Wall Street is rising more and more uneasy about an options-driven momentum commerce that has helped push the S&P 500 index into report territory.

As demand for bullish name choices surges to its highest degree in years, some analysts have set their sights squarely on Nvidia Corp.’s

NVDA,

Wednesday earnings report, warning that it could possibly be the catalyst that slams the brakes on this commerce, doubtlessly reversing a considerable quantity of the market’s rally over the previous 4 months.

Their reasoning is rooted in the truth that traders have gotten so bulled up on dangerous choices bets, the mere proven fact that the earnings report has handed could possibly be sufficient to sink the principle U.S. stock-market indexes as a result of inner dynamics of the choices market — even when Nvidia’s outcomes fulfill Wall Street’s expectations, in response to a number of derivative-market consultants who spoke with MarketWatch.

According to FactSet, analysts anticipate Nvidia to report earnings per share of $4.59, a rise of greater than 700% from the identical quarter final 12 months.

See: Nvidia could shine once more when it experiences on Wednesday

Traders pile into bullish choices at quickest tempo since 2021 meme-stock frenzy

As shares rallied over the previous 12 months, taking many on Wall Street without warning, traders have more and more relied on choices to chase the market larger and increase returns.

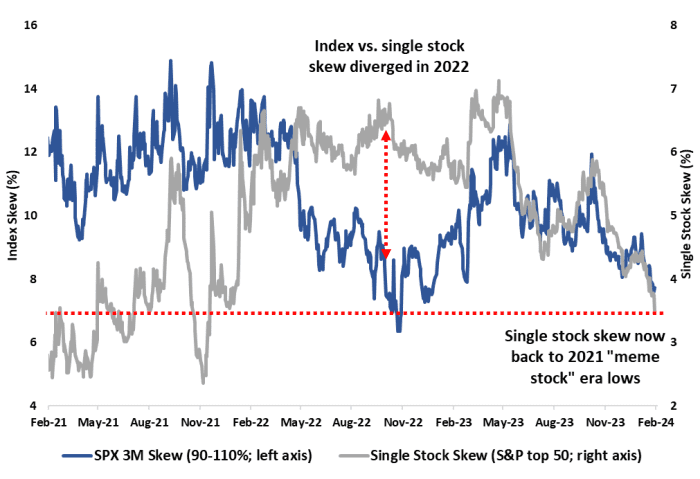

This has brought about demand for bullish out-of-the-money calls on the biggest U.S. shares to strategy probably the most skewed degree for the reason that meme-stock craze of 2021, in response to information from Cboe Global Markets, one of many greatest options-exchange operators.

An possibility is claimed to be buying and selling “out of the money” when the strike value of the choice is above the place the underlying inventory or index is buying and selling, within the case of calls, or beneath it, within the case of places.

In the choices market, “skew” usually measures demand for out-of-the-money calls in contrast with out-of-the-money places, or demand for out-of-the-money places or calls in contrast with their at-the-money counterparts. In this case, it’s the former.

CBOE GLOBAL MARKETS

One key distinction between the meme-stock period and the most recent options-market frenzy is that this time round, extra of the motion is going down in shares which might be closely weighted in the principle market indexes, stated Michael Lebowitz, a portfolio supervisor at RIA Advisors.

“Option buyers are normally more insurance buyers. But now they’re more speculative traders, that’s what the skew is telling you,” he stated throughout an interview with MarketWatch.

Michael Kramer, a longtime impartial stock-market analyst and founding father of Mott Capital, stated Nvidia earnings could possibly be a make-or-break second for the market, however the odds are stacked towards the chipmaker.

“The market in my opinion has placed a gigantic bet on one company,” Kramer stated. “If Nvidia doesn’t guide up significantly, what is going to keep this thing going higher?”

With the inventory already up almost 50% this 12 months, Nvidia has contributed roughly 25% of the S&P 500’s 4.9% advance for the reason that begin of 2024, Kramer stated.

As of Thursday, the skew in Nvidia reached its highest degree since June, in response to information from SpotGamma, which offers information and analytics in regards to the derivatives market.

Kramer stated many of the inventory’s advance over the previous few months has been pushed by aggressive name shopping for, which has pressured choices market makers to scoop up shares of the underlying inventory to hedge their positions.

Rally poised to reverse after Nvidia earnings

While Nvidia has change into the poster-child of the momentum commerce, loads of different shares have gone alongside for the journey. That’s why Brent Kochuba, founding father of SpotGamma, believes the broader market might decline subsequent week, alongside Nvidia, as bullish name choices tied to a swath of main U.S. corporations are more likely to cheapen after the chipmaker experiences its earnings.

Once Nvidia’s earnings report has handed, implied volatility throughout the choices market is more likely to decline, Kochuba defined. This can be a typical response: implied volatility rises when traders see doubtlessly market-moving occasions forward that they need to hedge towards, or speculate on. The reverse usually occurs when these occasions cross the market by.

As implied volatility falls, the choices would get cheaper, whereas permitting the market makers that bought them to dump a few of the shares they collected to hedge their positions.

“Anything with a rich call skew could feel a bit more selling pressure” after Nvidia experiences on Wednesday, Kochuba stated in a word to shoppers shared with MarketWatch.

Options market makers usually purchase shares or index futures to hedge their positions since, if an possibility goes within the cash, they could possibly be on the hook to ship the underlying inventory.

Plenty of different know-how names are seeing an excessive name possibility skew additionally, notably semiconductor names like Advanced Micro Devices Inc.

AMD,

and Arm Holdings

ARM,

in addition to different Big Tech giants like Microsoft Corp.

MSFT,

as merchants wager that Nvidia’s rising tide might carry the broader information-technology sector.

Many on Wall Street, together with Kramer, have been uneasy with the function the choices market has performed in driving the broader market larger since October, notably as traders have reined of their expectations for the variety of interest-rate cuts by the Federal Reserve this 12 months, whereas earnings exterior of a handful of megacap know-how names have typically been lackluster, Kramer stated.

The market’s torrid advance has left shares to commerce at their richest ranges relative to their anticipated earnings in additional than two years as main fairness indexes just like the S&P 500 and Nasdaq-100 have marched into report territory, whereas Wall Street analysts’ expectations for company earnings development in 2024 have lessened.

The ratio of the S&P 500 relative to its anticipated full-year earnings not too long ago topped 20 for the primary time since early 2022, in response to FactSet information, rising above its five-year and 10-year averages.

The ahead price-to-earnings ratio for the Nasdaq-100

NDX

is even larger, and was buying and selling north of 26 on Friday.

“Stocks aren’t trading on earnings momentum. They are trading on multiple expansion,” Mott Capital’s Kramer stated.

Momentum begets momentum

To be certain, simply because momentum has helped propel shares larger, doesn’t imply merchants can simply flip a revenue by betting that the momentum will imminently reverse. As is usually the case on Wall Street, momentum usually begets momentum.

“The pace of these rallies is not really sustainable — and in the case of something like Nvidia, it sets a pretty high bar to hurdle on earnings — but timing when the momentum fades is always the tough part,” stated Bret Kenwell, U.S. choices funding analyst at eToro.

U.S. shares completed decrease throughout the closing buying and selling session of the week, with the S&P 500

SPX

and Nasdaq Composite

COMP

snapping five-week successful streaks. The Dow Jones Industrial Average

DJIA,

however, managed to increase its successful streak to a sixth straight week.

Aside from Nvidia’s earnings, subsequent week’s calendar of doubtless market-moving occasions is trying fairly gentle, except for the discharge of minutes from the Fed’s January assembly.

Source web site: www.marketwatch.com