The employment image began off 2023 on a stunningly robust notice, with nonfarm payrolls posting their strongest achieve since July 2022.

Nonfarm payrolls elevated by 517,000 for January, above the Dow Jones estimate of 187,000 and December’s achieve of 260,000.

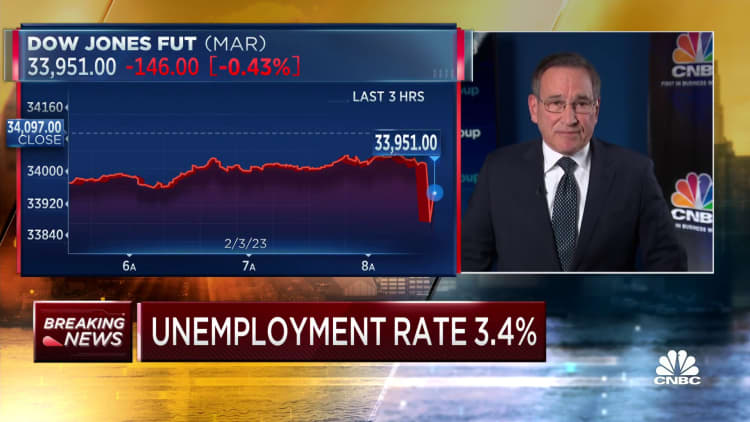

The unemployment price fell to three.4% versus the estimate for 3.6%. That is the bottom jobless degree since May 1969. The labor power participation price edged larger to 62.4%. A broader measure of unemployment that features discouraged employees and people holding part-time jobs for financial causes additionally edged larger to six.6%.

Markets slumped following the report, with futures tied to the Dow Jones Industrial Average down about 200 factors.

Growth throughout a large number of sectors helped propel the huge beat in opposition to the estimate.

Leisure and hospitality added 128,000 jobs to guide all sectors. Other vital gainers have been skilled and enterprise providers (82,000), authorities (74,000) and well being care (58,000). Retail was up 30,000 and building added 25,000.

Wages additionally posted stable features for the month. Average hourly earnings elevated 0.3%, consistent with the estimate, and 4.4% from a yr in the past, 0.1 proportion level larger than expectations although a bit under the December achieve of 4.6%.

The surge in job creation comes regardless of the Federal Reserve’s efforts to sluggish the economic system and convey down inflation from its highest degree for the reason that early Nineteen Eighties. The Fed has raised its benchmark rate of interest eight occasions since March 2022.

In its newest evaluation of the roles image, the Fed on Wednesday dropped earlier language saying features have been “robust” and famous solely that the “unemployment rate has remained low.”

However, Chairman Jerome Powell, in his post-meeting news convention, famous the labor market “remains extremely tight” and remains to be “out of balance.” As of December, there have been about 11 million job openings, or simply shy of two for each out there employee.

“Today’s report is an echo of 2022’s surprisingly resilient job market, beating back recession fears,” stated Daniel Zhao, lead economist for job evaluation website Glassdoor. “The Fed has a New Year’s resolution to cool down the labor market, and so far, the labor market is pushing back.”

Though Fed officers have expressed their intention to maintain charges elevated for so long as it takes to deliver down inflation, markets are betting the central financial institution begins slicing earlier than the tip of 2023. Traders elevated their bets that the Fed would approve 1 / 4 proportion level rate of interest hike at its March assembly, with the chance rising to 94.5%, in response to CME Group knowledge.

The Fed is hoping to engineer a “soft landing” for an economic system that’s pressured by inflation and geopolitical components that held again development in 2022.

Most economists nonetheless count on this yr to see no less than a shallow recession, although the labor market’s resilience might trigger some rethinking of that.

“Our base case is still recession likely toward the latter part of the year,” stated Vanguard senior economist Andrew Patterson. “One report is not indicative of a trend, but certainly if we continue to see upside surprises, our baseline is up for discussion. This does increase the marginal probability of a soft landing.”

Source web site: www.cnbc.com