Investors have driving fairly a bounceback for shares throughout 2023, and the pattern for features that began late in October has been gaining steam. Below is a listing of the favourite shares for 2024 amongst analysts working for brokerage companies.

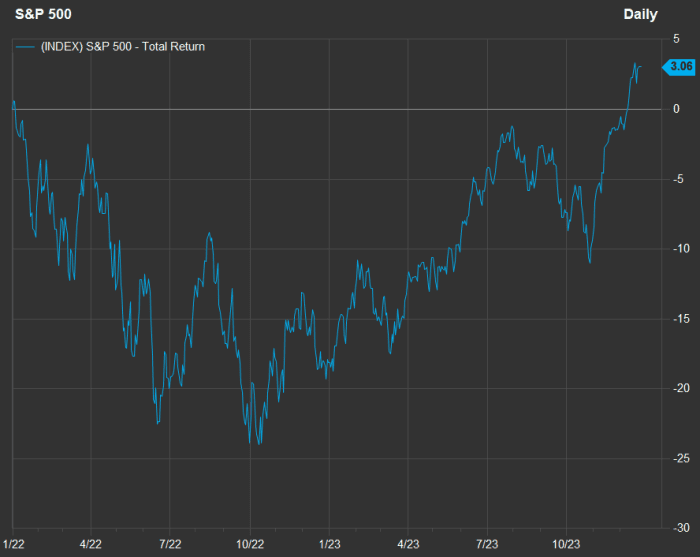

For perspective, check out the S&P 500’s return for the reason that finish of 2021:

The S&P 500 has returned almost 26% this 12 months, however it’s up solely 3.1% for the reason that finish of 2021.

FactSet

All returns on this article embody reinvested dividends. The chart incorporates the 25.9% improve for the S&P 500

SPX

this 12 months, which has adopted an 18.1% decline in 2022. So the index is up solely 3.1% for the reason that finish of 2021. The motion in 2022 tracked the Federal Reserve’s change in coverage to lift the federal-funds fee repeatedly and push long-term charges greater by shrinking its bond portfolio.

And now that buyers are satisfied the Fed is completed elevating charges, with the central financial institution’s projections even baking-in three cuts to the federal-funds fee in 2024, the S&P 500’s upward path has accelerated since late October.

Here is a abstract of how the 11 sectors of the S&P 500 have carried out, together with ahead price-to-earnings ratios. The full index is on the backside:

| Healthcare | 2023 return | 2022 return | Return since finish of 2021 | Forward P/E | Current P/E to 5-year common | Current P/E to 10-year common | Current P/E to 15-year common |

| Information Technology | 57% | -28% | 13% | 26.6 | 117% | 141% | 159% |

| Communication Services | 56% | -40% | -6% | 17.4 | 92% | 92% | 100% |

| Consumer Discretionary | 43% | -37% | -10% | 26.2 | 86% | 102% | 118% |

| Industrials | 17% | -5% | 11% | 19.9 | 96% | 107% | 117% |

| Materials | 13% | -12% | -1% | 19.4 | 113% | 118% | 126% |

| Real Estate | 11% | -26% | -18% | 18.0 | 91% | 95% | 96% |

| Financials | 11% | -11% | 0% | 14.5 | 98% | 102% | 109% |

| Health Care | 1% | -2% | -1% | 18.1 | 109% | 110% | 122% |

| Energy | 0% | 66% | 66% | 11.0 | 100% | 59% | 68% |

| Consumer Staples | -1% | -1% | -1% | 19.2 | 96% | 99% | 108% |

| Utilities | -8% | 2% | -7% | 15.7 | 86% | 90% | 99% |

| S&P 500 | 26% | -18% | 3% | 19.6 | 102% | 109% | 121% |

| Source: FactSet | |||||||

You will see dire warnings that shares are overvalued always, particularly at year-end. So the present ahead price-to-earnings ratios are in contrast with common ranges over the previous 5, 10 and 15 years. Forward P/E ratios within the desk are based mostly on rolling weighted consensus earnings-per-share estimates amongst analysts polled by FactSet.

Seven sectors are buying and selling at weighted mixture ahead P/E ratios which can be under their five-year averages, with utilities most cost-effective by this measure. That is probably not a shock, as utility shares are usually relied upon by buyers to pay dividends, and valuations for income-producing securities fell as rates of interest rose. If we exit to 10 years, 5 sectors commerce under common P/E, whereas solely three sectors commerce under their 15-year common P/E ranges.

Analysts’ favourite shares

Sell-side analysts (those that work for brokerage companies) sometimes set 12-month worth targets for shares. For this display we started with the S&P 500 and tossed the one firm with lower than 5 scores amongst analysts polled by FactSet (Lowes Corp.

L,

an insurer). Then we narrowed the checklist to 92 firms with no less than 75% “buy” or equal scores.

Among these 92 firms, listed here are the 20 with essentially the most upside potential for 2024 implied by consensus worth targets:

| Corteva Inc. | Ticker | Share “buy” scores | Dec. 22 worth | Consensus worth goal | Implied upside potential | Forward P/E |

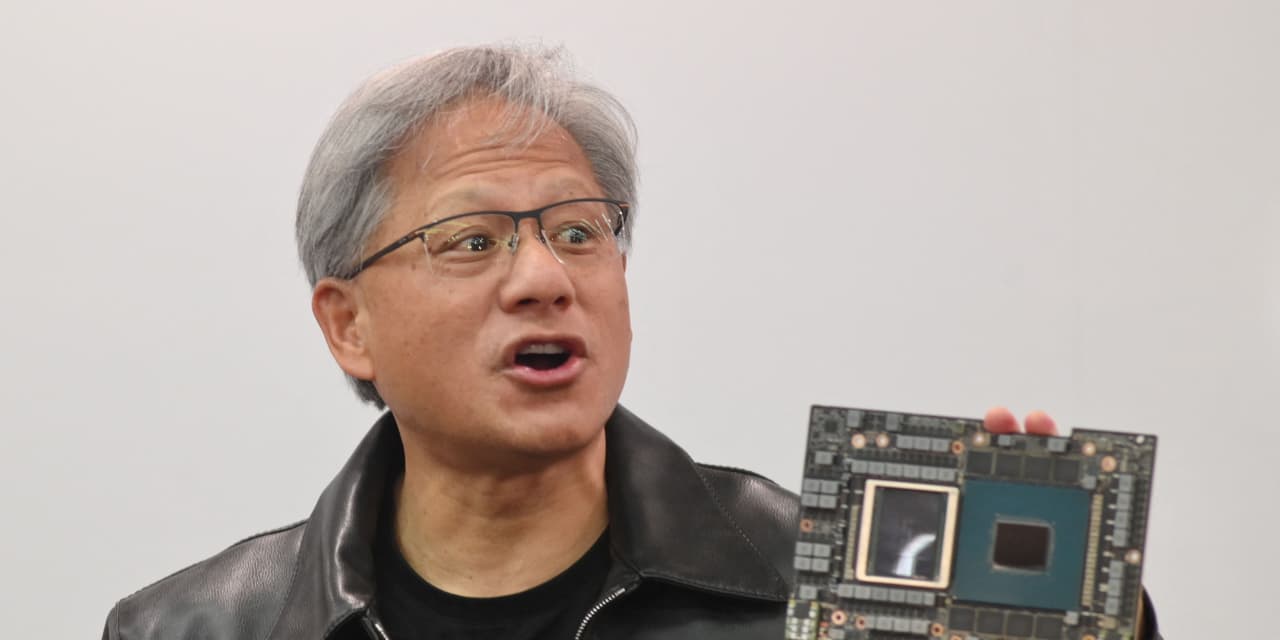

| Nvidia Corp. |

NVDA, |

94% | $488.30 | $668.11 | 37% | 24.5 |

| First Solar Inc. |

FSLR, |

83% | $170.39 | $231.56 | 36% | 13.1 |

| Halliburton Co. |

HAL, |

87% | $36.59 | $49.04 | 34% | 10.6 |

| Bunge Global SA |

BG, |

77% | $101.64 | $135.33 | 33% | 8.8 |

| Bio-Rad Laboratories Inc. Class A |

BIO, |

75% | $320.74 | $424.00 | 32% | 27.5 |

| Las Vegas Sands Corp. |

LVS, |

83% | $48.92 | $64.45 | 32% | 16.4 |

| Schlumberger N.V. |

SLB, |

93% | $53.08 | $69.72 | 31% | 14.8 |

| LKQ Corp. |

LKQ, |

75% | $47.80 | $61.89 | 29% | 11.4 |

| Aptiv PLC |

APTV, |

85% | $89.02 | $113.96 | 28% | 15.1 |

| Delta Air Lines Inc. |

DAL, |

96% | $41.13 | $52.40 | 27% | 6.3 |

| Targa Resources Corp. |

TRGP, |

95% | $86.71 | $107.96 | 25% | 14.5 |

| Corteva Inc |

CTVA, |

78% | $47.46 | $58.53 | 23% | 15.7 |

| Constellation Brands Inc. Class A |

STZ, |

83% | $237.88 | $292.37 | 23% | 18.0 |

| Biogen Inc. |

BIIB, |

82% | $257.97 | $315.48 | 22% | 16.3 |

| Baker Hughes Co. Class A |

BKR, |

79% | $34.12 | $41.58 | 22% | 16.6 |

| Live Nation Entertainment Inc. |

LYV, |

80% | $91.43 | $111.17 | 22% | 41.6 |

| MGM Resorts International |

MGM, |

79% | $44.38 | $53.74 | 21% | 18.6 |

| Elevance Health Inc. |

ELV, |

86% | $466.59 | $563.67 | 21% | 12.6 |

| Jacobs Solutions Inc. |

J, |

88% | $128.07 | $153.17 | 20% | 15.4 |

| Synopsys Inc. |

SNPS, |

88% | $524.46 | $624.57 | 19% | 38.1 |

| Source: FactSet | ||||||

Click on the tickers for extra about every firm.

Click right here for Tomi Kilgore’s detailed information to the wealth of data out there without spending a dime on the MarketWatch quote web page.

Nvidia tops the checklist, as analysts count on the corporate to keep up its main place offering graphics processing items (GPU) to knowledge facilities build up their functionality to help company purchasers rolling out synthetic intelligence expertise.

Here’s a sampling of current protection of Nvidia:

A concentrate on worth: 13 shares which can be down for 2023 however might bounce again in 2024 or past

Source web site: www.marketwatch.com