Nikola Inc. shares closed at an all-time low Thursday, and the maker of electrical and fuel-cell automobiles expects to promote inventory at a 20% low cost to that worth.

Nikola introduced Thursday afternoon that it supposed to promote $100 million in shares to the general public and one other $100 million to an unnamed investor in a direct providing. Later Thursday, nonetheless, the corporate stated that it could as an alternative elevate $100 million whole, splitting the shares between the general public and the unnamed investor, and charging $1.12 per share.

Nikola’s inventory

NKLA,

closed Thursday at an all-time low of $1.40, and moved to $1.30 a share in after-hours buying and selling, following the announcement of the preliminary model of the deal. Nikola introduced the worth of the deal and the modified phrases after the prolonged session ended.

Nikola reported that it expects to promote about 29.9 million shares to the general public on the providing worth, and about 59.4 million shares within the non-public providing, totaling roughly $100 million. The firm may supply about 4.5 million extra shares by its underwriter, Citigroup Inc.

C,

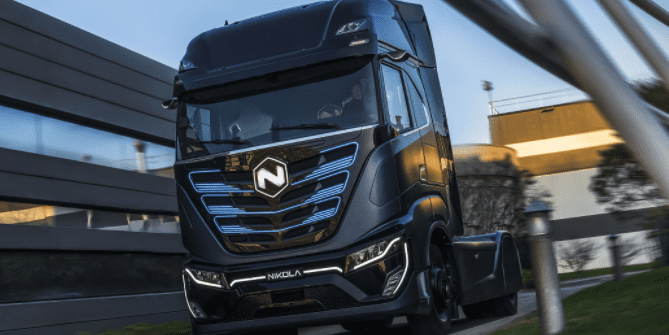

Nikola started producing an electrical freight automobile in 2022, producing 133 of the automobiles within the fourth quarter, when its income disenchanted traders. The firm intends to ship one other 250 to 350 of these vans in 2023, govt projected in February, and start producing its hydrogen fuel-powered model within the fourth quarter, when executives intend to ship 125 to 150 of these vans.

The firm reported a internet lack of $784 million for the yr, and money and short-term investments of about $244 million when 2022 ended. Analysts on common count on the corporate to report a internet lack of about $155 million for the primary quarter, which ends this week.

Nikola’s founder, Trevor Milton, was convicted of securities fraud final yr for guarantees he made in regards to the firm’s work on hydrogen-fueled heavy vans. Milton’s alternative as CEO lasted about three years earlier than leaving the corporate in the beginning 0f 2023. Nikola’s chief monetary officer introduced her departure earlier this week, and was changed by the corporate’s controller.

Shares have plunged 87.4% up to now 12 months and 35.2% up to now this yr, because the S&P 500 index

SPX,

has declined 12.5% and gained 4.9% in these intervals respectively.

Source web site: www.marketwatch.com