Nvidia Corp.’s newest earnings report was one for the historical past books in some ways as the corporate delivered report earnings and income — and spurred the most important one-day haul of market capitalization for any U.S. firm.

See extra: Nvidia makes Wall Street historical past as inventory surge provides $277 billion in market cap

But it’s not simply Nvidia

NVDA,

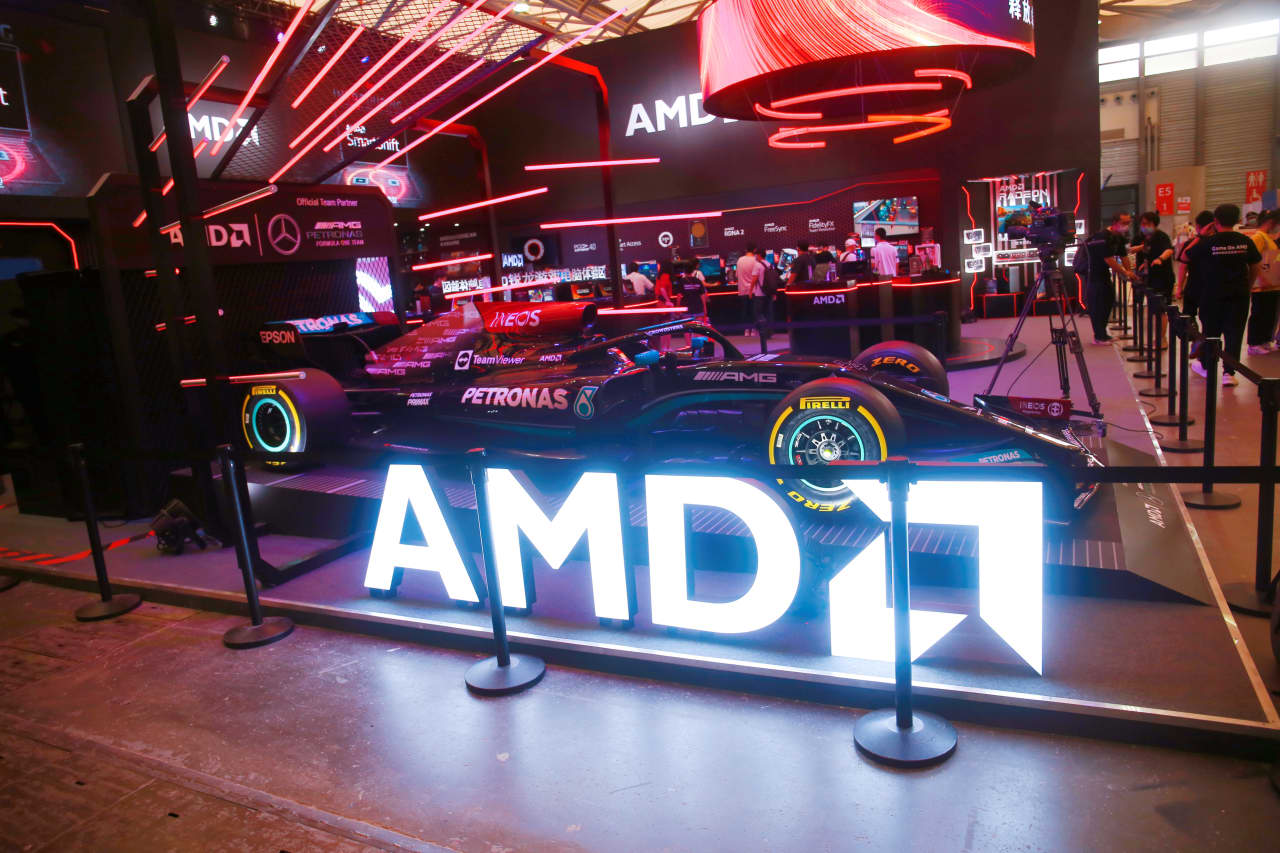

setting data within the wake of its outcomes. Shares of rival Advanced Micro Devices Inc.

AMD,

closed at a brand new all-time excessive, up 11.7% to $181.86. The inventory additionally noticed its largest single-day share achieve since May 25, 2023, when it rose 11.2%.

Mizuho desk-based analyst Jordan Klein stated he preferred AMD’s setup and suggested that buyers watch that inventory, together with shares of Marvell Technology Inc.

MRVL,

Taiwan Semiconductor Manufacturing Co.

TSM,

and Broadcom Inc.

AVGO,

as fund managers doubtlessly make changes.

Don’t miss: After Nvidia’s newest blowout, listed below are 20 AI shares anticipated to rise as a lot as 44%

In his view, “AI euphoria and FOMO [fear of missing out] is too early stage and too painful for many to not chase,” Klein wrote. “This is the type of market we are in right now. Not suggesting it is healthy and it will not last forever, but not owning enough AI [semiconductor] winners would be painful for many relative (and even absolute) managers in coming months.”

Admittedly, he acknowledged that AMD shares include a little bit of threat as Nvidia prepares to make product updates subsequent month at its GTC convention.

That occasion “could pressure AMD some as we approach and get through GTC,” he wrote, however he doesn’t assume Nvidia’s preview of its new B100 chip will “hamper” AMD’s MI300 traction this yr.

Nvidia’s outcomes and commentary lifted the broader chip sector to data as effectively. The iShares Semiconductor exchange-traded fund

SOXX

superior practically 5% and nabbed a brand new report shut, whereas the VanEck Semiconductor ETF

SMH

rose nearly 7% to rack up one as effectively.

Read: Super Micro’s explosive inventory rally eclipses Nvidia’s, as AI mania trumps convertible bond deal

Source web site: www.marketwatch.com