Bonds issued by Paramount Global Inc. have seen vital unfold tightening — and better costs — in robust quantity in latest weeks, amid reviews that Chairwoman Shari Redstone is in talks on promoting a controlling stake within the firm.

Holders of the bonds might money out handsomely if there’s a change of management and the credit score is downgraded, because of a particular provision of their phrases.

The reviews emerged final week when Deadline reported that media and leisure group Skydance — which is run by David Ellison, son of Oracle Corp.

ORCL,

Founder Larry Ellison — and RedBird Capital had been kicking the tires on National Amusements and Paramount

PARA,

National Amusements is the Norwood, Mass.-based exhibitor that owns 77% of Paramount’s Class A shares.

Then on Sunday, Puck and the New York Times mentioned the talks had been occurring for weeks. Skydance is certainly one of Hollywood’s prime impartial studios, and has produced Paramount blockbusters similar to “Mission: Impossible—Dead Reckoning” and “Top Gun: Maverick.” RedBird is a monetary backer of Skydance.

A sale could be a significant reversal for Redstone, the daughter of late Paramount CEO Sumner Redstone, who waged a bitter battle for management of the corporate in 2016, and who later led the hassle to merge CBS Corp. and Viacom, which led to the creation of the present Paramount Global.

A deal might sign the beginning of a significant shake-up throughout the media business, as conventional TV corporations are struggling to generate income within the streaming age. Comcast Corp.

CMCSA,

which owns NBCUniversal, could possibly be seeking to increase, whereas Warner Bros. Discovery

WBD,

could possibly be a possible vendor. Disney

DIS,

CEO Bob Iger lately floated the concept of promoting ABC, however rapidly walked that again.

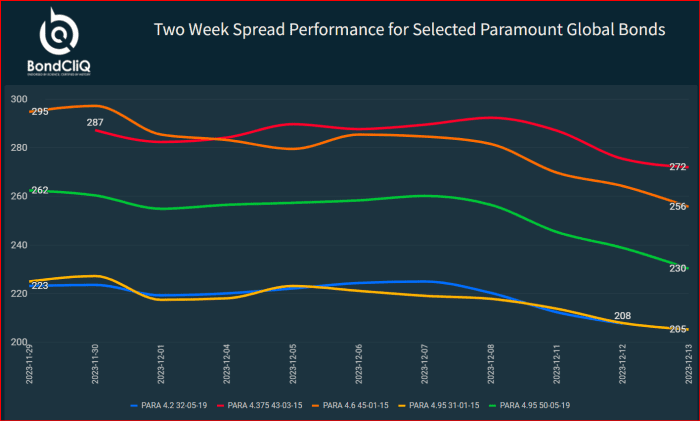

Paramount’s bond spreads have been tightening for the previous two weeks, as the next chart from information options supplier BondCliQ Media Services exhibits.

Paramount’s bond spreads commerce large of sector friends that embrace Charter Communications Inc.

CHTR,

Netflix Inc.

NFLX,

T-Mobile US Inc.

TMUS,

and Warner Bros, in line with Bloomberg Intelligence. That’s even supposing the corporate has sufficient liquidity, is previous the stage of peak funding in streaming and is forecasting progress in Ebitda, or earnings earlier than curiosity, taxes, depreciation and amortization, in 2024. Ebitda is commonly considered as a measure of an organization’s capability to cowl curiosity funds.

Two-week unfold efficiency for choose Paramount international bonds.

BondCliQ Media Services

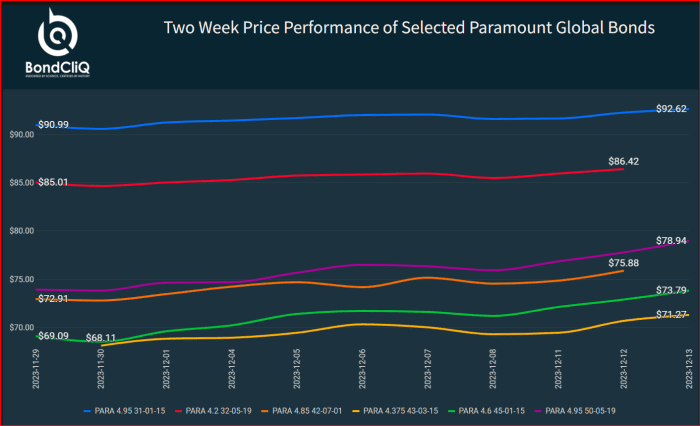

Prices of the bonds have climbed, though they continue to be beneath par. That’s as a result of the latest rise in rates of interest despatched costs decrease because of the inverse relationship between the 2, and never due to any credit score high quality points.

The bonds have a change-of-control provision that obliges the corporate to supply to repurchase them at 101 cents on the greenback if there’s a change of management on the firm and the credit score is downgraded. The bonds are at present rated at Baa3/BBB-/BBB.

Two-week worth efficiency of choose Paramount Global bonds.

BondCliQ Media Services

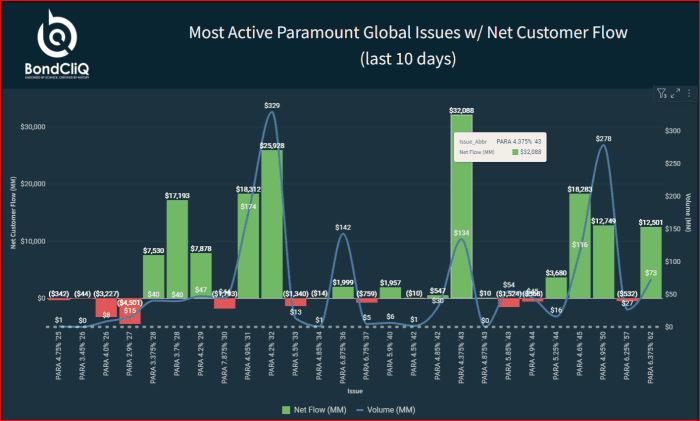

The bonds have seen internet shopping for during the last two weeks, a pattern that continued on Tuesday.

Most energetic Paramount Global points with internet buyer stream (final 10 days).

BondCliQ Media Services

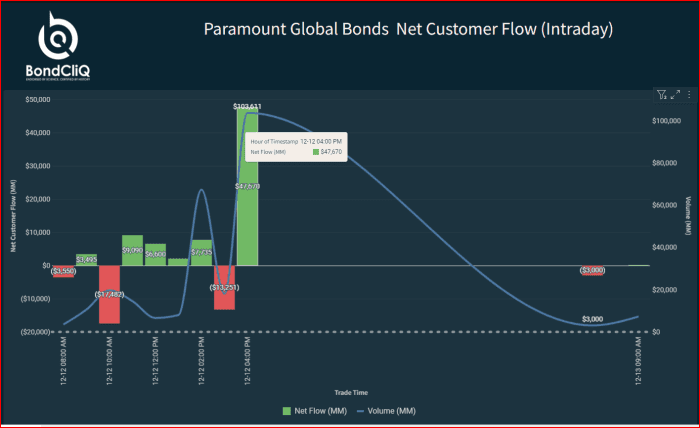

The shopping for spiked on Tuesday earlier than changing into extra subdued to this point Wednesday.

Paramount Global bonds internet buyer stream (intraday).

BondCliQ Media Services

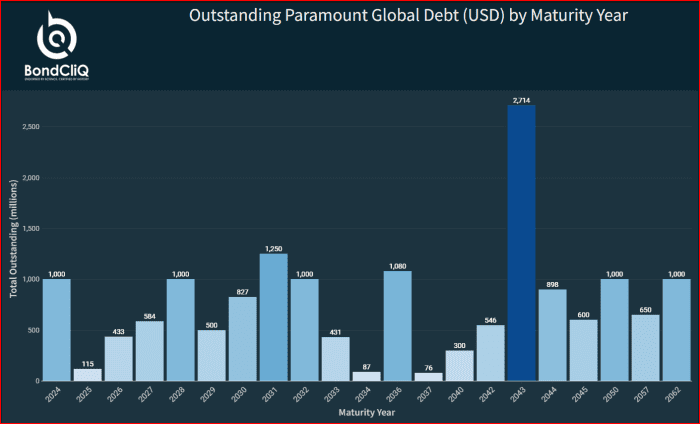

Paramount has about $16 billion of excellent bonds with maturities that stretch out to 2062.

Outstanding Paramount Global debt (USD) by maturity yr.

BondCliQ Media Services

Paramount’s inventory, in the meantime, has struggled this yr and is down 11%, underperforming the S&P 500

SPX,

which has gained 21%. The inventory has gained 25% within the month thus far.

Research firm Lightshed Partners, which makes a speciality of expertise, media and telecoms corporations, mentioned Paramount has a bleak future forward because it doesn’t see any apparent strategic purchaser who would buy all the firm.

That’s assuming a transaction might attain regulatory clearance, which isn’t assured within the present regulatory atmosphere, to not point out what might occur if there’s an administration change, analysts Richard Greenfield, Brandon Ross and Mark Kelley wrote in commentary on Tuesday.

“While a strategic combination with one of Paramount’s peers would yield significant synergies, any legacy media company who buys more broadcast/cable network assets will suffer (especially if they acquire the declining assets using leverage),” they wrote.

Lightshed is skeptical {that a} tech platform would need broadcast and cable community property, though the studio may enchantment to a number of consumers.

“However, we would think the first move in such a scenario would be to shutdown Paramount+ and become an arms dealer,” mentioned the analysts. “This would help juice studio free cash flow, unencumber the studio assets and make for a more viable remain Co.

“It seems odd to sell now with the studio making virtually no money and Paramount+ bleeding $1.7 billion,” they added.

Source web site: www.marketwatch.com