“There is no magic level of yields that, when reached, will automatically draw in enough buyers to spark a sustained bond rally.”

That was Barclays’ head of macro analysis, Ajay Rajadhyaksha, warning purchasers Wednesday that solely a inventory selloff will stem the bond bleeding. Add to that Pimco co-founder Bill Gross, who notes that “spooked” retail buyers have began dumping their huge holdings in bond alternate traded funds.

Also learn: Gross says buyers ought to shun shares and bonds and purchase this asset as an alternative

The sum of all that’s that persistence for this to play out, even when you get the decision:

@Fullcarry

H/T to Kevin Muir of the Macro Tourist publication for recognizing the above, which brings us to our name of the day, from his Wednesday interview with Harris “Kuppy” Kupperman, founding father of hedge fund Praetorian Capital, who sees no backside for bonds and prefers “real economy” investments as an alternative.

A penchant for buying and selling in manias, Kupperman nailed final 12 months’s tech selloff however bought burned on Russian trades. His Praetorian Capital Fund nonetheless returned 11% plus it had triple digit positive aspects in 2020 and 2021, and is up 16% to this point in 2023.

As for the bond market, he says it’s “not panicky at all.”

He mentioned the underside can’t be in whereas 10-year Treasury bonds are nonetheless inverted relative to shorter-term bonds, and mentioned there’s no motive why the yield can’t go to six%, a median space for the final 50 years, after which most likely overshoot that.

Read: The chart that has one strategist satisfied bond market is divorced from fundamentals

“I wouldn’t be surprised if it got back to the teens,” which he sees taking place over time “unless our government has some fiscal sanity,” mentioned Kuppy.

“Think how ridiculous it is that we’re running an effectively 8% nominal GDP, 8% deficits in the boom, probably like teens in the next recession…payroll tax was up 9% year over year for Q3, so the economy is really strong. So how is the 10 [year Treasury yield] at 4% and change? It makes no sense. It should have a 6% handle.”

But a 6% yield is an issue for the Wall Street guys it can make “insolvent,” because of the leverage they use — borrowing cash to commerce elsewhere. “And so you have these Wall Street guys crying and crying and crying, but my friends in the real economy, I mean it hasn’t been better for them. It really is a one percenter depression, that’s all it is,” he mentioned.

Kupperman sees excessive yields inflicting ache in some unspecified time in the future as a result of many companies must fund themselves. “They did 5-year bonds in 2021 and 2022 and you know they’ve got three or four years left on it and are putting it back to work in money markets and actually earning a positive carry. That’s not sustainable long term.” (Positive carry refers to when advantages of holding an asset exceed its prices.)

Kupperman says he’d maintain shut eye on the banks for indicators of bother, noting that Goldman Sachs

GS,

“is in freefall” — the inventory has been dropping since September.

“You have lots of sectors in the economy that are going to do just fine and you have lots of sectors that are going to be terrible and I think you’re not really going to see a stock market crash as much as a giant sector rotation,” he mentioned.

The supervisor, for his half, is extra bullish on the actual economic system, and he’s been a fan of uranium for awhile. His uranium bets middle on his view that the world will finally determine on nuclear energy as the most effective compromise for baseload energy era.

The world isn’t going to expire as a result of it’s plentiful, however “there seems to be a spot interval the place for just a few years, the deficits will merely overwhelm the power to ramp up manufacturing. I feel that there can be a super-spike within the uranium worth…that can stun everybody, he mentioned in a current weblog put up, after attending an business convention the place he mentioned nobody appeared to care a couple of huge scarcity.

Read: What World War II can inform us in regards to the present stock-market atmosphere

The markets

Stock futures

ES00,

NQ00,

are down whereas bond yields

BX:TMUBMUSD30Y

BX:TMUBMUSD10Y

are blended. Oil costs

CL.1,

BRN00,

are down one other 1% after Wednesday’s rout. The greenback

DXY

is down and Europe markets

XX:SXXP

are just a little shaky.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Rivian

RIVN,

is down 8% after the EV maker mentioned it can supply $1.5 billion price of “green” convertible senior notes, as preliminary gross sales estimates simply met forecasts.

Clorox shares

CLX,

are down 4% after the bleach maker slashed its outlook following cyberattack disruptions.

BlackBerry inventory

BB,

is up almost 3% after the tech group mentioned it can spin off and publicly listing its Internet-of-Things enterprise.

Dell

DELL,

mentioned it can add $5 billion to its share buybacks, and plans to develop its quarterly dividend by 10% or extra yearly by way of 2028.

Amazon

AMZN,

and Microsoft

MSFT,

are dealing with a contest probe within the U.Okay. over cloud providers.

Data confirmed weekly jobless claims rose barely to 207,000, however they remained close to pandemic-era lows. Meanwhile, the commerce deficit for August dropped 9.9% to $58.3 billion. Cleveland Fed President Loretta Mester is because of converse at 9 a.m., San Francisco Fed President Mary Daly will converse at 12 midday, then Fed. Gov. Michael Barr at 12:15 p.m.

Best of the online

My 8-year-old son was given $35,000 in gold bars. Do we maintain onto them — or promote and make investments the cash?

America’s manufacturing facility growth brings billion-dollar initiatives to tiny cities.

This $4 trillion market is caught in a rut.

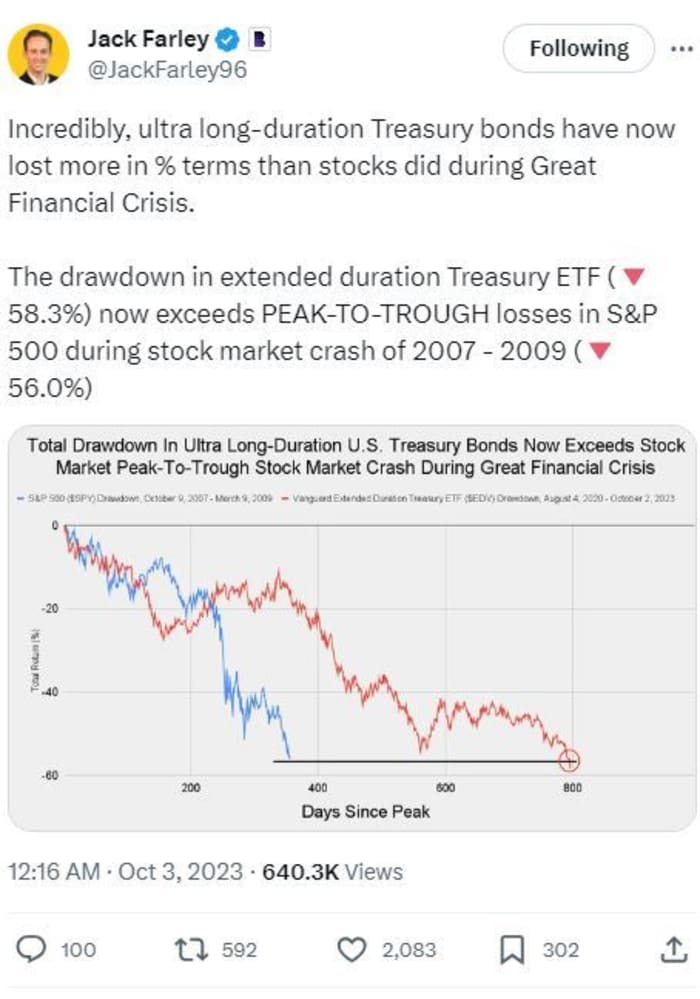

The chart

Here’s a chart from Jack Farley, video journalist at Blockworks, who just lately provided up this chart displaying the extent of the selloff on ultra-long Treasury bonds.

@JackFarley96

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

GME, |

GameStop |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir Technologies |

|

TTOO, |

T2 Biosystems |

Random reads

Tokyo urges Halloween revelers to avoid the positioning of a tragic accident final 12 months.

806 Jr, or a 70 pound bear cub, goals to be the champion of chonk.

Victoria Beckham says she’s a “working class” woman. David Beckham shouldn’t be so certain.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com