One of Wall Street’s most-vocal bears is seeing indicators of softness in company earnings that would impede shares’ skill to proceed climbing in 2024.

Michael Wilson, the highest U.S. fairness strategist at Morgan Stanley, mentioned in a word shared with MarketWatch on Monday that he has doubts concerning the skill of the most important U.S.-traded firms to proceed increasing their revenue margins in 2024 as aggressively as Wall Street analysts anticipate. That may make it harder for firms to fulfill analysts’ lofty targets for earnings progress.

Signs of waning revenue margins have helped encourage analysts to decrease their expectations for earnings progress for the quarter already underneath approach.

FactSet information cited by Wilson and others present EPS forecasts for the fourth quarter of 2023 have fallen sharply because the finish of September, having declined by 5.3% to $54.81 from $57.86 in mixture for the S&P 500

SPX.

To be certain, analysts nonetheless anticipate earnings progress of 11.8% for calendar 12 months 2024, which is properly above the trailing 10-year common progress fee of 8.4%, Butters mentioned. Analysts have caught to their forecasts regardless of economists anticipating the recession that by no means materialized in 2023 to lastly start someday subsequent 12 months.

But Wilson has a way more modest view on the prospects for EPS growth subsequent 12 months. He and his crew see progress of simply 7%, properly under the Wall Street consensus. Ultimately, this might all rely upon the speed at which firms can develop their revenue margins — if they are often expanded from ranges which might be already comparatively excessive.

“We also expect a rebound in EPS growth next year (+7%), but are slightly less optimistic in terms of the magnitude of margin expansion (30 bps y/y vs. consensus at 50 bps y/y) as we see earnings risk persisting in the near term before a broader recovery takes hold as next year evolves,” Wilson mentioned in his report.

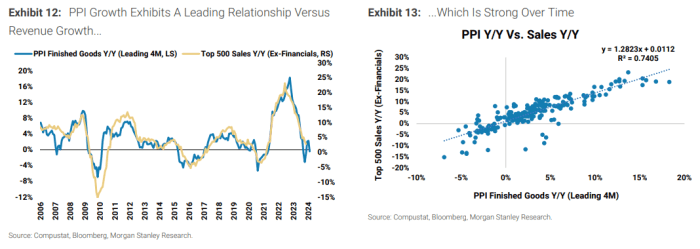

As traders scan for early indicators about how firms may fare subsequent 12 months, Wilson and his crew advised purchasers that firms’ skill to spice up their gross sales progress, typically crucial for enhancing income, may rely upon what occurs with wholesale costs.

Historically, the index’s finished-goods part has been a dependable main indicator for income progress amongst S&P 500 corporations.

MORGAN STANLEY

He and his crew can be watching Wednesday’s PPI Index report for extra clues. The median forecast from economists polled by The Wall Street Journal is asking for progress of simply 0.1% in November, in contrast with a drop of 0.5% in October, which was the biggest decline since April 2020.

As Wilson identified, profit-margin estimates seem like driving earnings forecasts.

MORGAN STANLEY

FactSet information present the estimated web revenue margin for the S&P 500 this quarter 2023 is 11.2%. That can be under the ultimate studying of 12.2% for the third quarter, and under the five-year common of 11.4% — however equal to the margin from the fourth quarter of final 12 months, when firms reported damaging year-over-year progress in earnings per share.

Things are anticipated to enhance within the new 12 months, nevertheless. For 2024, Wall Street analysts anticipate S&P 500 firms to report a revenue margin of 12.3%. If that involves move, it will mark the second-highest annual net-profit margin reported by the index since FactSet started monitoring the metric in 2008.

Source web site: www.marketwatch.com