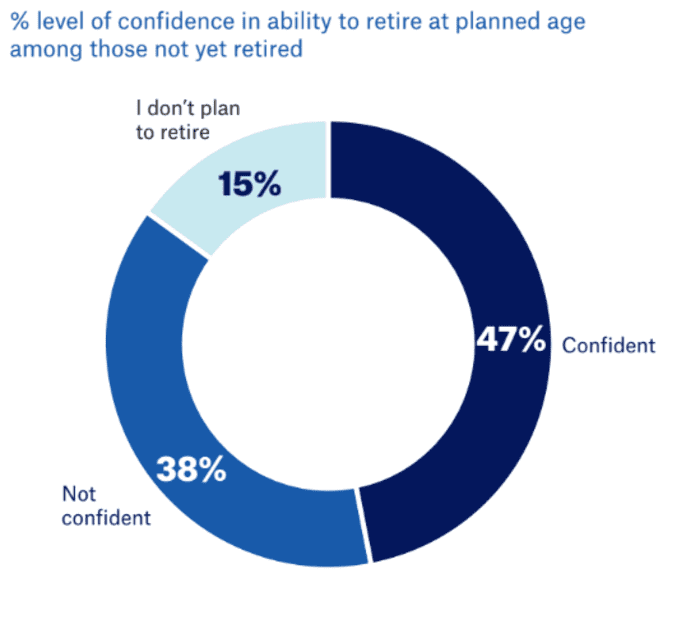

Not everybody believes they may retire someday: 15% of Americans total stated they don’t plan to retire in any respect, and youthful individuals as a bunch had been much less assured than their fellow employees, a brand new research discovered.

More than one in 5 youthful Americans haven’t any plans to retire, and 21% of Hispanic members stated the identical, based on TIAA Institute’s newest report, “State of Financial Preparedness in a Diverse America.”

The largest cause to skip retirement? The incapacity to save lots of sufficient. Social causes, akin to having a way of goal, avoiding boredom and profession enjoyment, had been additionally causes to not retire, members stated.

“If most people are planning for retirement but can’t follow their plans, that’s a call to action for employers, policymakers, financial advisors, retirement services providers and others. We need to better identify the steps we must take to give people the resources they need,” Surya Kolluri, head of the TIAA Institute, stated in an announcement.

Source: TIAA Institute

Less than half of individuals nonetheless working had been assured they’d retire someday. Young Americans and Hispanics had been tied for lowest confidence, with greater than a 3rd in every demographic responding as such.

The survey included responses from 1,684 adults between the ages of twenty-two and 75 years outdated, who represented a mixture of demographics, together with age and racial and ethnic teams.

TIAA Institute additionally discovered Americans had little to no liquid investable financial savings — 26% of Black members, 26% of Native American members and 1 / 4 of Hispanic Americans have none, the survey discovered — and three in 10 respondents stated they’d be unable to pay for a $2,000 emergency. People usually tend to haven’t any liquid investable property (15%) or below $50,000 (29%) than to have greater than $500,000 (19%), the survey discovered.

Read: Retirement planning for Gen X and millennials: To make it efficient, make it bite-sized

For about three-quarters of present retirees, Social Security was the highest retirement supply, adopted by greater than half who stated employer pensions. But that might not be the case for youthful employees — virtually half of members between 22 and 34 years outdated stated they don’t count on to make the most of Social Security or pensions after they retire.

Two-thirds of individuals did have a retirement account, such because the 401(okay), however virtually 1 / 4 of individuals didn’t understand how a lot that they had saved, together with 24% of these at present retired and 22% planning to retire.

Source web site: www.marketwatch.com