Oil | 0.63 | 5.79% | 7.8% | 10.8% |

| Walgreens Boots Alliance Inc. | WBA | Drugstore Chains | 0.83 | 5.32% | 11.5% | 4.4% |

| Philip Morris International Inc. | PM | Tobacco | 0.48 | 5.10% | 10.6% | 7.3% |

| Iron Mountain Inc. | IRM | Real-Estate Investment Trusts | 0.93 | 4.89% | 9.6% | 9.0% |

| Hasbro Inc. | HAS | Recreational Products | 0.93 | 4.86% | 21.8% | 8.9% |

| Kimco Realty Corp. | KIM | Real-Estate Investment Trusts | 1.00 | 4.51% | 6.0% | 10.6% |

| Truist Financial Corp. | TFC | Regional Banks | 0.97 | 4.42% | 10.7% | 5.0% |

| Extra Space Storage Inc. | EXR | Real-Estate Investment Trusts | 0.92 | 4.20% | 7.0% | 8.4% |

| Huntington Bancshares Inc. | HBAN | Major Banks | 0.96 | 4.15% | 9.4% | 5.9% |

| U.S. Bancorp | USB | Major Banks | 0.79 | 4.04% | 10.0% | 5.4% |

| Entergy Corp. | ETR | Electric Utilities | 0.53 | 3.98% | 7.4% | 4.6% |

| AbbVie Inc. | ABBV | Pharmaceuticals | 0.35 | 3.93% | 8.8% | 5.0% |

| Public Service Enterprise Group Inc | PEG | Electric Utilities | 0.59 | 3.75% | 10.2% | 6.2% |

| Avalonbay Communities Inc. | AVB | Real-Estate Investment Trusts | 0.75 | 3.74% | 16.8% | 4.8% |

| United Parcel Service Inc. Class B | UPS | Air Freight/ Couriers | 0.90 | 3.67% | 12.3% | 6.4% |

| NiSource Inc. | NI | Gas Distributors | 0.58 | 3.62% | 7.6% | 4.9% |

| Source: FactSet | ||||||

Click on the ticker for extra about every firm or exchange-traded fund.

Click right here for Tomi Kilgore’s detailed information to the wealth of data accessible free of charge on the MarketWatch quote web page.

Remember that any inventory display screen has its limitations. If a inventory passes a display screen you approve of, then a special type of qualitative evaluation is so as. How do you’re feeling about an organization’s enterprise technique and its chance of remaining aggressive over the following decade, at the least?

When discussing the outcomes of this inventory display screen, for instance, Altfest says he would remove AbbVie from the record due to the menace to earnings and the dividend from elevated competitors because the patent expires on its Humira anti-inflammatory remedy.

He would additionally take away Philip Morris, he says, as a result of “the movement toward health overseas could bring earnings and dividends down.”

Source web site: www.marketwatch.com