Is the bear market of 2022 over? Are we already within the early innings of the subsequent nice bull market?

The S&P 500

SPX,

completed 2022 with a 19% decline (its largest pullback since 2008). Meanwhile, the Dow Jones Industrial Average

DJIA,

misplaced 8.8% and the Nasdaq

COMP,

tumbled 33%.

It’s been a distinct story in 2023, with most U.S. shares powering forward. This sort of value motion has pundits, specialists, and CEOs doubting the potential of any sort of extreme recession and that the Federal Reserve will pull off a “soft landing” after its collection of rate of interest hikes. A delicate touchdown is a “cyclical slowdown in economic growth that avoids recession.”

Support for this concept comes from the truth that the Fed has raised rates of interest considerably since March 2022, reducing inflation to about 6% from round 10%. The labor market has remained sturdy all through, with the unemployment fee at 3.4%. Because inflation is on the decline, Wall Street is anticipating (hoping?) that charges will start to say no prior to later.

So is the upswing for the Nasdaq and lots of speculative shares really a mirrored image of an bettering economic system? I’m reminded of this passage from the basic guide on investing, “One Up on Wall Street” by Peter Lynch: “In centuries past, people hearing the rooster crow as the sun came up decided that the crowing caused the sunrise. It sounds silly now, but every day the experts confuse cause and effect on Wall Street.”

On Wall Street, the roosters are inventory costs. It appears that the specialists now are complicated inventory positive aspects with the underlying economic system’s well being.

Fundamentals nonetheless matter. The crowing of the rooster (costs going up) doesn’t imply that the basics have improved.

For instance, Carvana’s

CVNA,

enterprise mannequin isn’t working. Unless Carvana raises money via a secondary providing or personal bailout, the inventory value is probably going on the trail to zero. The exhausting half with shorting Carvana is that nearly everyone is aware of Carvana is in bother. It doesn’t take very a lot brief protecting to make the inventory go up considerably in a short time. Obviously then, we will ignore the short-squeeze motion in Carvana when assessing the well being of the U.S. economic system and company earnings.

Yet the image doesn’t get a lot better trying on the earnings and development from many Nasdaq-traded names. For occasion, Alphabet

GOOGL,

is one in all my favorites, however its income in 2022 was up just10% vs. 41% a 12 months earlier. Even worse, the corporate’s fourth-quarter 2022 YouTube income was down virtually 8% from the year-ago quarter. Overall, Alphabet’s EPS fell to $4.56 in 2022 from $5.61 in 2021.

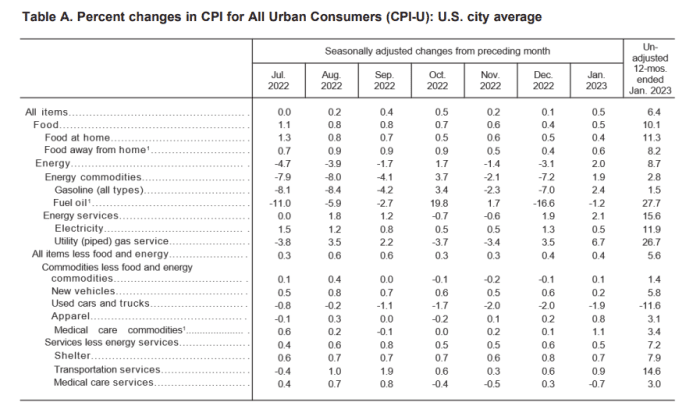

Looking on the fundamentals of the economic system itself, it isn’t clear that inflation is definitely slowing as a lot because the market might need you imagine. Here is the breakdown from the newest CPI report:

Excluding used vehicles and vans, each different class is up, with many rising in double-digits. Looking at this makes us assume we’re nonetheless removed from the Fed’s goal fee of two%. The concept that the Fed will cease elevating charges and/or begin reducing anytime quickly appears unlikely to us.

Reckoning with the Fed

We’re not ones to try to sport the Fed, however we don’t see a delicate touchdown. Raising the fed funds fee from basically 0% to five% in lower than a 12 months is critical, and we expect it’s unlikely that we’re seeing the complete influence of that change simply but. It is vital to do not forget that we’re in Year 1 after virtually 14 years of constant 0% rates of interest and quantitative easing.

Many corporations comparable to Carvana have enterprise fashions that have been constructed on and relied on 0% rates of interest and straightforward cash insurance policies. It will take time for the trillions of {dollars} of liquidity that the Fed pumped into the market over the previous 14 years to return out of the market. We are seemingly within the early phases of a recession and wouldn’t depend on continued resilience within the labor market and client spending as indicators {that a} recession received’t occur.

No one can time the subsequent recession, and though we count on one is coming, that doesn’t imply you shouldn’t personal shares or purchase extra of your favorites on weak spot. Every crash often results in an incredible shopping for alternative. But we don’t wish to chase this market both.

Cody Willard is founding father of 10,000 Days Fund Capital Management and runs the ten,000 Days Fund, a hedge fund. Bryce Smith is an analyst at 10,000 Days Fund Capital Management. At the time of publication, Willard, Smith and the hedge fund have been lengthy GOOGL and had put positions on CVNA. Positions can change at any time and with out discover.

More: ‘Not a time to buy’: S&P 500 exiting ‘best era’ in many years for earnings development amid ‘dried up’ liquidity

Plus: The inventory market is simply taking a breather after January’s monster rally. These shares and ETFs can energy the subsequent leg up.

Source web site: www.marketwatch.com